Understanding What Drives BOLD

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

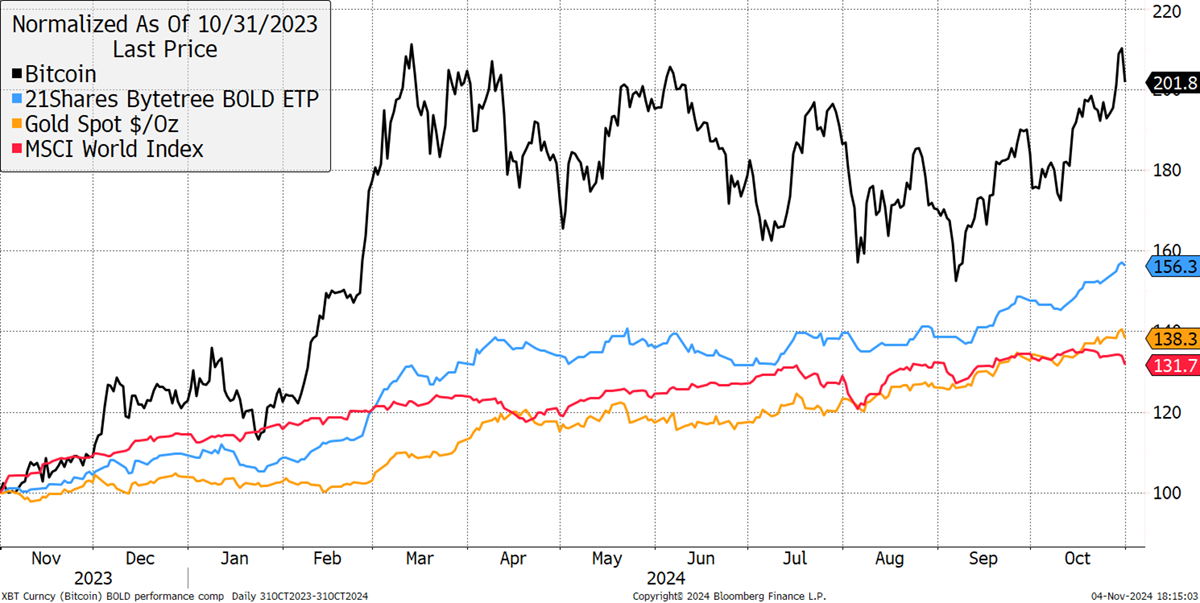

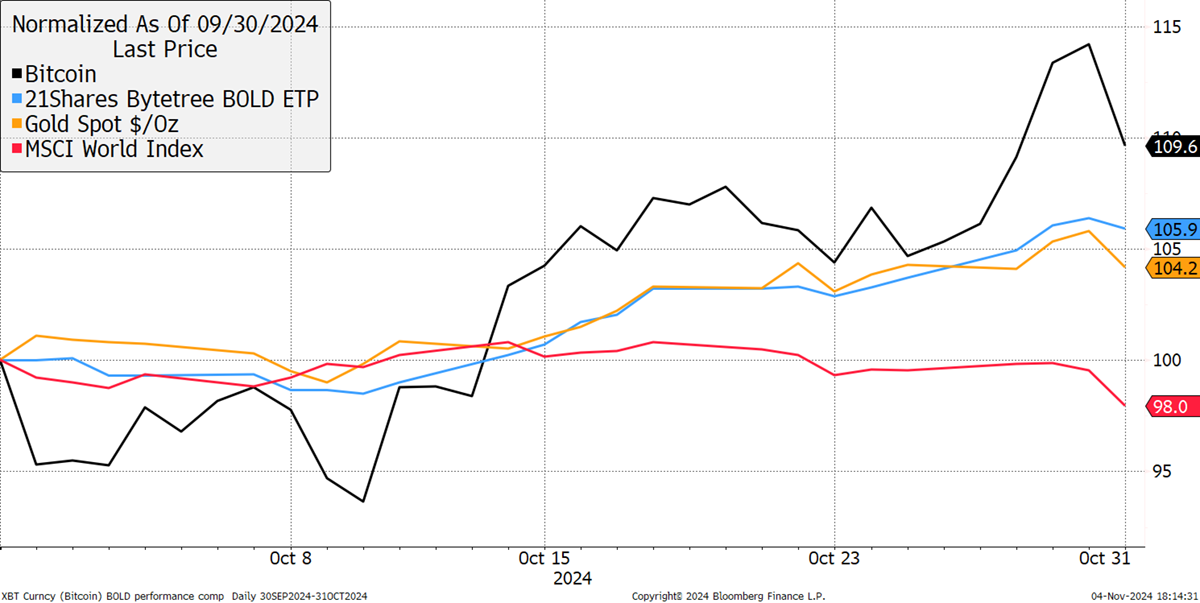

In October, BOLD rose by 5.9%, Bitcoin rose by 9.7%, and Gold rose by 4.2%, while global equities fell by 2.0% in USD terms. The target weights last month were 24.6% and 75.4% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 25.8% and 74.2%. This means the latest end-October rebalancing has seen 1.2% reduced from Bitcoin and added to Gold to meet the new target weights.

Bitcoin, Gold, BOLD, Equities USD – October 2024

Understanding What Drives BOLD

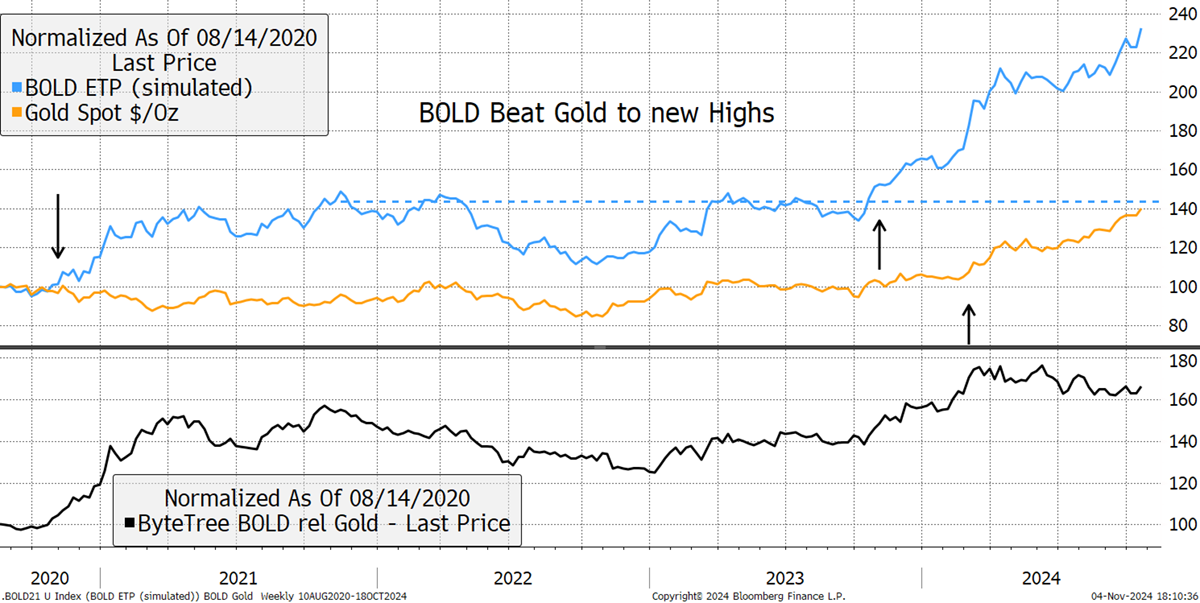

Blending Bitcoin and Gold on a risk-weighted basis leads to a more favourable outcome than Bitcoin or Gold alone. Shortly after the pandemic, Gold made an all-time high on 7th August 2020, where the chart begins. The price of Gold didn’t make a new high until March 2024. Yet BOLD made a new high in the autumn of 2020 and again in October 2023, five months before Gold’s high in March this year. The lower black chart shows how BOLD has outperformed Gold by 68% since the start.

BOLD Versus Gold

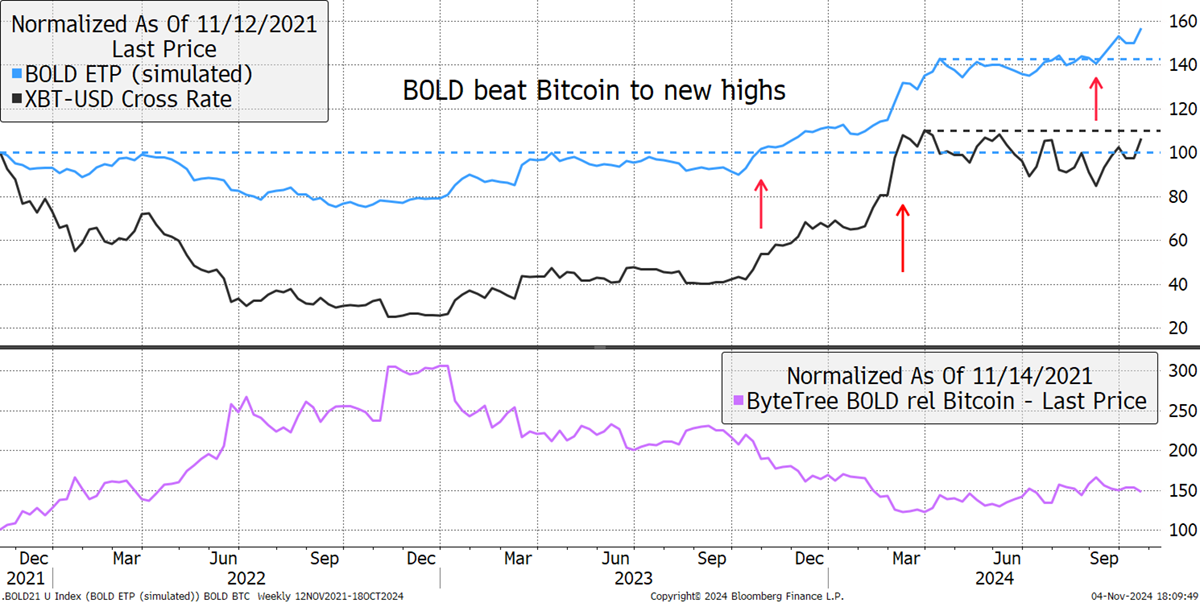

The same is true for Bitcoin, which made a notable high on 12th November 2021, where the below chart starts. Bitcoin collapsed by 75% into 2022, whereas BOLD’s maximum loss was 25%. BOLD’s new high occurred in October 2023, again six months earlier than Bitcoin’s in March 2024. BOLD continued to make more new highs, and today, it is 56% higher than at the start, in contrast to Bitcoin, which is up 6%.

BOLD Versus Bitcoin

The lower purple chart shows BOLD relative to Bitcoin, which has outperformed by 47%. There can be no doubt that Bitcoin will beat BOLD in a Bitcoin bull market, but BOLD seems to hold the fort, providing shelter from Bitcoin’s volatility.

In other words, BOLD has beaten both Bitcoin and Gold over the periods since their last major all-time highs. It has achieved this through risk-adverse allocation and monthly rebalancing transactions, which repeatedly add to the weaker asset and take away from the stronger asset.

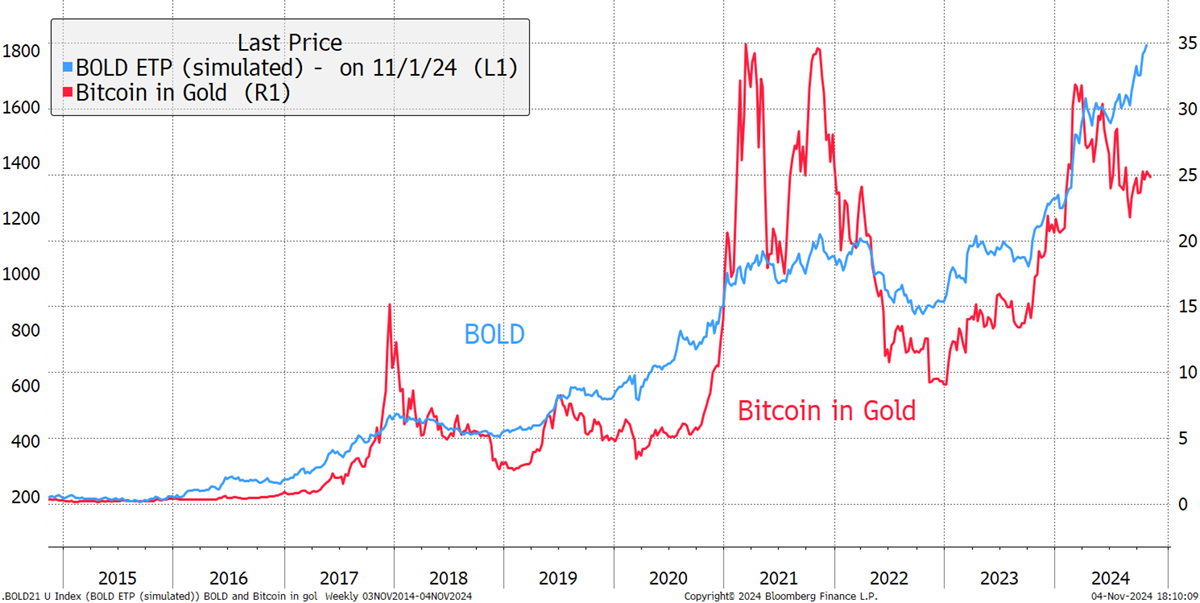

I compare BOLD to Bitcoin in Gold (red), which is currently 25 ounces. That is, one Bitcoin is worth the same as 25 ounces of Gold. The success of BOLD has been most notable when Bitcoin has outperformed Gold, but not always. These past six months have seen BOLD rise strongly when Bitcoin has been weak. In recent weeks, the strong seasonality for Bitcoin has kicked in, and unusually, both assets are performing well simultaneously.

What Drives BOLD

Unsurprisingly, BOLD is often a smoothed version of Bitcoin in Gold, missing out on the peaks but, crucially, also the troughs.

BOLD Performance

Over the past year, Bitcoin’s performance has returned +101.8%, in contrast to Gold with +38.3%, while equities rose +31.7%. BOLD has returned +56.3%.

Bitcoin, Gold, BOLD, Equities - Past Year