Q1 2025 Performance Review

As a matter of record, I publish performance data for the two portfolios in the Multi-Asset Investor, Whisky and Soda, for Q1 2025. With Trump’s tariffs announced on Thursday, 2 April, much has happened over the past two weeks, making Q1 a distant memory of market calm. Regardless, I shall report performance for Q1, and I will address Q2 in July.

Key Points in Q1 2025

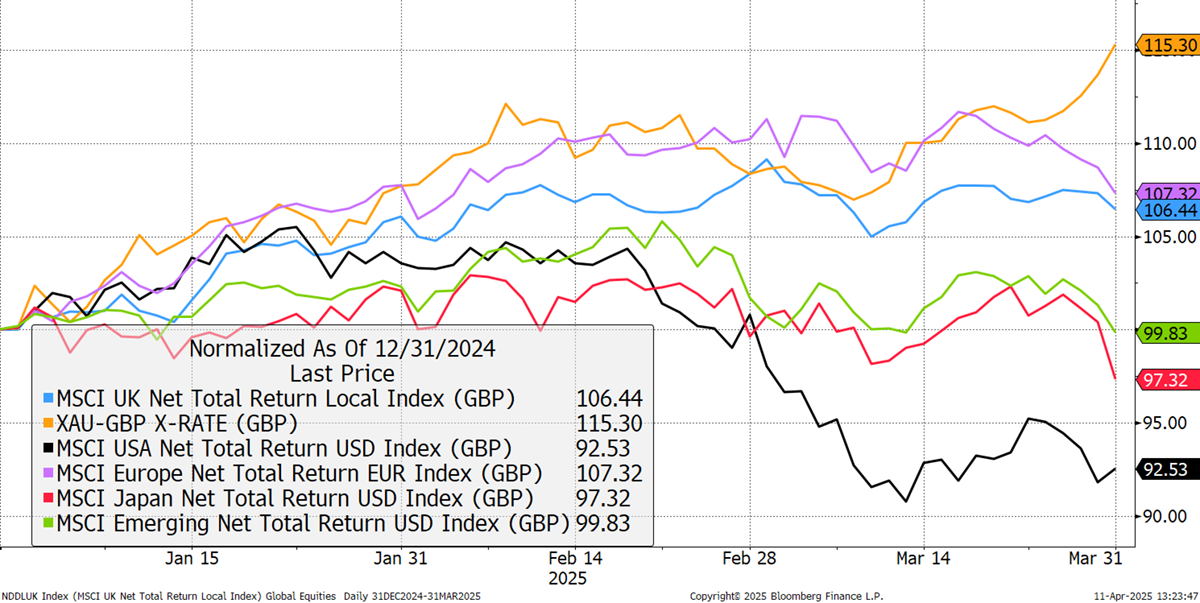

- Europe and the UK made gains in Q1. Emerging markets were flat. Japan fell slightly, while the US market fell by 8%.

- Gold rose by 15% in GBP as uncertainty grew.

- The dollar fell by 4%.

- Bonds continued to come under pressure as the long-dated gilt yield brushed with all-time highs.

- Technology and consumer discretionary stocks fared worse, with energy holding up. In Europe, the banks were strong.

- Small and mid-cap stocks lagged large caps.

Global Equities in Q1 2025

Soda

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd