Gold to the USA, Dollars to Europe

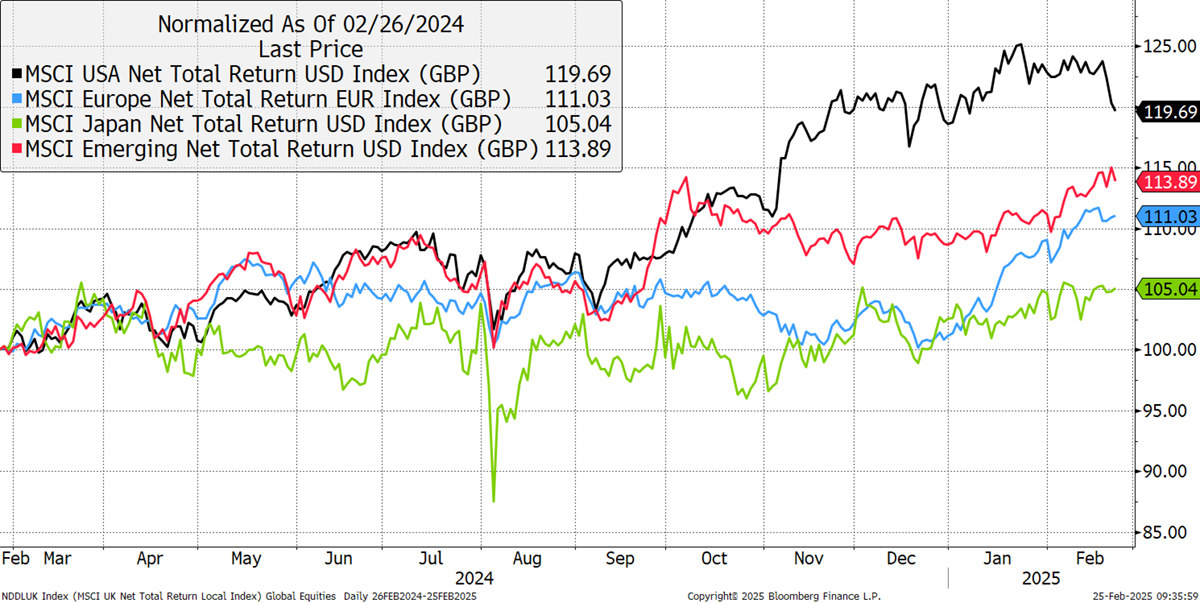

There has been much talk about the gold moving to the USA, but what about the dollars coming the other way? The dollar is down this year, with most of the gains shifting to the most undervalued currencies, notably the Japanese yen and the Swedish krona. This year has seen US stockmarkets stall, alongside Turkey, India, and the Asian Tigers, while Europe, Mexico, Brazil, and Hong Kong have flourished.

I have been talking about the great rotation away from US stocks towards the rest of the world, and that shift is now well underway. The largest US companies, which have done well, have wobbled over the past week, but the real sign of weakness comes from the mid and small caps. I show that over the past year, but note how they were in line with the large caps as in late November. It’s a big move.

US Mega, Mid and Small Cap Indices

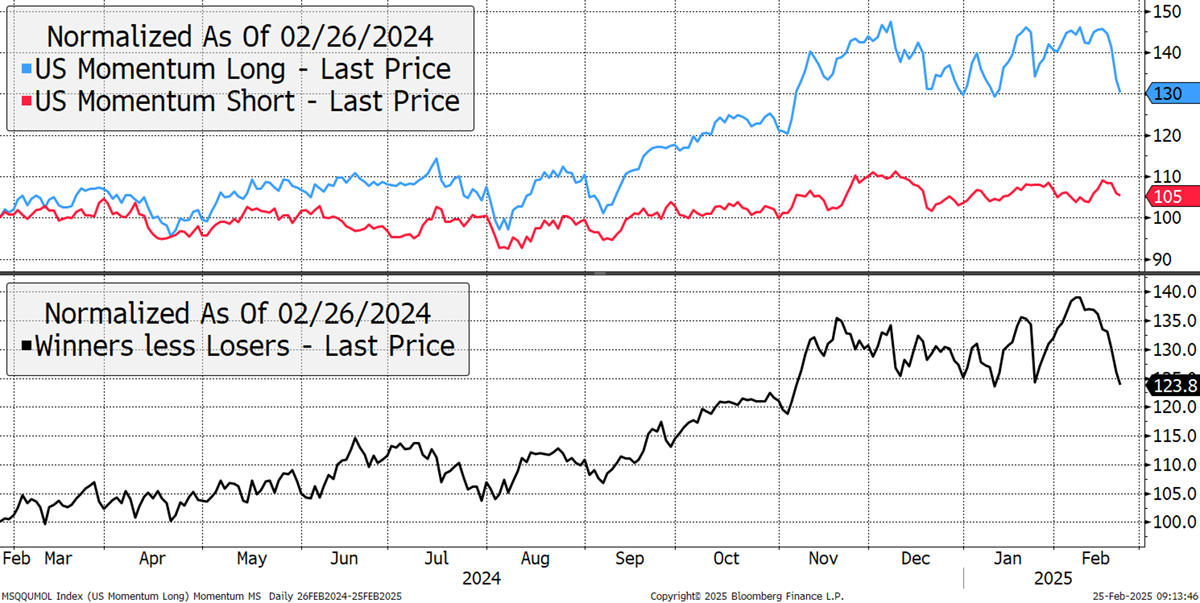

The story is better told through momentum than market cap, which captures the current disparity more accurately. The blue past winners, the stocks that were already doing well, surged higher in November on the Trump trade and are now giving background. The red losers are stable, which indicates we are looking at a market rotation of leadership as opposed to a bear market at this point in time. The lower black line shows winners less losers and appears to have broken. That is unsurprising, given it packed at 40% over the past year.

US Momentum Winners vs Losers – Past Year

That black line over 25 years has risen with a trend rate of 4.3% p.a. It is currently at the top of the range and signalling a reversal. Cutting through the upper green line means the momentum trade is two standard deviations (that’s a lot) above the trend. It is impossible to say whether the correction will be mild or severe, but it is very likely underway.

US Momentum Winners Relative to Losers – Past 25 Years

The momentum trend is back to levels last seen in 2000 and 2008. Looking at the stock level, 6 of the largest 7 stocks are down this year, with only META still up. The earnings season is underway, and expectations for next year are clearly too high. That becomes clearer when we compare the global markets. The US is easing back, while Europe and the emerging markets are catching up. Japan is lagging as the yen finally begins its long-overdue appreciation. A strong currency is normally positive for a stockmarket, but not when the make-up is heavily export-driven, as is the case in Japan.

Key Global Markets – Past Year

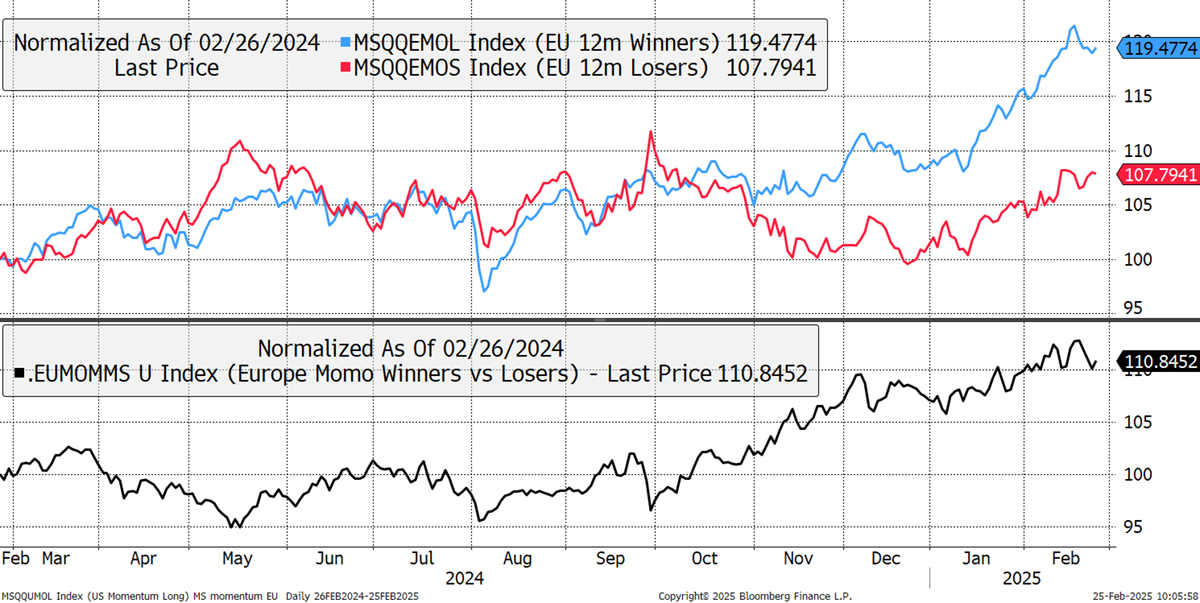

Just as US momentum has cooled, European momentum has taken off. The best bit for me is that the losers are rising as well. This means a stockmarket downturn in Europe is unlikely at this point. The excess return has also been calm so far, with the winners just 10% ahead this year. This is far from being overcooked.

European Momentum Winners vs Losers – Past Year

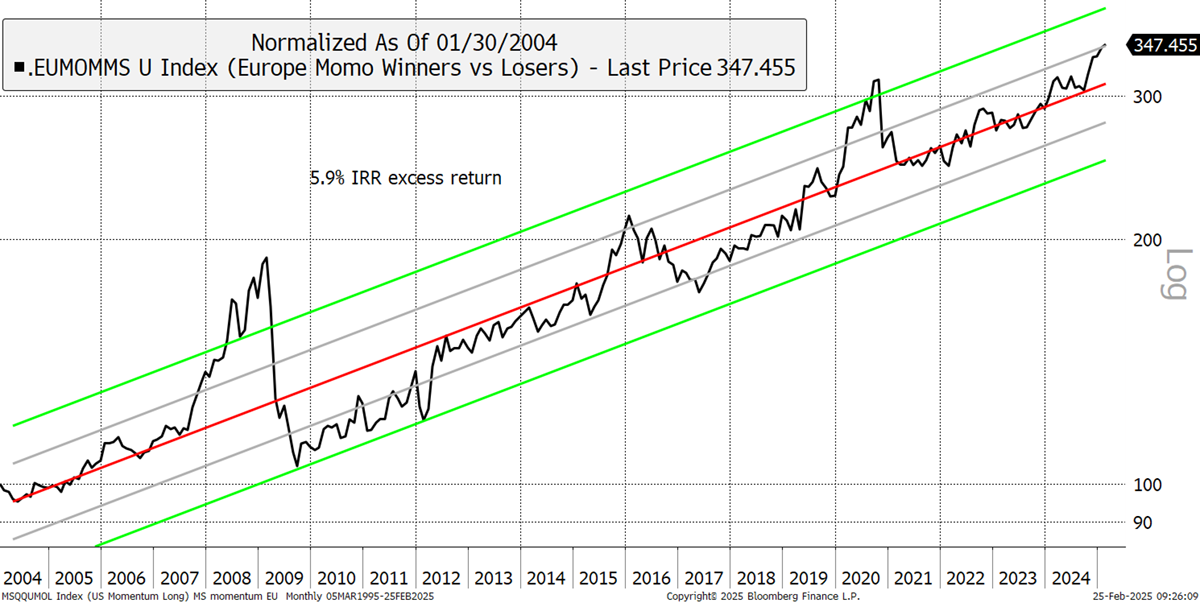

Longer-term, the European momentum effect is above the mean (red line) but much less so than in the US market, being just one standard deviation above the trend (less than a lot). That means it’s less risky and has more to give.

European Momentum Winners Relative to Losers – Past 20 Years

The investment implications are to be aware that major change is upon us, and to be prepared to adapt. Unsurprisingly, Bitcoin has sided with US tech, but gold has remained firm; at least so far.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 Crypto Composite Ltd