Altcoin Rally Delayed as the Market Shifts to Risk-OFF

Disclaimer: Your capital is at risk. This is not investment advice.

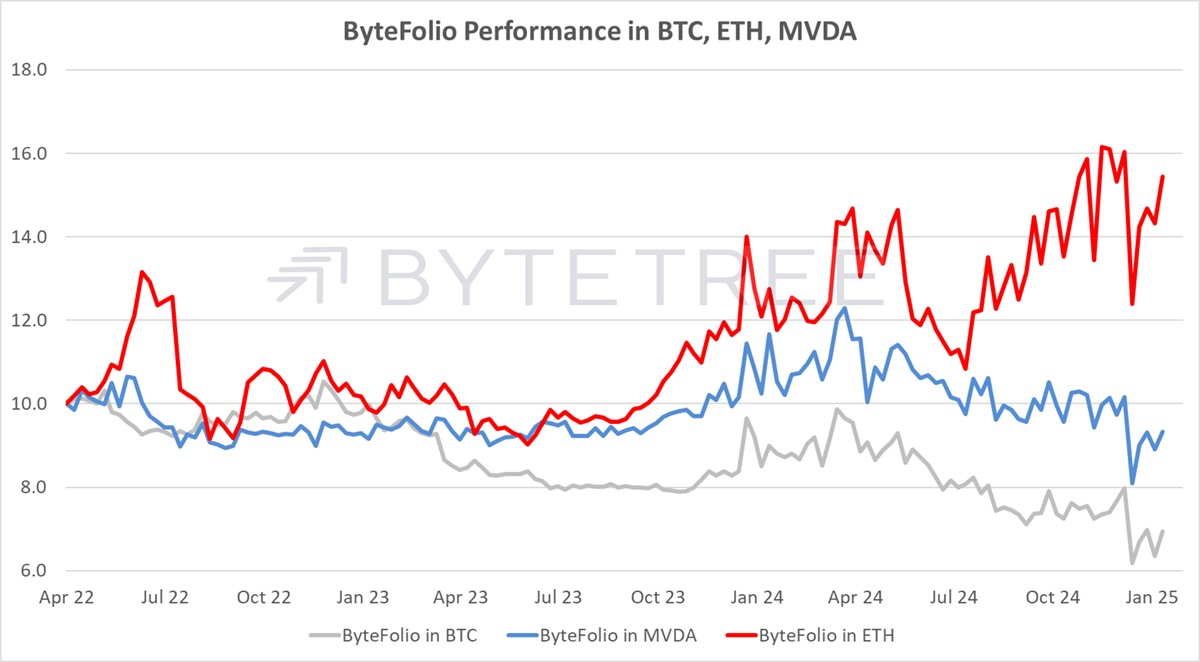

ByteFolio Issue 141;

Cutting exposure is never a comfortable thing to do, but last week, sensing the long-awaited altcoin rally had been postponed, it was time. Things may get worse before they get better, and that is largely down to macro factors, combined with the uncertainty ahead of next week’s inauguration in the US. A week from today, there will be a policy explosion. The Bitcoin short-term trend is under pressure, but the medium-term remains strong.

Bitcoin Trend Strength 2 out of 5

The macro has seen rising bond yields and a surging US dollar, putting downward pressure on asset prices. The NASDAQ futures are sliding (red), and Bitcoin (black) is following. The BitDAQ line (blue) is stable, suggesting that tech and Bitcoin are sticking together. The hope that Bitcoin would be a safe haven from a tech correction is not to be.

Bitcoin in NASDAQ

Growth assets are supposed to be more resilient against rising bond yields than other assets because, as they so often say, this time is different. There is a bond crisis, and gold is beating Bitcoin, which is unusual. A Bitcoin peaked at 40 ounces of gold in December and is now 34 ounces. This reaffirms the market shift towards risk-OFF.

Bitcoin and Gold

The strength in altcoins compared to Bitcoin remains soft, and it makes little sense to try to call a turn until markets get a sense of what the new administration will really mean. We can assume it is pro-crypto, but we cannot escape the fact that major financial markets are richly priced, with the tech sector vulnerable to a pullback.