The Long-term Gold Supply

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 100;

I started writing Atlas Pulse in late 2012 to communicate my thoughts on gold in an era where my employer at the time made it more difficult to communicate with the public. I had been a commentator on CNBC and Bloomberg TV since 2002, banging the drum on gold, and that then ceased to be. Atlas Pulse was born, published under a pseudonym, and 100 issues later, here we are.

Highlights

| Track Record | Solid |

| Technicals | No Bubble |

| Models | Atlas Pulse Creations |

| History | Long-term Comparisons |

| Bitcoin | The Upstart Closes in |

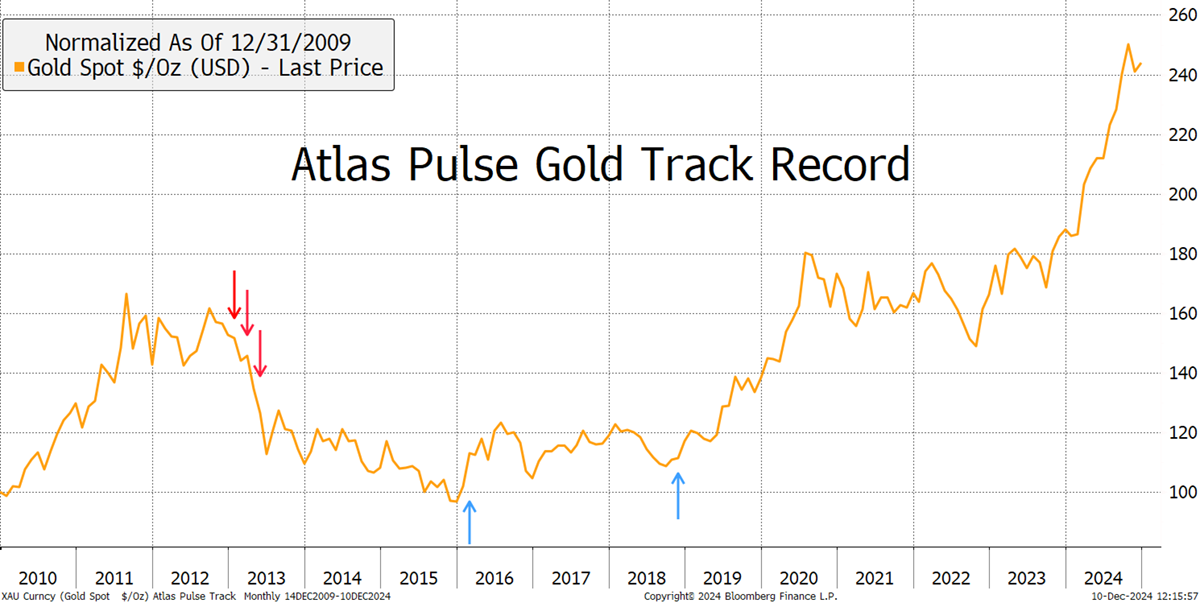

Atlas Pulse Track Record

There has been a resounding track record that has successfully navigated the gold market. There should have been more issues, but I wrote them more seldomly during the quiet patch between 2014 and 2018, as there was little to say at the time.

The dial above indicates the state of the gold market, and it hasn’t moved since December 2018. That doesn’t mean I haven’t thought about it for each issue. It has remained on “bull” because that’s where we are. I felt this was a useful way to communicate the state of gold, which, as a long-term asset, only needs to be flagged when things go wrong. They aren’t, so according to Atlas Pulse, gold remains in a bull market.

Track Record Since 2012

I cut gold in early 2013, taking the weight in the portfolios I managed at the time from over 10% down to 1%. The sell call wasn’t difficult because we had come out of a period of euphoria, silver was sliding, and real interest rates were about to surge. Inflation was low, while bond yields were rising, and the Euro crisis was coming to a resolution.

The buy in early 2016 followed the China slowdown and the bear market in commodities in 2015. The dollar had peaked, and real interest rates had settled down. The low for the gold price was in. Then, by late 2018, real rates were about to collapse, and the bull market, which started around 5,000 BC, resumed. Atlas Pulse was on it, and the price has risen 126% since.

Technicals – No Bubble

I stick with buy because the gold market has evolved once again, as it has many times over the years, and there are still no signs of a bubble. At the 2011 peak, silver was in the lead, peaking in April at $50 ($49.80 intraday), while gold carried on into the summer. A rich silver price is a sign of trouble, as it implies the animal spirits are riding high. The gold-to-silver ratio (GSR) fell to 32, which is very low, implying silver is expensive compared to gold. Today, the GSR is 85, which is cheap. That suggests the level of speculation in precious metals is low.

Gold-to-Silver Ratio

I have used a 50-year regression, which clips the GSR by 0.6% each year. On that basis, the middle of the range is 78. If you assume a constant, that would be 65, implying silver was very cheap. But, since the GSR was 15.5 in 1717 when Sir Isaac Newton was the Master of the Royal Mint, we should assume the GSR will rise over time because gold is the world’s primary monetary asset, and silver isn’t. Nor is Bitcoin, for that matter, but it’s certainly having a go, and we will come to that later.

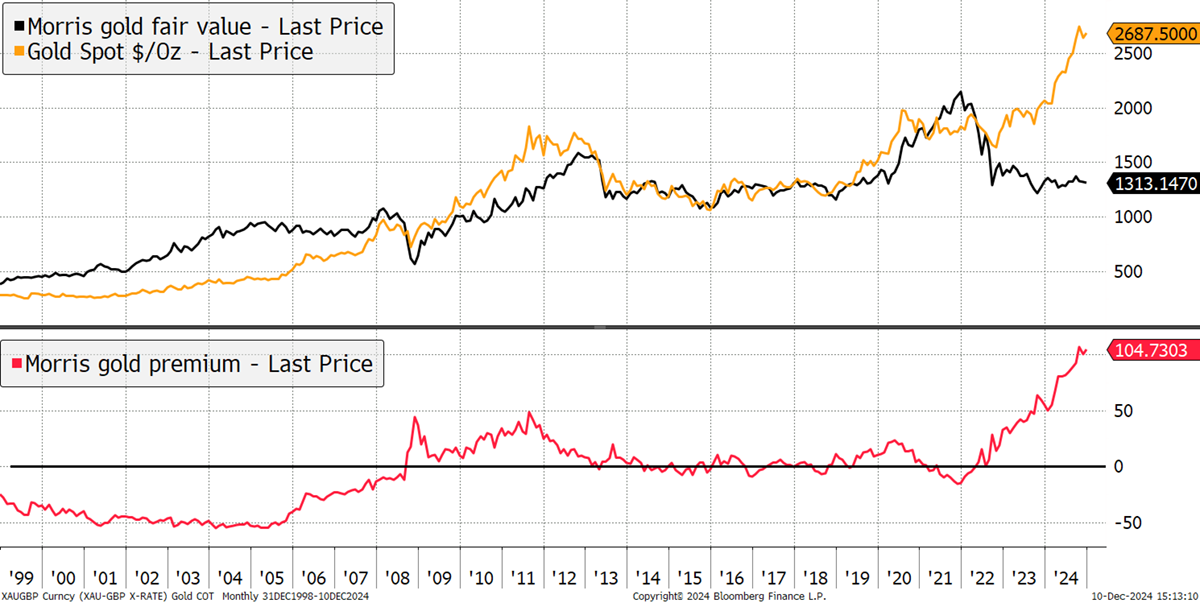

Models - Atlas Pulse Creations

Over the years, Atlas Pulse has brought much to the gold market, with a focus on how investors should think about gold. In around 2012, I modelled the gold price as a 20-year TIPS (US inflation-linked government bond). In modelling gold as a bond rather than an equity or a commodity, as was popular at the time, it started to make sense. I asked the question: if gold was a bond, what kind of bond would it be?

- It is zero-coupon because it pays no interest.

- It has a long duration because it lasts forever.

- It is inflation-linked, as historic purchasing power has demonstrated.

- It has zero credit risk, assuming it is held in physical form.

- It was issued by God.

It got a few laughs, which is always a bonus, but when I modelled it as such, the results were incredible. That held until 2022, when the world changed with the invasion of Ukraine. It wasn’t the war but the use of reserves and the dollar as a weapon. Gold changed roles and became a neutral asset that couldn’t be ceased. Investor demand peaked in 2020, but then the central banks stepped in.

The Gold TIPS Model

On the basis of the TIPS model, gold is currently 104% overvalued, with a fair value of $1,313. The fall in fair value can be attributed to higher interest rates since 2022. Bonds collapsed that year, and if gold is a bond, so to speak, it should have collapsed too.