The US Is the Catalyst in This Bitcoin Rally

Disclaimer: Your capital is at risk. This is not investment advice.

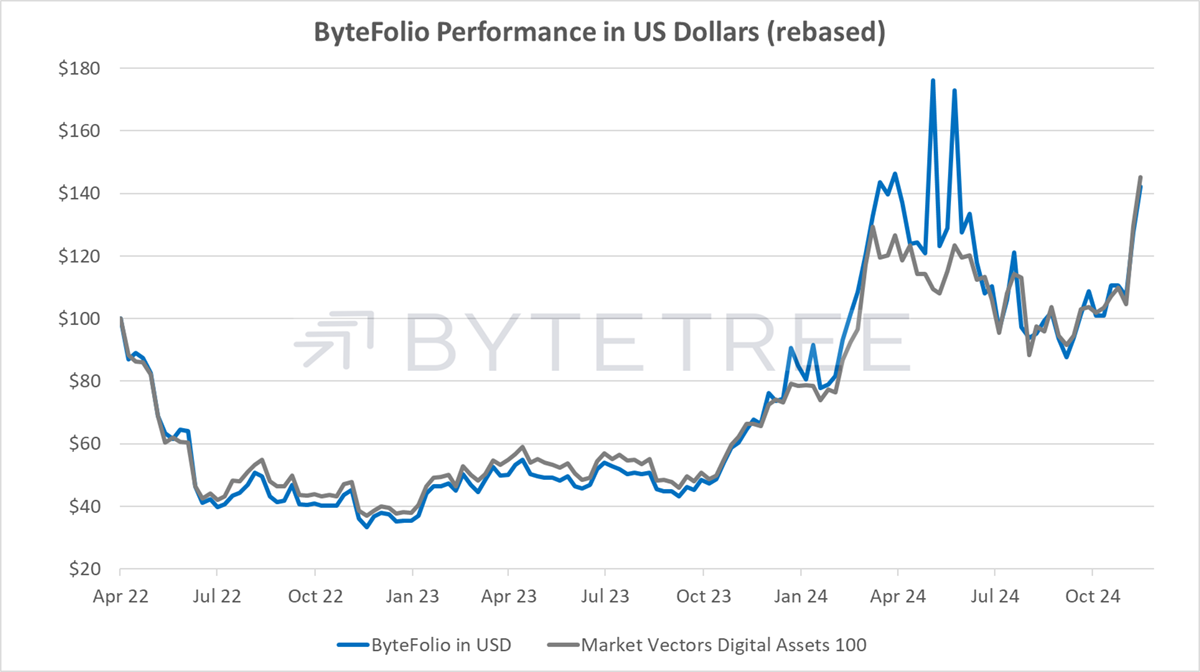

ByteFolio Issue 134;

The Bitcoin price trend is strong and in new all-time high territory. The US is driving this rally with friendly government policy. I think the rest of the world is watching from the sidelines, wondering why they aren’t involved.

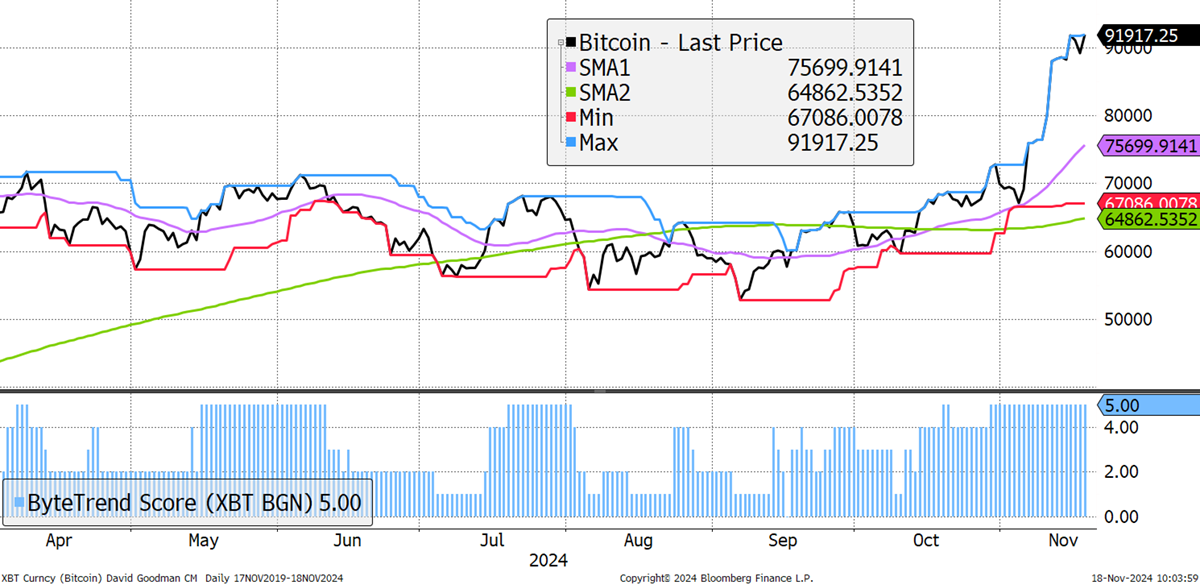

Bitcoin Price

The price is currently 45% higher than in April 2021, which is only a 10% IRR since. Going back to the 2017 high of just over $19k, the IRR is 25%. Bitcoin is a much more mature asset these days than many realise. Yet Bitcoin remains cyclical, and we can follow the trajectory compared to the 6x move from October 2020 to April 2021. In January 2020, the price briefly traded more than twice the level of the 90-day moving average, 100%, before another reading of 80%. These extreme readings led to a period of consolidation.

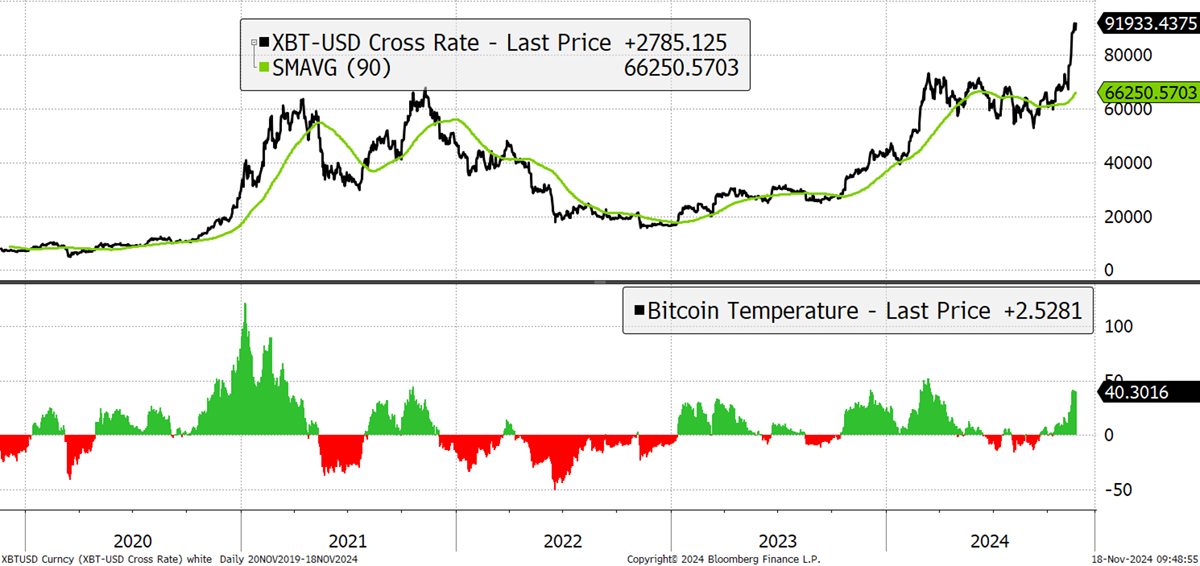

Bitcoin Temperature

In the Q3 rally of 2021, it reached 40%, which is where we are today. 40% is high, but not extreme, and the behaviour of this breakout is nothing like Q4 2020. That was wild.

Yet, this time, the flows are huge. The purchase of Bitcoin ETFs is nearly as high as at the time of their launch in Q1 2024. Yet, we have since had the halving, making Bitcoin scarcer. In Q1, the appetite for BTC was significant as the ETFs were acquired at an average purchase price of $48k. This time, they are buying at the same pace, but for twice the price. The big money is here.

Bitcoin ETF Inflows

This week, we picked up a project that has lagged behind this rally.