Bonds and Rebalancing Bitcoin

Trades in Whisky and Soda;

On Monday, 20th January, Donald Trump will be sworn in as the 47th President. They say a week is a long time in politics; well, that’s nearly two. Before we even consider what happens in the first 100 days, he will probably be sentenced for the hush money trial this week, although the Judge has offered an unconditional discharge. This is the sort of thing markets will face in the run-up to the inauguration. It will be a choppy fortnight.

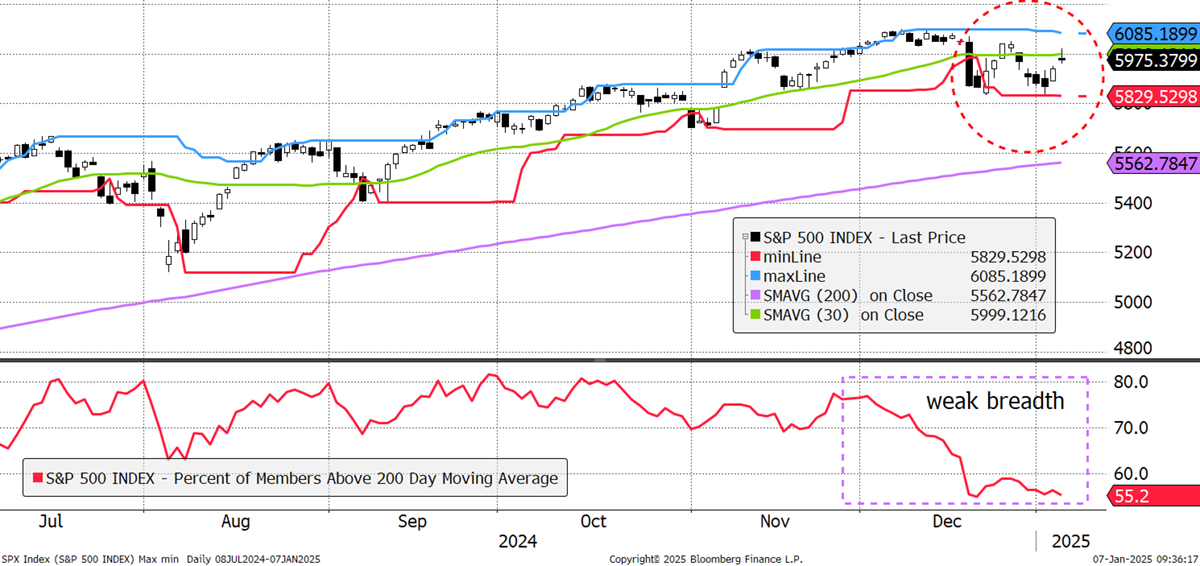

Although US equities had a good year, most of it was banked by July, with notable falling breadth later in the year. That means fewer stocks are driving the market, which increases risk.

S&P 500 – Past Six Months

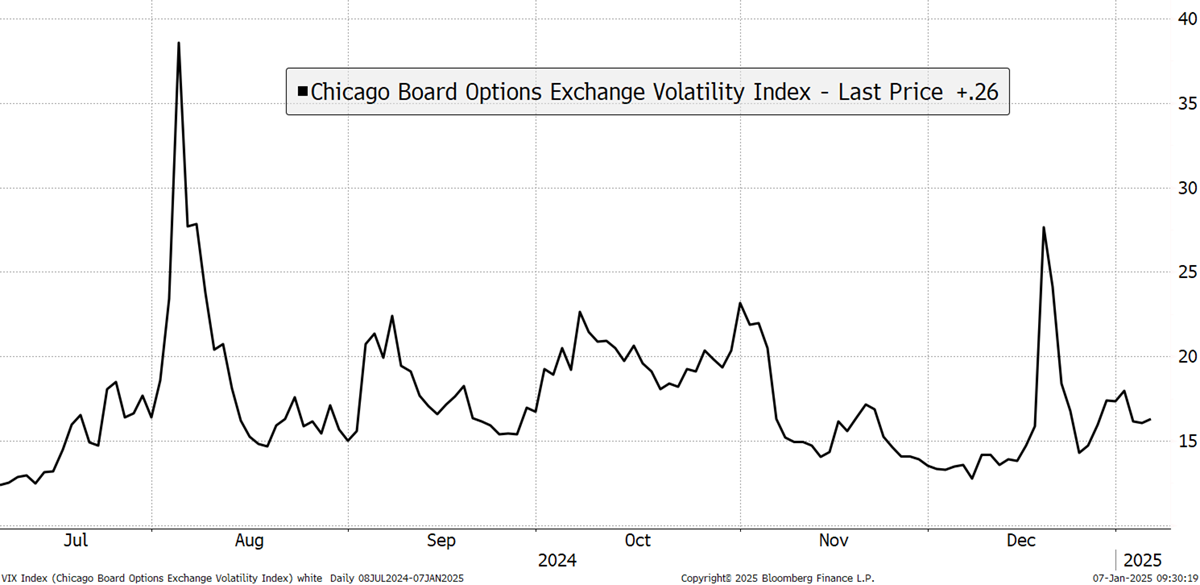

We also saw two spikes in market volatility in August and December. These were not on par with the financial crisis or the pandemic crash, but shots across the bow, nevertheless. Note how the S&P500 has not yet made a new high since December’s VIX spike. The vast majority expect the S&P to spring to new highs when Trump returns to office.

VIX - S&P 500 Implied Volatility Index – Past Six Months

In less than two weeks, Trump’s administration will hit the ground running, and it will surely be good for the US economy, and hopefully good for the world economy, albeit with caveats. There will be winners, and we are already seeing a move in oil and gas. There has also been strength in crypto, although I have my doubts about how far they will go on the idea of a US Bitcoin strategic reserve. There will also be losers relating to tariffs and other unknowns, and that may even impact the UK.

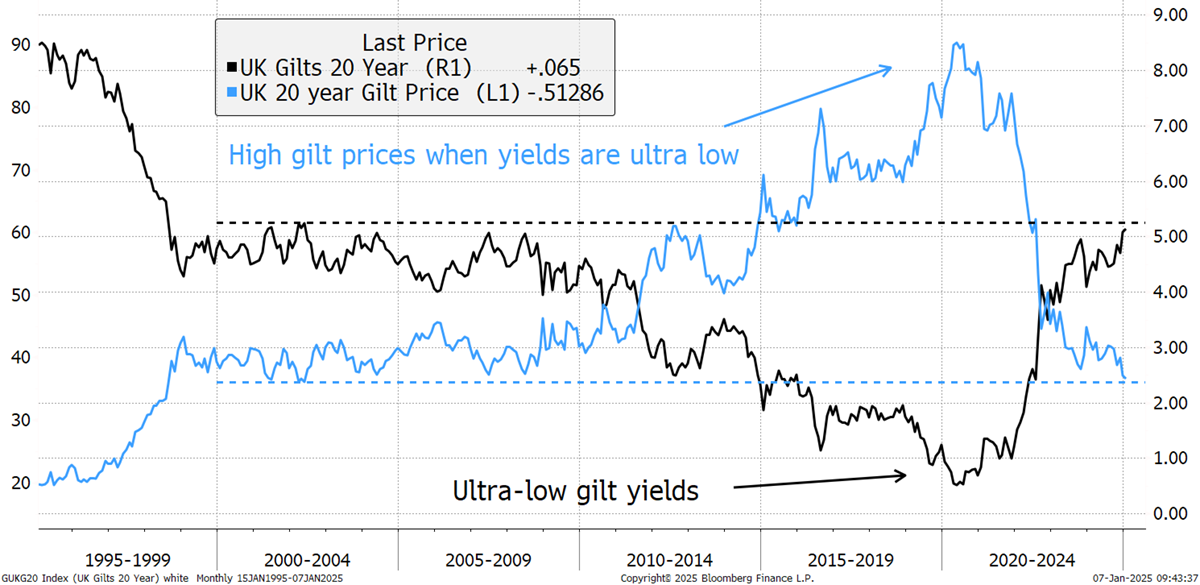

Whatever policies he enacts, there is no escaping the fact that the US stockmarket and the dollar are richly priced, and the value has shifted to bonds. I have seldom been bullish on the long bond in recent years, having been firmly in the bond bear camp. However, the primary reason for being cautious on bonds was the ultra-low yields, and that is now firmly behind us. Bond yields are now high and moving higher.

UK 20-Year Gilt Yields (black) and Prices (blue)

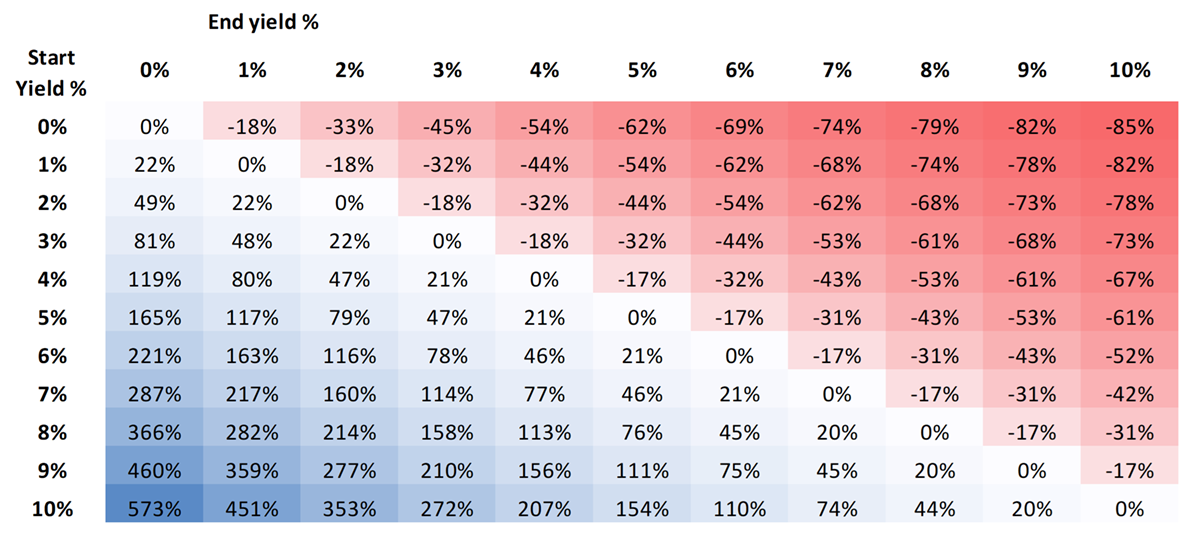

Prices and yields look at each other in the mirror. To simulate what would happen to bond prices with changes in yield, I have produced this table. Start on the left vertical and choose your yield. Move along to the right to see your end yield. The number on display in the table is your approximate capital profit or loss, excluding income.

Impact on 20-Year Gilt Price by Change in 20-Year Yield

Complex bond maths simplified, but that covers 90% of it. The table helps us to understand what is at stake. If the gilts purchased in Soda in November, at a yield of 4.9%, were to see a deflationary crash back to the gilt yield seen in March 2020 (0.4% - an unlikely event), the capital gain would be around 150%. Similarly, a melt-up in yields would cause losses.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd