Happy Christmas from the Fed

I remind you that these two subjects are well covered at ByteTree and are the reason I do not spend much time writing about Bitcoin and Gold in The Multi-Asset Investor, leaving more space for traditional assets. A reminder for those unaware. This is the last issue before the Christmas break, and I will be back on Tuesday, 7 January, but I will hopefully have published the quarterly performance review before then.

I reiterate a point I made in yesterday’s ByteFolio regarding last week’s Fed meeting, where they cut interest rates by 0.25% to 4.5%. That was the good bit. The markets reacted negatively because they stated that future rate cuts would slow. Expectations were for interest rates of 3.5% in two years’ time and falling thereafter. That gave financial markets something to look forward to but instead, expectations have risen to 4%. Monetary policy will remain tighter for longer, which is good for the US dollar but less so for financial assets.

US Two-Year Interest Rate Expectations

While stocks, bonds, commodities and Bitcoin fell, higher rate expectations caused the dollar to rise from an already lofty position. So long as the dollar stays firm, that’s a negative force for markets in 2025, but the hope is the Trump administration will put pressure on the Fed to cut rates. Be in no doubt that Trump likes low interest rates because he’s a property tycoon.

US Dollar Index

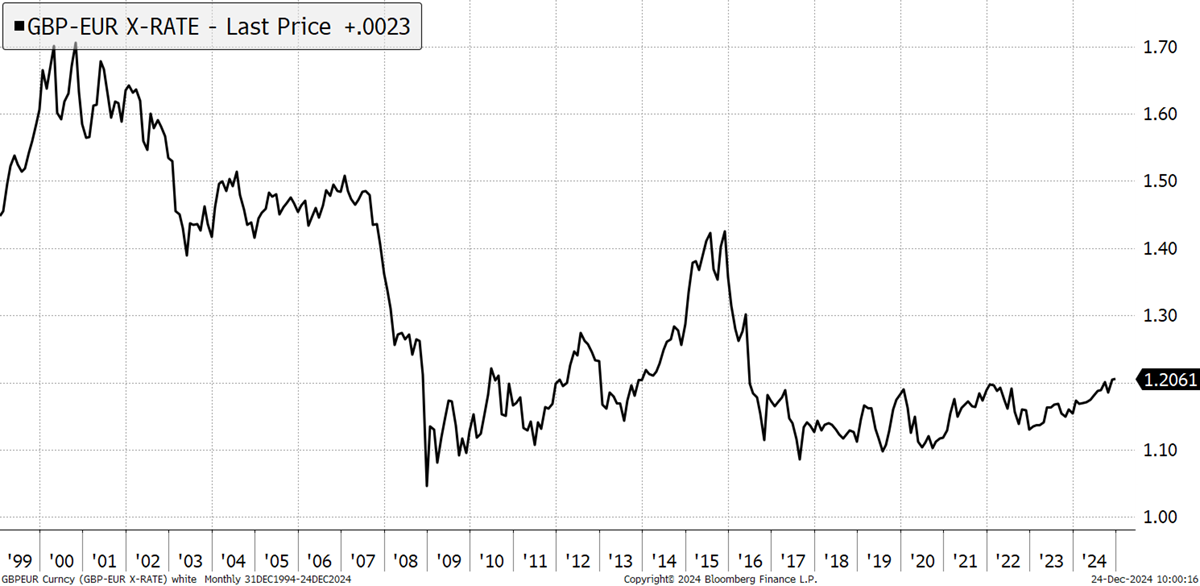

The pound fell, but by less than other currencies, because UK rates are keeping the pound firm as well. The pound is trading at a post-BREXIT high versus the euro. By this measure, Britain is not in crisis, but things could certainly be better.

GBP vs EUR

It’s all about inflation, and the Fed does not believe the battle has been won. Long-term expectations have fallen but remain above the 2% target. I remind you that UK RPI is typically 0.9% above CPI, so don’t panic about the gap, as if you adjust for the difference in the calculation, they are roughly the same. Inflation expectations have turned down, with wages and rents holding out. Commodity prices haven’t been rising in recent months, reminding us that the strength in the economy isn’t broadly shared across countries and sectors.

US Inflation Expectations – 10-year

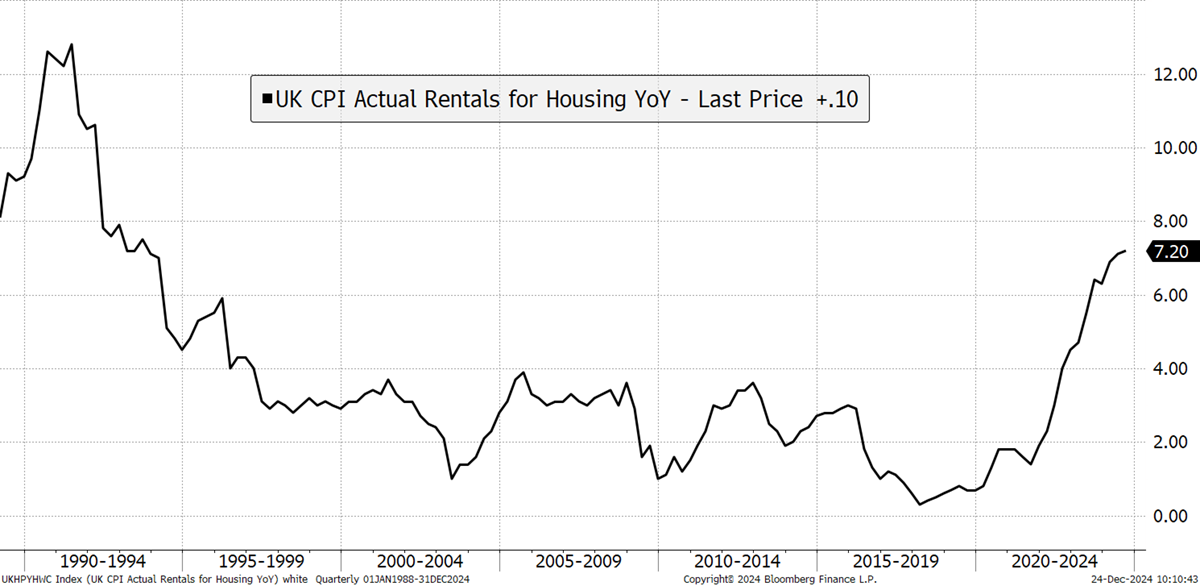

The inflation outlook is softening, but the Fed are concerned that if they cut rates too soon, inflation pressures will return. And there are hotspots. UK rents are out of control, up 7.2% this year. The laws of supply and demand suggest there are more renters than landlords, and this is a major issue for the UK government and the cost-of-living crisis.

UK Rents Year on Year change

They will build more houses on brown fields, green fields, and even on the greenbelt. But, I sense a more structural problem is the lack of landlords, who have turned away as the rules have become stacked against them. There is not a housing shortage for buyers but for renters, and this will be one of the inflationary bottlenecks. A little deregulation would go a long way.

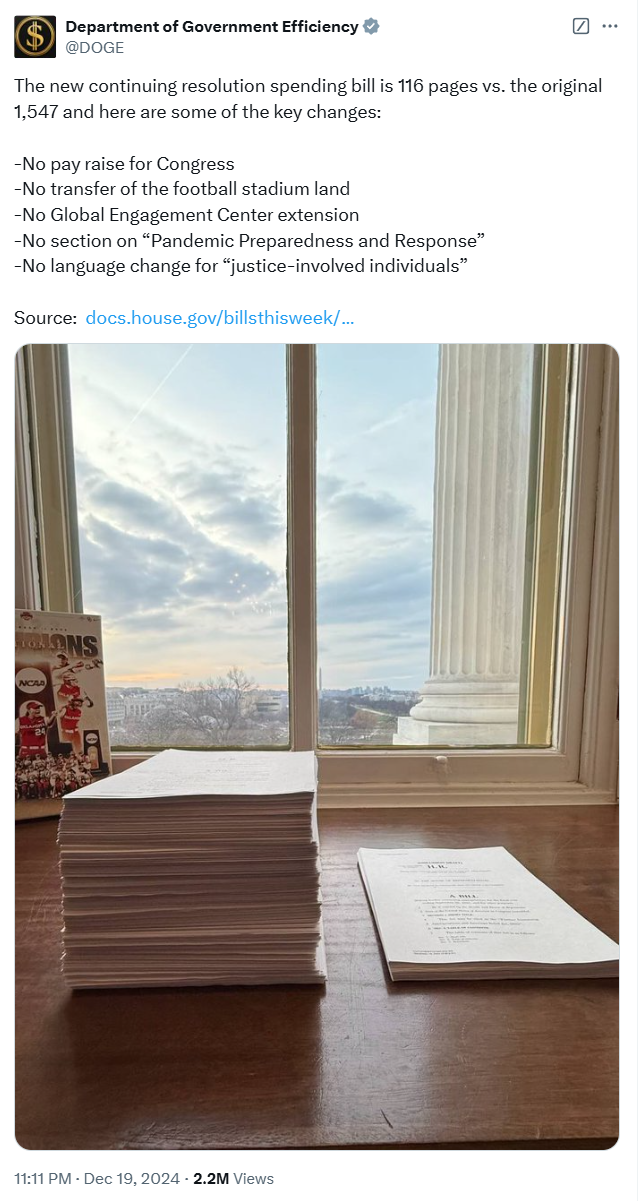

The Americans will have deregulation in spades, with the Department of Government Efficiency (DOGE) declaring its first victory in quashing a budget bill before they are even in office. See how the size of the bill was quashed, not only in terms of cost to the taxpayer but in the length of the legislation.

Department of Government Efficiency

I believe DOGE will become a major influence in tackling budgets and government efficiency in general. If the US, and don’t forget Argentina, succeeds, other countries will have to follow suit. Even Tony Blair was saying in interviews this year that the government needed to embrace automation and technology. Just as we had practically given up on the idea of a more efficient government, the seeds are being sown.

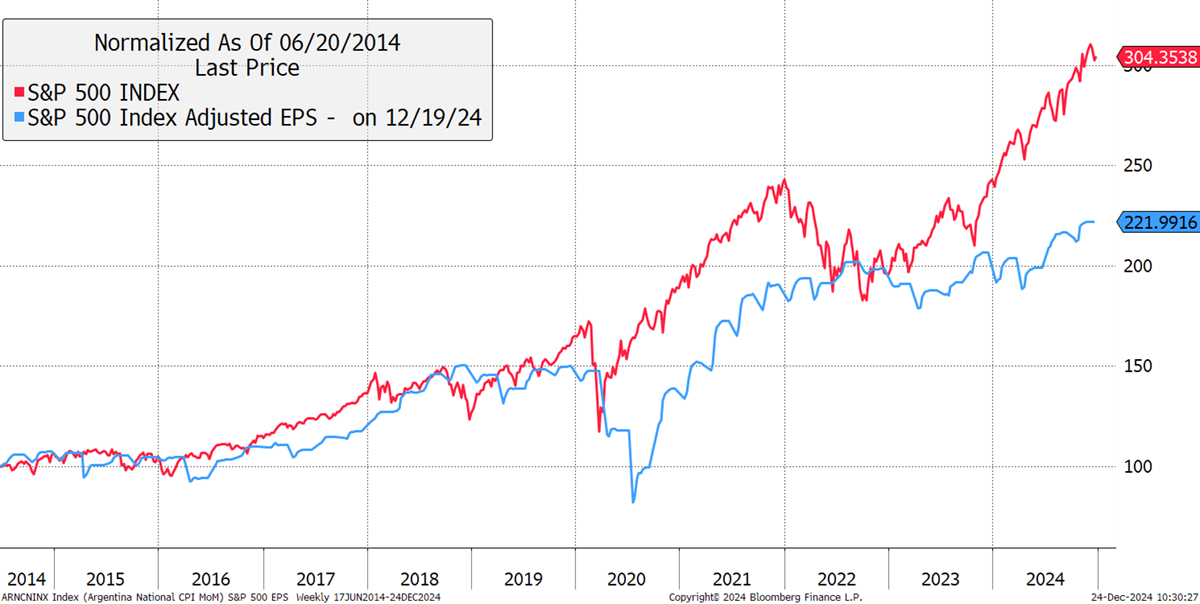

But perhaps it’s more bullish for bonds than equities. Bond yields, with stable inflation, are at attractive levels, and although US equities have done well, prices have surged beyond earnings. This cannot continue forever.

US Equities vs Earnings

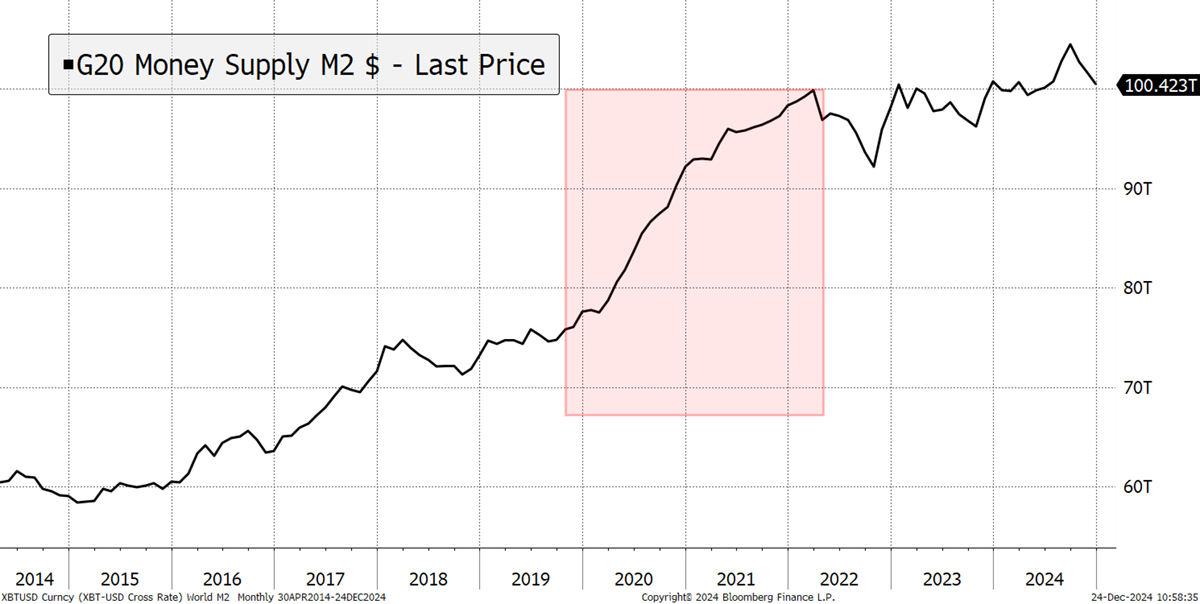

In 2021, we blamed quantitative easing and the increase in the money supply for exuberant markets, but the money supply has been flat ever since. Now, we blame government deficits and their burgeoning deficits. This will change. The money supply will also grow again when the dollar peaks, which is likely to happen when the Fed signal the next round of easing. Remember, Trump likes low rates.

G20 Total Money Supply $ Trillion

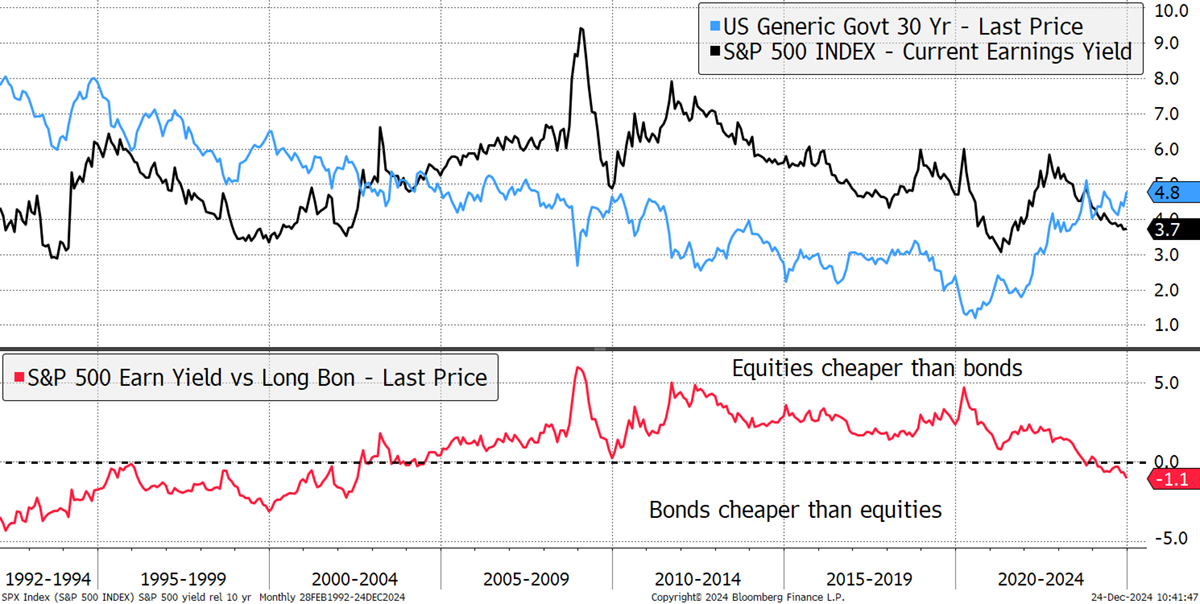

Inverting the PE ratio for the S&P 500 gives the earnings yield, which allows us to compare the stock market with the long bond. With zero rates post-2008, equities have always stood out, but that is no longer the case. While the long-dated bond yields may rise a little further, they are moving into attractive territory, especially if inflation remains in control and DOGE reduces the budget.

S&P 500 Earnings Yield and the Long Bond Yield

The spread is now favouring bonds, and I believe this is an important point as we look to 2025 and beyond. The stockmarket has a challenger.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 Crypto Composite Ltd