Venture: Portfolio Update

Issue 65;

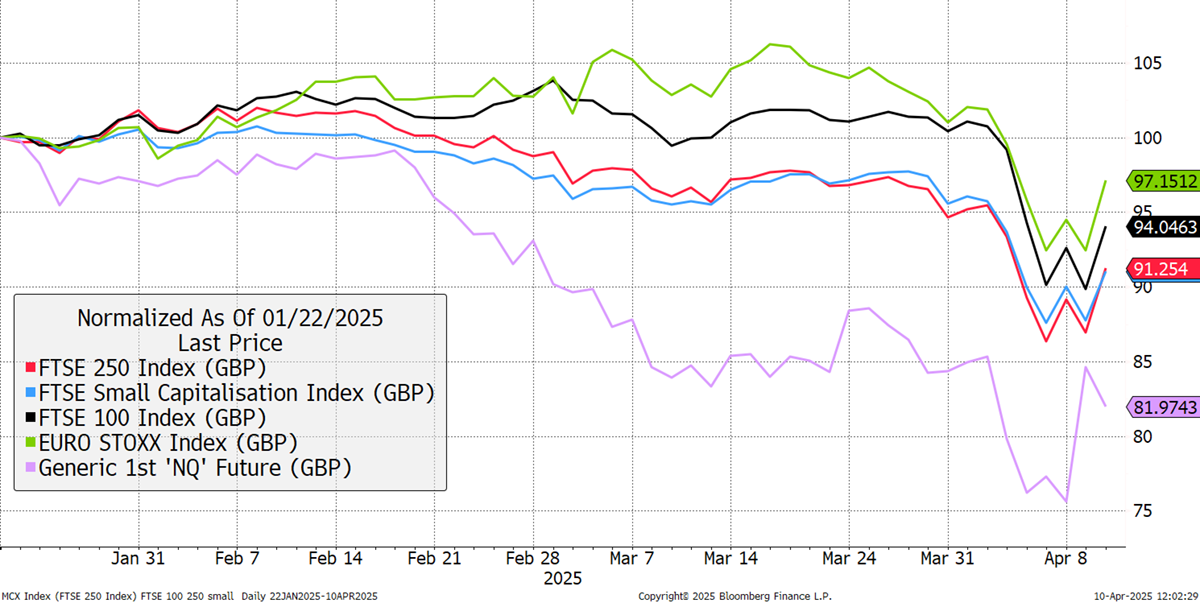

Trump has stepped back from the worst of the tariffs, and the market has rallied. Yet, huge damage has been left behind. UK large-caps (black) have held up well, but small- and mid-caps have fared worse. Yet, the dollar is down, and the Nasdaq futures, which rallied last night, have turned down in GBP. The shift of capital back to the UK and Europe continues.

UK, Europe and the Nasdaq in GBP

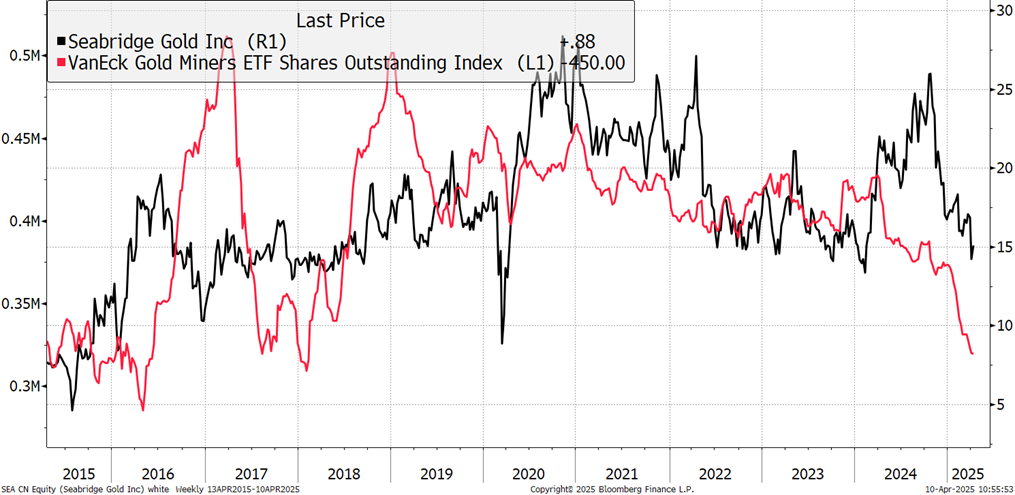

Recent days have once again demonstrated gold’s strength as a safe haven asset during troubled times. Venture holds some gold stocks and will hopefully add to the list, but there is a curious thing going on. Just as the price of gold has risen to all-time highs, investors are withdrawing money from the gold funds at an alarming pace. I highlight the exploration company Seabridge (SEA Canada), which has massive reserves that it will likely never mine. It ought to be a highly geared play in this gold bull market but has recently failed to participate.

Fund Flows: Seabridge and GDX Gold Mining ETF

Seeing huge outflows of capital from the gold miners is a curious thing to see when the price of gold is so high. The good news is that at least we know what is holding the miners back. Now that the tech sector has taken a blow, investors will start to look for alternatives. They’ll find the gold miners soon enough.

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd