DataGroup SE (D6H) Bid

“Bidder intends to launch a public purchase offer for all outstanding shares of DATAGROUP at a price of EUR 54.00 per share in cash… The management board and the supervisory board of DATAGROUP, which have approved entering into the investment agreement today, support the Offer which they consider to be fair and attractive and intend to recommend the acceptance of the Offer to the shareholders of DATAGROUP. The members of the supervisory board and the management board have confirmed that they will also tender all Dante shares personally held by them into the Offer.”

KKR has made an offer for D6H, which has been agreed. The shares will be delisted following the deal. A bid is welcome, but the price is disappointing. The offer comes at €54/share when the average analyst price target was €78.67. We will realise a gain of 21%. The stock has been held for 138 days, realising a gain of 65% IRR.

I covered D6H on 29 November 2024, when the price was €45.3. With the bid at €54 per share and the current price above €53, there is little reason to hold from here, as the takeover has been accepted by the board.

Action

Sell DataGroup SE (D6H)

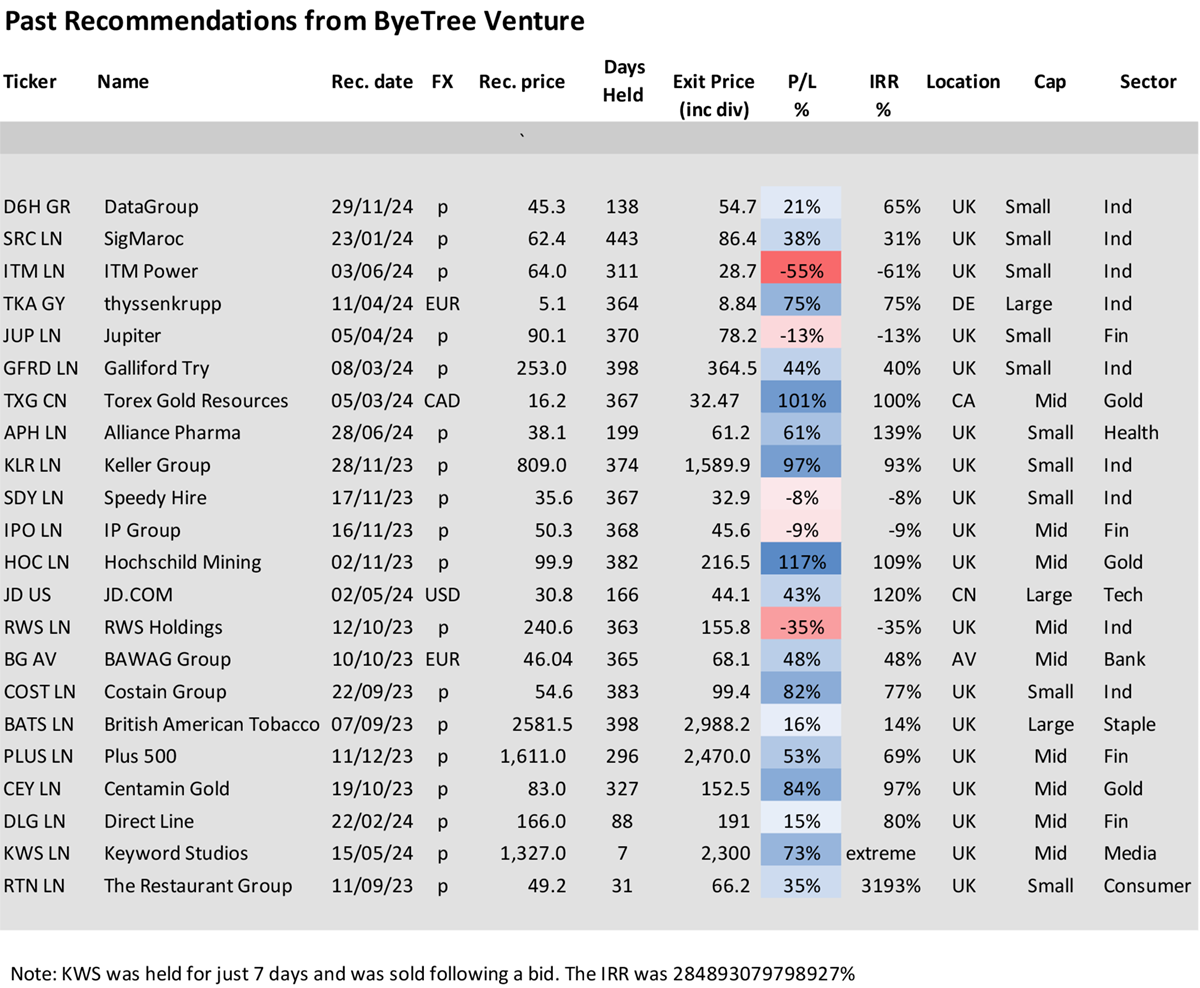

Past Recommendations

Venture Update

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd