Value Investing: Introducing Book Value

Disclaimer: Your capital is at risk. This is not investment advice.

My Journey in Finance;

Following on from the enterprise value-to-sales ratio (EVS), we move to book value (BV), the price-to-book ratio (PBK) and book value per share (BVPS).

BV looks at a company’s net assets, i.e. the assets less the liabilities. It is most useful for asset-heavy companies, such as property, banks, and industry. It is less useful for asset-light companies, such as software, consumer goods, and support services, yet it still has its merits.

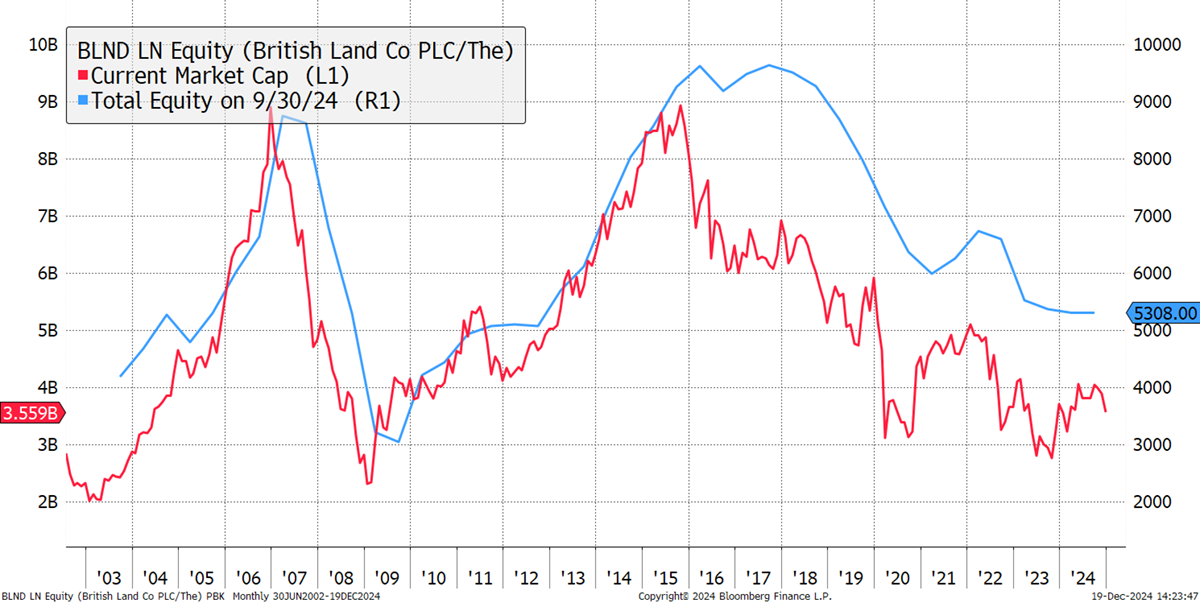

British Land

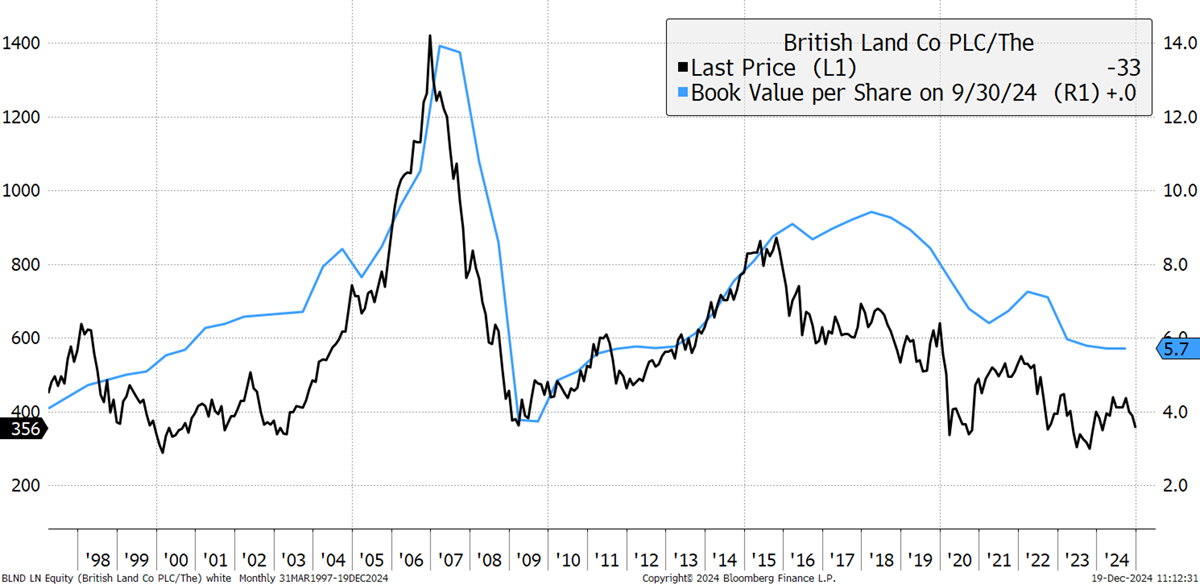

I show British Land (BLND), which has a UK property portfolio and debt. The blue line, total equity or BV, is an estimate of what the company would be worth if it sold the properties and repaid the debt. I show it against the market cap.

British Land Book Value

Until 2007, BLND’s properties were appreciating in value, only to reverse in the 2008 financial crisis. Interest rates then plunged, and BLND was able to refinance with lower borrowing costs. BV increased again until 2017 before falling into the pandemic. Note how the market cap was higher than BV on the way up and below on the way down. The stockmarket was able to anticipate what was coming.

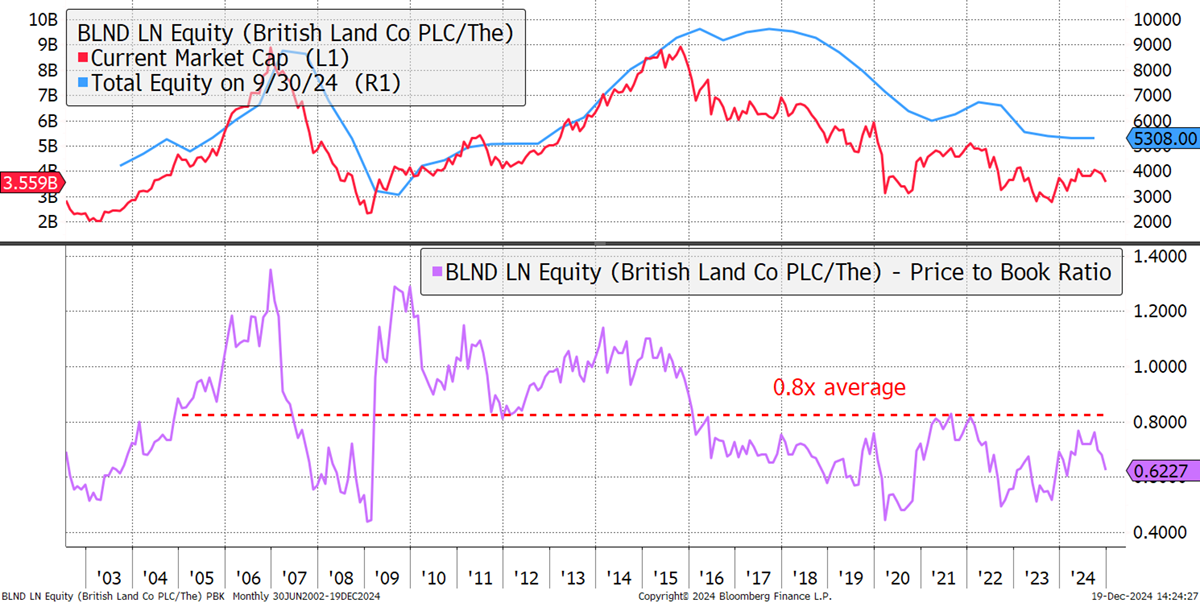

British Land Book Value and Price-to-Book

I have added the price-to-book (PBK) in purple. That takes the market cap and divides it by the BV. BLND has a market cap of £3.5 bn and a BV of £5.3bn. Therefore, the PBK is 0.62x, as shown in the above chart.

In theory, you could buy the company, sell the assets and make a profit, but for whatever reason, no one has done it. That is probably because a takeover would need to pay book value, or else the shareholders and the board would reject the offer.

The valuation is indicative of the fact that the property market remains soft. Notice how the 20-year average PBK is 0.8x, and so for BLND, trading below BV, i.e. at a discount, has become the norm. That said, in the late 1990s and before the financial crisis of 2008, BLND shares were trading significantly above book value, i.e. at a premium. During those times, investors were willing to pay more for the property portfolio than it could be sold for at the time. In the late 90s, that was well-founded because the property market continued to do well over the next decade. But in 2007, it proved to be a disaster.

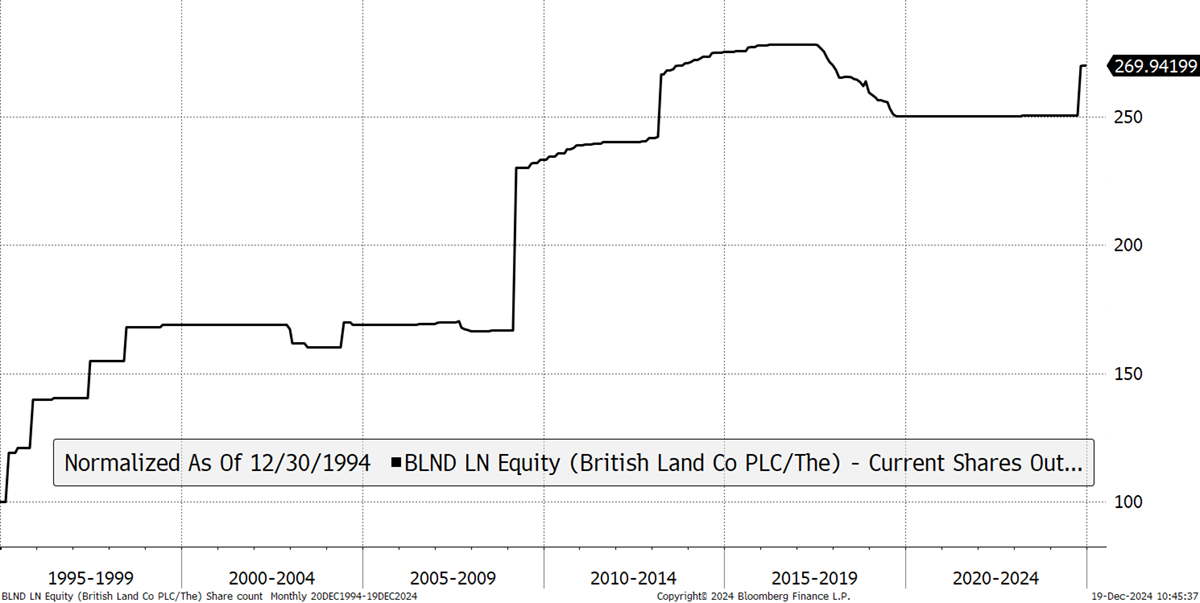

In 2008, BLND was in trouble, and the company had to raise new capital by issuing shares. In the late 1990s, the company issued shares at a premium, which enhanced shareholder value because they were able to buy property at 100 while selling shares at 130 to pay for it. The share sale in 2008 took place at a discount, and BLND was selling shares at a discount.

British Land Shares Outstanding (Rebased to 100)

With property price movements, debt refinancing, share price movements and share issues, it soon gets complicated. That brings us to book value per share, which I show against the share price. The chart gets us back to where we started, with the advantage of seeing everything on a per-share basis. That is a clear measure of what each share has gained or lost, in terms of assets, over the period. In 1997, BLND shares had 410p of BVPS and today 570p. That’s a 40% gain, while the shares have fallen by 13%. BLND shares have cheapened.

British Land Book Value per Share

BLND shareholders may have seen a lower share price, but the dividends boosted returns. Dividends boosted returns to 141% over the period, or 3.2% per annum. That is approximately half of the return of the FTSE All Share Index.

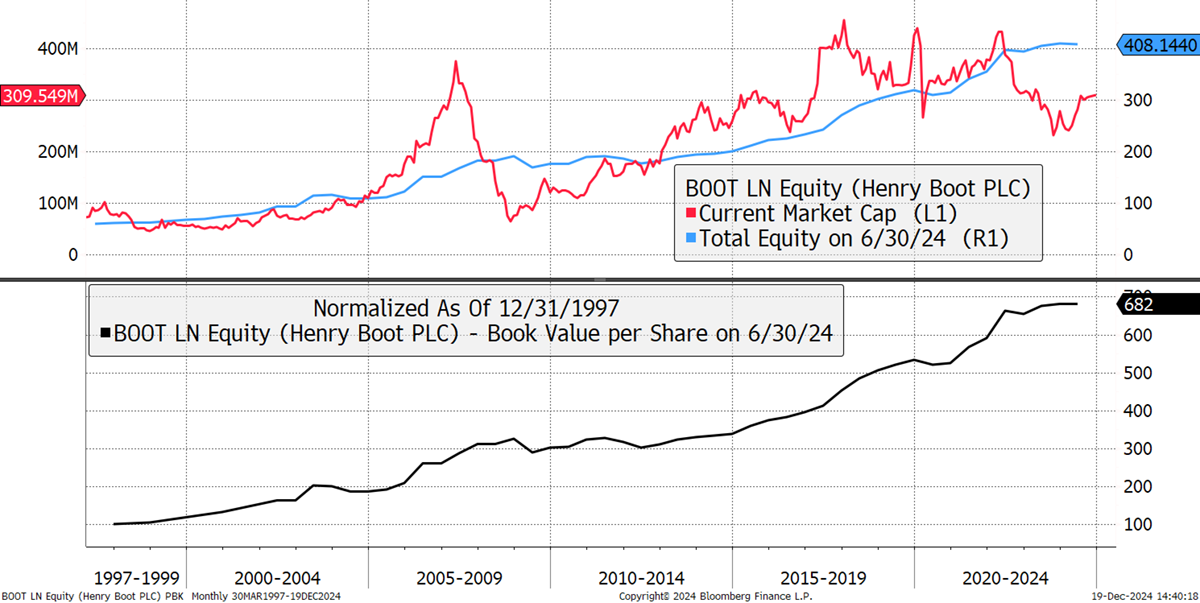

Henry Boot

BVPS is a useful measure, not just for comparing attributable value to the share price, but to see how the company has added value over the long term.

Henry Boot (BOOT) is a family-controlled, UK small-cap held in ByteTree Venture, and is involved in property development and construction. It faced the same pressures as the other property companies yet kept debt levels low, so it managed to avoid going backwards at times of stress. It has consistently added to the asset pot, growing BVPS six-fold 6x over the period shown. Over the period, and with dividends, the shares have gained 8.3% p.a., which is 3% higher than the FTSE All Share, and the shares trade below book value.

Henry Boot Book Value per Share