Trump’s Impact on Financial Markets

Trade in Soda;

Financial markets have had a busy week following the surprise Trump victory last Wednesday. It’s a surprise in the sense that the markets hadn’t priced it in, for if they had, they wouldn’t have had the extreme moves over the past week.

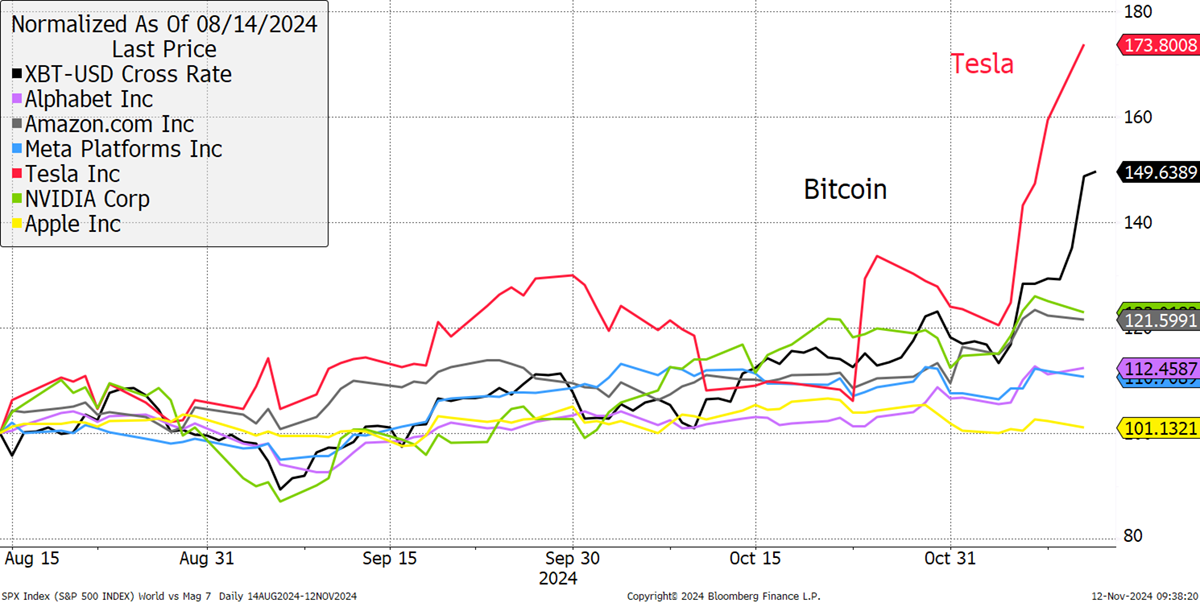

Many would say Bitcoin was the winner of this election, but with a 50% gain, it was overshadowed by Tesla (TSLA), which managed 74%. The other large technology stocks jumped, but not by much. Apple (AAPL) was flat, while the winner besides Tesla was Alphabet (GOOG), up 6%. I will return to Bitcoin, and gold, later in this piece.

Bitcoin and Big Tech

The other winner, not shown, was Palantir Technologies (PLTR), up 45%. They are, in effect, one of the original AI companies that comb through data on behalf of governments and intelligence agencies. I suspect this market reaction is a sign of things to come. Musk will be head of the Department of Government Efficiency (DOGE). For those unaware, Dogecoin is a meme coin in crypto, launched as a joke with a picture of a dog, that Musk plans to use as the currency on Mars. Being head of DOGE is hilarious to a million crypto fans, but a joke missed by billions of people around the world.

This is a government that will be led by the Tech Bros. These are the right-leaning technology companies and their backers who will step up to transform the USA. Musk has pledged to save $2 trillion of annual government spending. Should we believe him? He launched a rocket into space on a shoestring budget and fired 80% of the staff when he took over Twitter. Maybe it’s best not to bet against Musk’s skills in budget restraint.

This is a bold attempt to reduce the escalating cost of government using technology, and we should all hope they succeed because if they do, the rest of the world will have a model to follow. And it surely needs one, especially over here in Europe. This is a point the market and the press might have missed. Trump might balance the budget, which, for a property guy, would be truly remarkable.

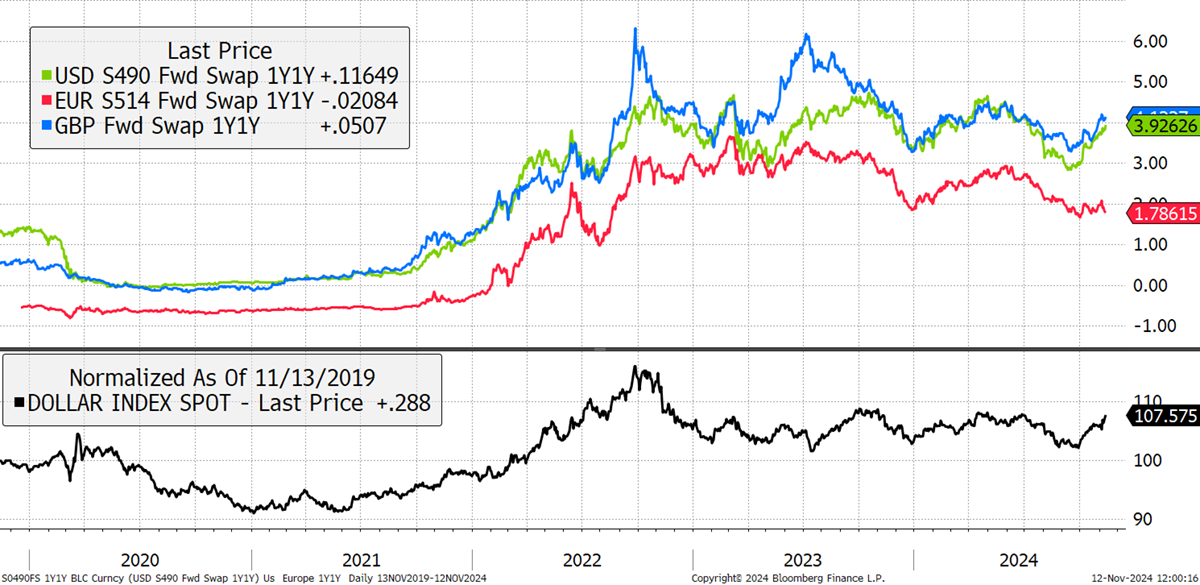

The dollar rose on Trump’s victory, and that can be attributed to higher interest rate expectations, especially against the Eurozone. In the US and UK, rate expectations have risen, whereas in Europe, they have declined. Hat tip to Patrick Perret-Green, my go-to macroeconomic expert when I need clarification. The chart shows the expected interest rates this time next year in the US, UK, and Europe.

Dollar Up on Higher Rates, European Rates to Fall

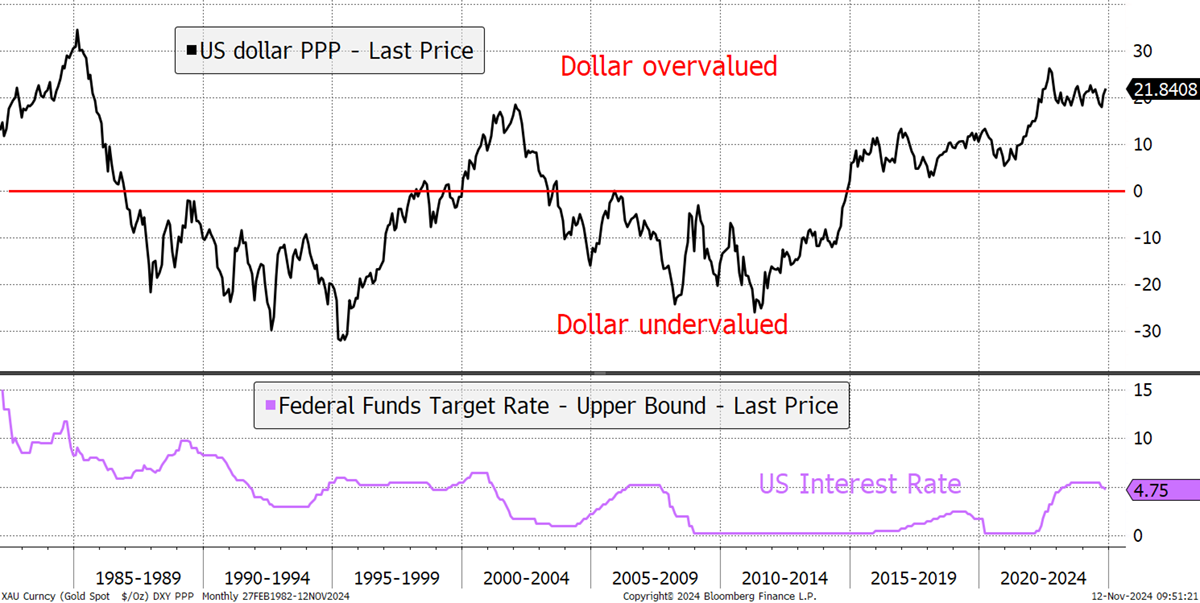

To remind you, in terms of purchasing power, the dollar is stretched, but higher rates will keep it stronger for longer. Yet competitive pressures will eventually kick in, and this is why Trump’s tariffs are another important factor. The world will be desperate to sell its cheap goods to the USA, but tariffs will become a negotiating tool, which will be used to generate revenue and help achieve foreign policy objectives.

The Dollar Is Expensive

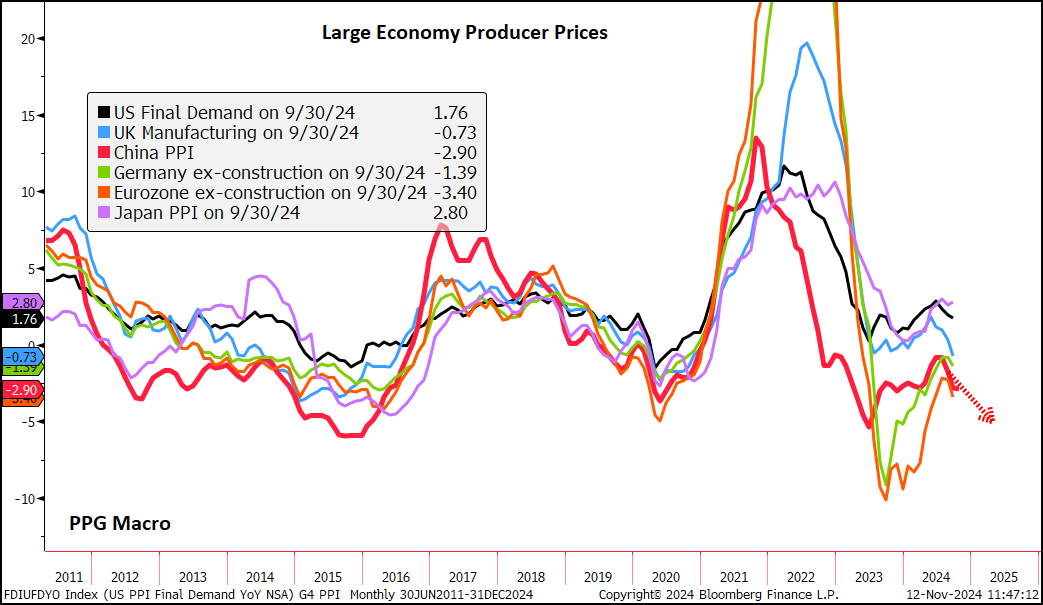

Looking at the economy, Perret-Green reiterated that the global economy remains weak, with producer prices sliding across the board. Japan is doing a little better than the rest, but due to a deeply undervalued currency, something Trump will no doubt address when he’s in office.

Producer Prices Sliding

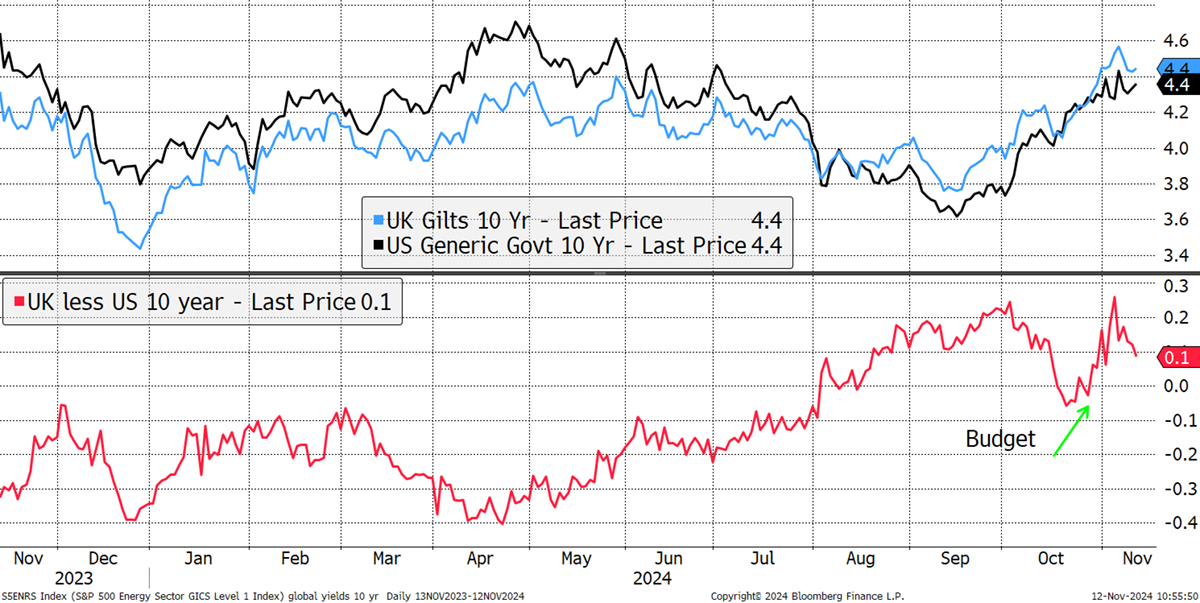

The rise in US bond yields is a welcome relief for the UK government following the high tax, high-spend budget two weeks ago. I showed this last week, but with US yields higher, the gap with UK yields has narrowed. Trump has handed the UK Chancellor a get-out-of-jail-free card.

UK US Bonds Spreads Narrow

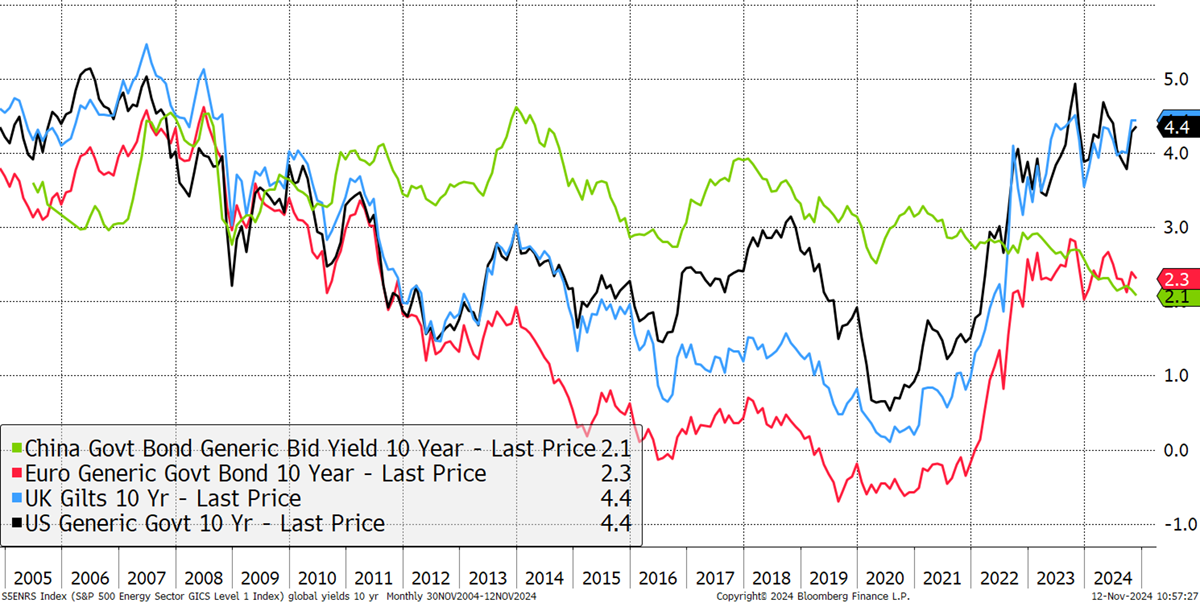

The other message from the bond market is that deflation is back, at least in the Eurozone, China and other manufacturing centres around Asia. Chinese yields are down to 2.1% and appear to be heading towards Japanese levels. A Chinese currency devaluation seems ever more likely, but what would be the penalty? Higher trade tariffs with the USA. Somehow, UK yields have remained more tightly coupled with the US than Europe. While lower yields mean the cost of borrowing is cheaper, the flip side is they reflect slower nominal GDP growth (growth plus inflation). On that basis, low yields are not necessarily a good thing.

US, UK, Eurozone, and Chinese Bond Yields - Divergence

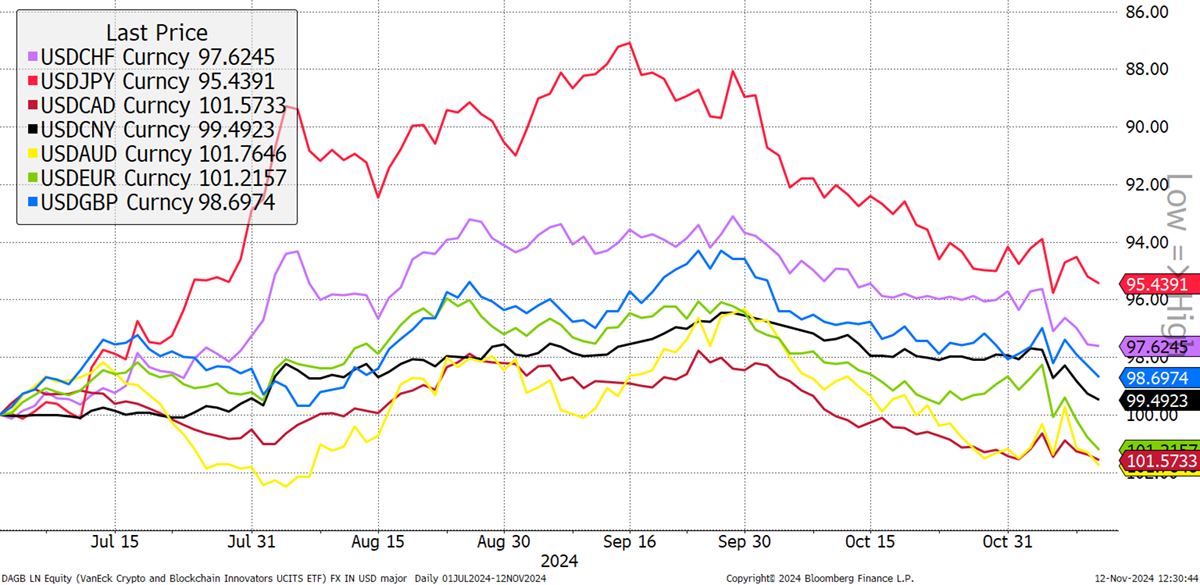

Looking at the major currencies, since the start of the Yen move in July, the Swiss Franc remains the most stable, with the commodity currencies, the Aussie and the Loonie (Canada), the weakest. The euro has also fallen.

Major Currencies – Since July

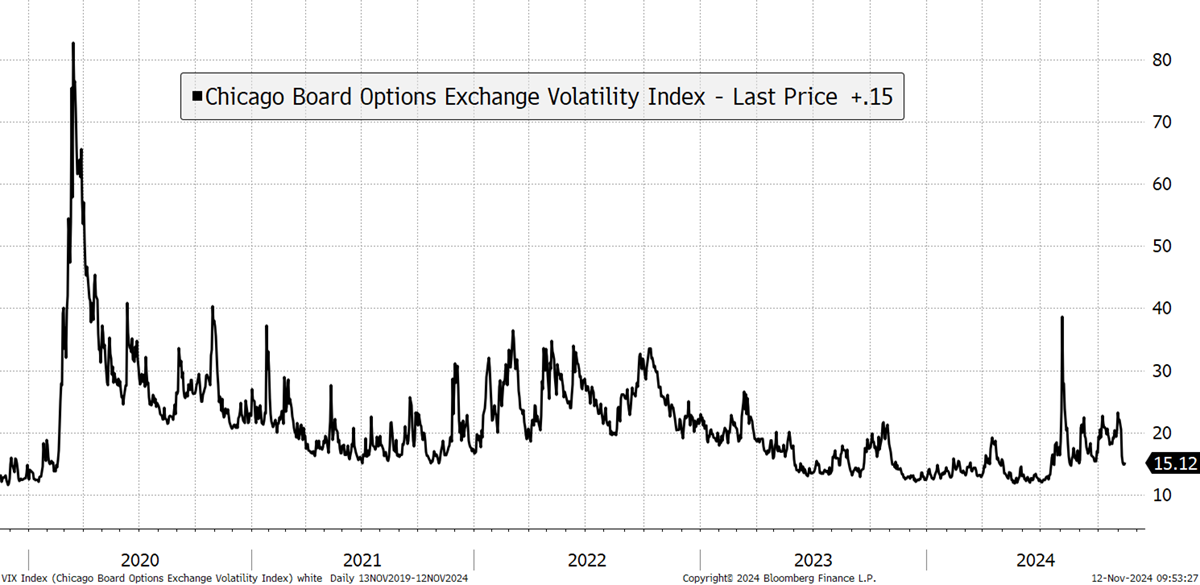

It may not feel like it, but according to the VIX, the stockmarket’s measure of uncertainty, risk has diminished. For the record, that hasn’t only happened in the US market but in Europe too. The relief is not related to policy changes, but that the election was a clean and decisive result that would not be contested. A civil war was averted.

The VIX Has Fallen

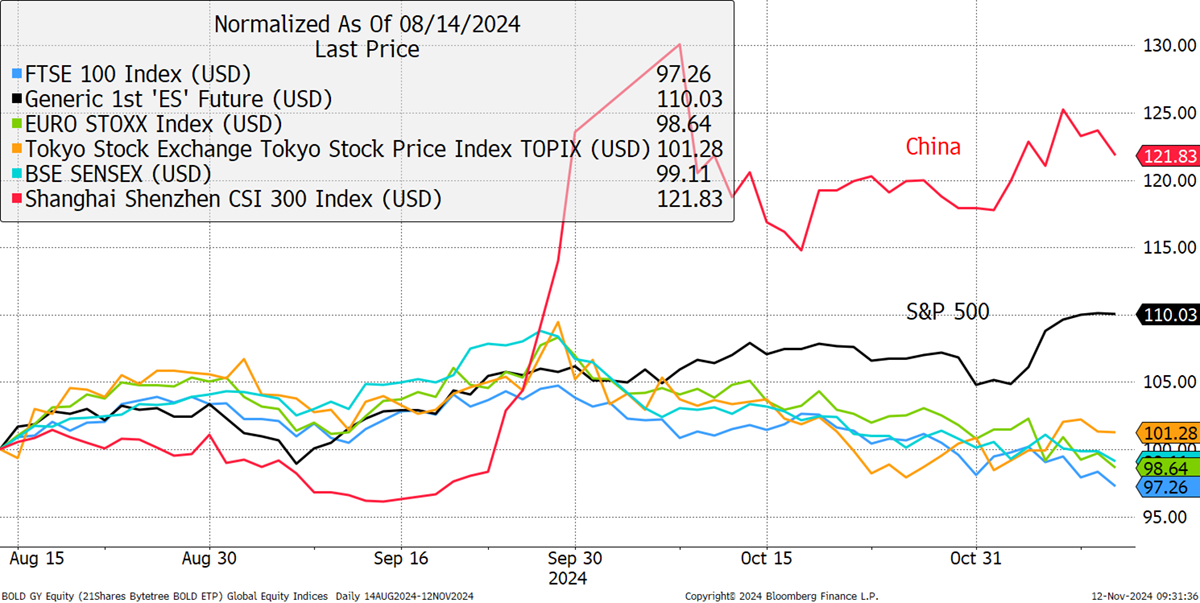

Moving onto the major stockmarkets, China has eased back, while the S&P 500 has risen only slightly. Bloomberg columnist John Authers made the point that the US rally was no better than the one that greeted Herbert Hoover in 1928, ahead of the great depression. Europe, the UK, Japan, and India are flat or down when viewed on a constant currency basis. From a high level, this move in equities is underwhelming.

Major Stockmarkets

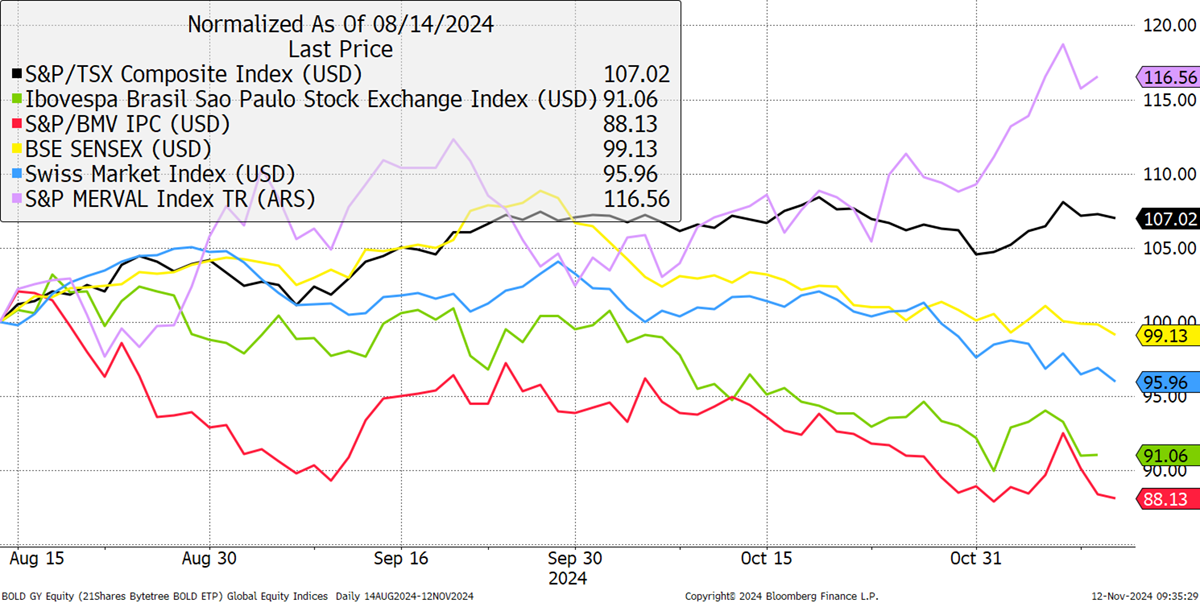

For the emerging markets, Argentina (purple) is a winner, as President Milei is a member of the Trump Club. I show America’s neighbours, Canada (black) and Mexico (red). Super-rich Switzerland is down, with Brazil up slightly since election day. Fast-growing India has also slid slightly despite not having much trade with the US outside of Silicon Valley executives.

US Neighbours and Other Markets

In the US market, where Bank of America stated that cutting corporation tax to 15% would boost the S&P 500 earnings by 4%, the winners are very much the Tech Bros, along with electricity producers to power AI (no net zero over there). Other winners include investment banks, regional banks, and airlines. The losers are renewable energy, healthcare, biotech, commodities, and surprisingly, REITS, probably due to higher rates.

In Europe, the winners are once again technology and travel, with the losers being natural resources, utilities (no AI and net zero), renewables, chemicals, and retail banks.

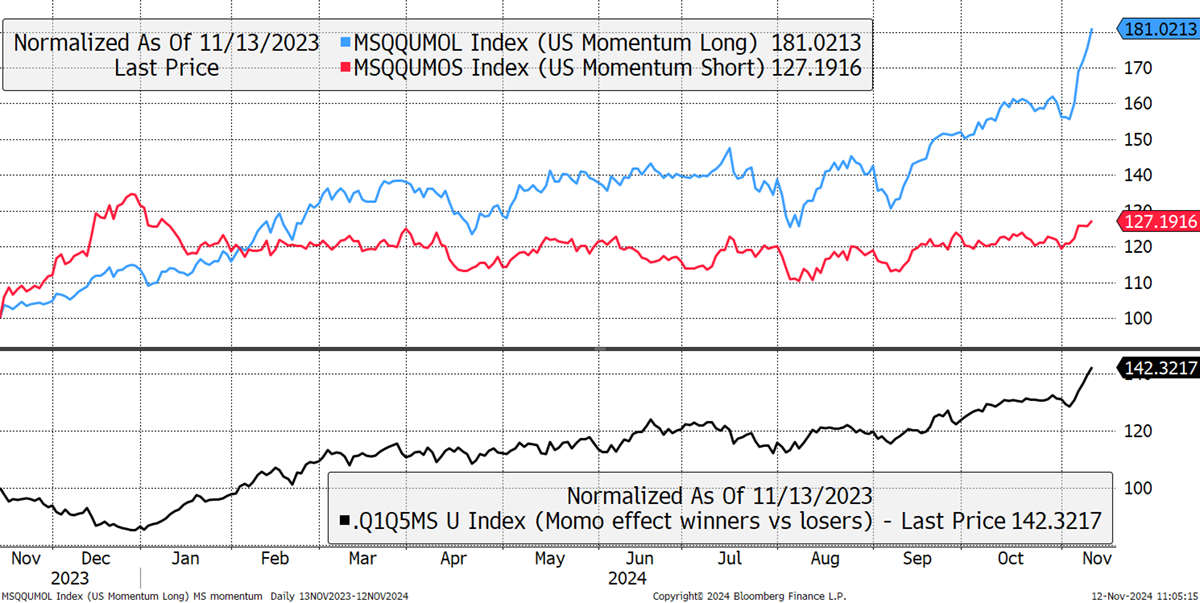

I hope you have been reading my five-part series on momentum and what it can show. The US market has seen the winners (high momentum stocks) surge, and the losers rise slightly. This is a relatively healthy state of affairs so far.

US Momentum - Healthy

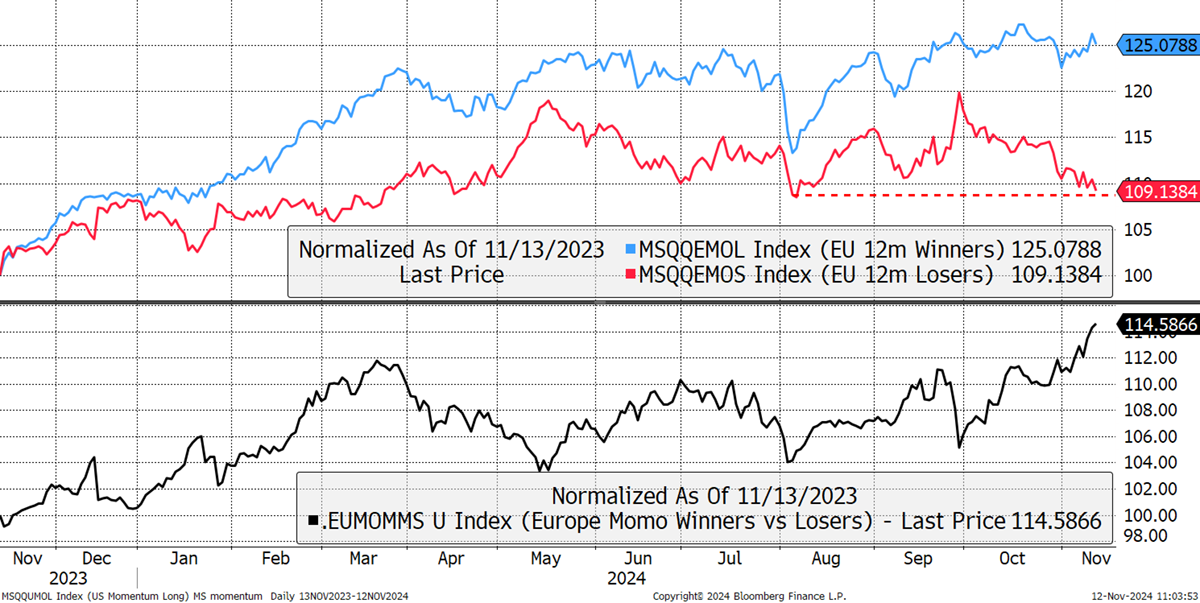

In Europe, the winners have held up but failed to make gains, which is late-cycle behaviour. The losers, on the other hand, the stocks that have been underperforming over the past year, are close to breaking. Should this happen, it would be a sign that a bear market is coming. Just as a bull market needs leadership, so does a bear. I will be following this closely because a break of the losers could be a precursor of things to come.

