Value Investing: Introducing Cash Flow

Disclaimer: Your capital is at risk. This is not investment advice.

My Journey in Finance;

Following on from book value, I move on to cash flow (CF), free cash flow (FCF), and free cash flow yield (FCF yield).

According to the accounting software company Xero,

“Cash flow refers to the money that flows in and out of your business within a specific time frame, whereas profit is what is left from your revenue once you’ve deducted your varying levels of costs (operational, taxes etc).”

In simple terms, CF looks at the bank account, whereas profit looks at the company’s books. A company might have sold goods and services that have been invoiced and delivered but yet to be paid for. It might also book profits on the revaluation of an asset, depending on US vs UK accounting standards, which is yet to be turned into cash. CF is the cash, whereas free cash flow (FCF) is the cash after the deduction of capital expenditure.

Net income (accounting profits) is the number one profit metric studied by investors. Because of how clever accountants are, this is more easily distorted and manipulated to look better than it is. Many companies have excellent profits but haven’t actually grown cash generation per share, which is the growth in money that is actually available to shareholders.

Therefore, studying the cash flows is crucial to make sure that a company is creating value and not just growing for the sake of it. It has also been shown that the lower a company’s conversion of net income to cash flow, the lower its share price returns.

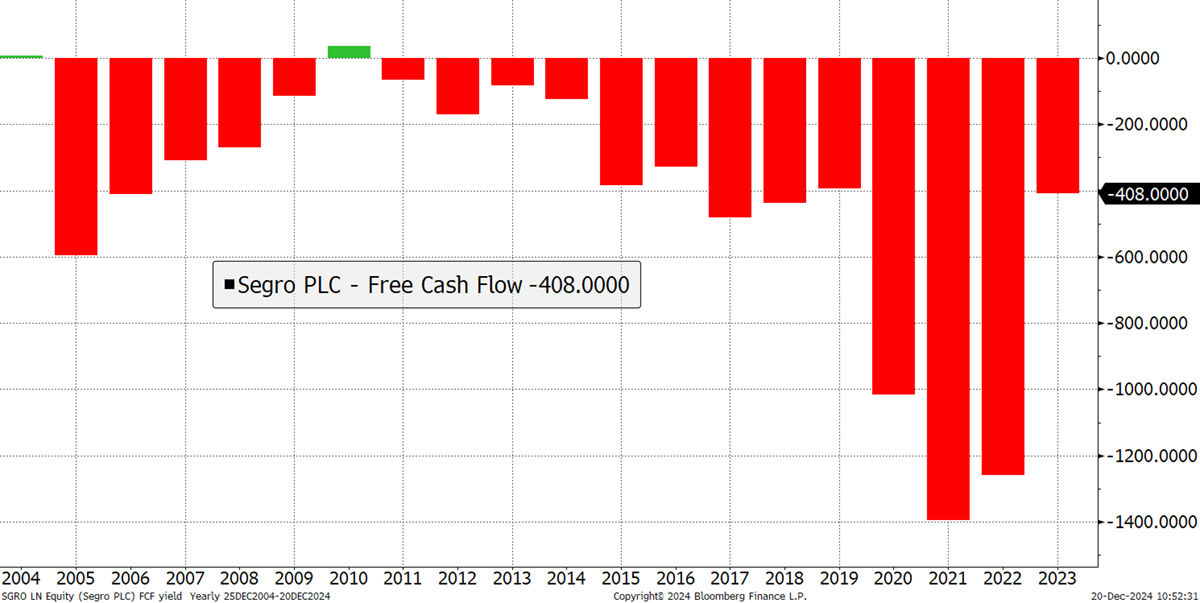

Property companies generally have poor cash flow because they carry interest-bearing debt and invest in costly development, which often exceeds the rents received. By contrast, their profits can be high as they grow their asset base.

The UK’s most valuable commercial property REIT, Segro (SGRO), has rarely generated FCF.

Segro Free Cash Flow

In contrast, Costco (COST), the US high-volume supermarket wholesaler for customers who like to buy in bulk, has a strong FCF. The goods for sale are delivered and sold before the invoice has been paid.