Europe Momentum – Risk of a Bear Market

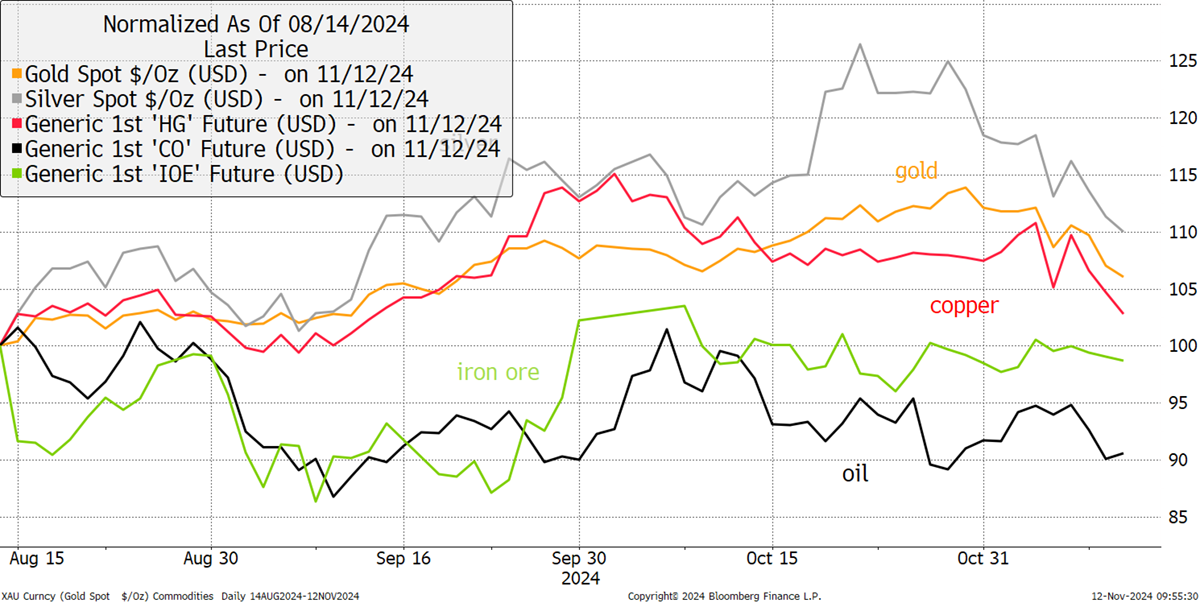

In commodities, which largely reflects global growth, the rally has stalled. Gold, silver, and copper are still up over three months, but prices have softened. As I keep on saying, gold and Bitcoin take it in turns, and now it’s Bitcoin’s turn. Oil remains stable despite Trump’s pledging to “drill baby, drill.”

Commodities

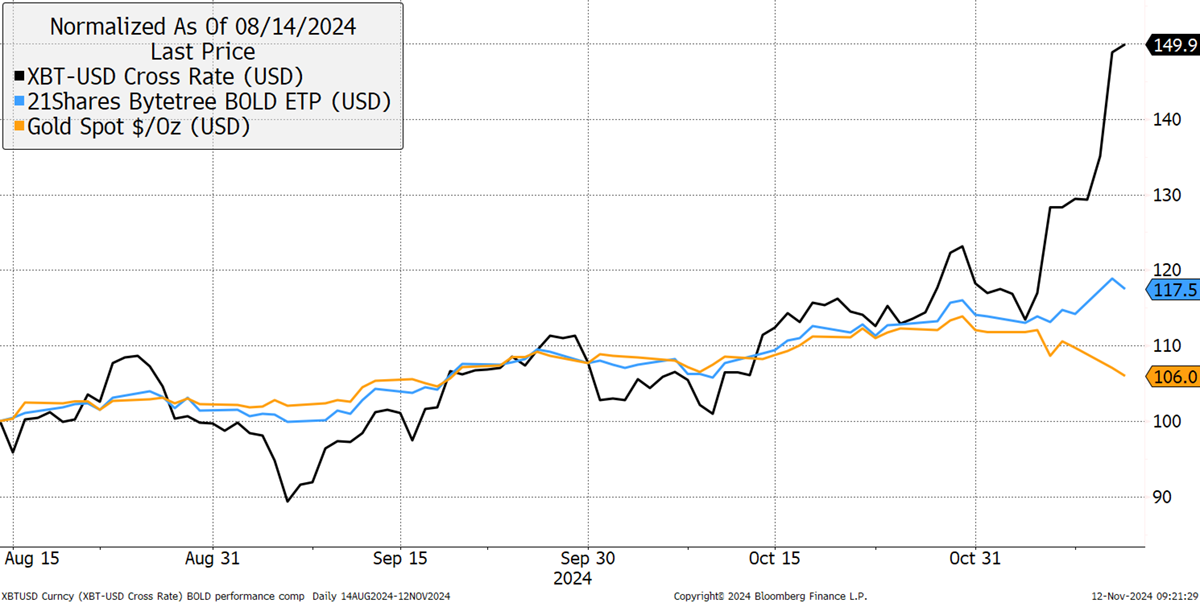

Moving on to Bitcoin and gold, I’ll run through a few charts to show you where we are. Bitcoin is in good company, and I covered it yesterday in the first part of the note, which is freely available.

Bitcoin is up, and gold is down, with ByteTree’s BOLD strategy remaining stable. It is remarkable how this natural offset between these assets continues to give.

Bitcoin, Gold and BOLD

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd