Buffett, Budgets, Rates and Fintech

Trade in Whisky;

Budgets, elections, Buffett selling stocks, and a potential rate cut on Thursday from the Federal Reserve and the Bank of England. With so much going on, it is little wonder markets are spooked.

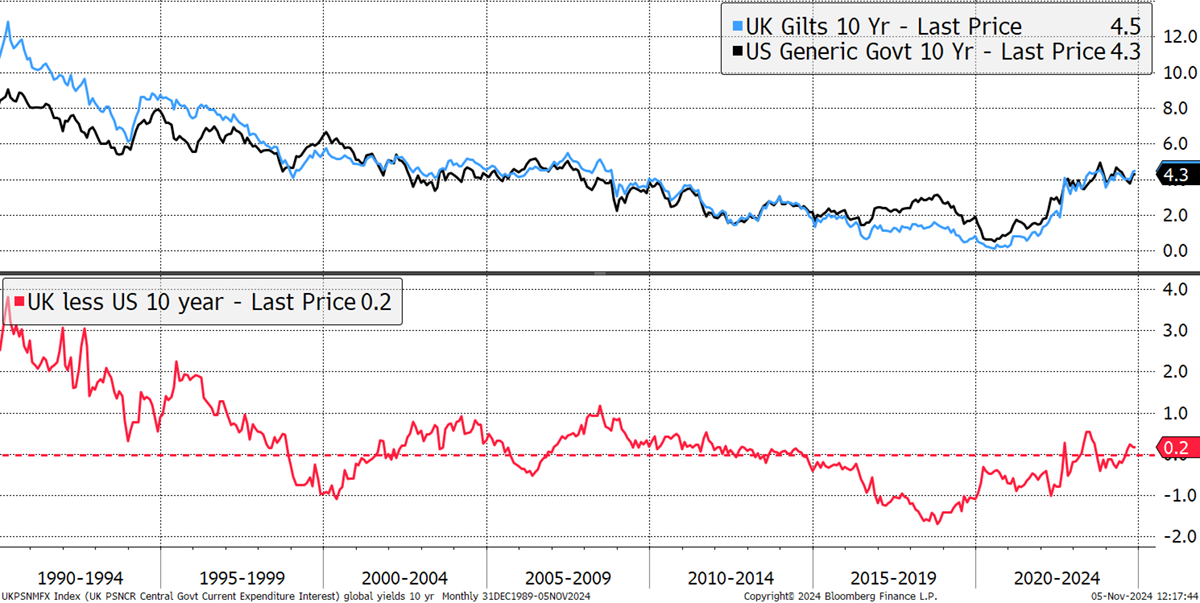

Starting with the UK budget and gilt yields, there has been plenty of noise from the bond market over the spending plans. I compare the UK 10-year gilt yields (blue) with the US 10-year treasuries (black). The spread is shown in red.

UK Versus US Bond Yields

Gilt yields were 0.4% below treasuries in April but are now 0.2% higher. When public borrowing goes into the trillions (est. £2.8 trillion), rises in bond yields costs real money. The interest on debt has become a major component of government expenditure and looks likely to worsen.

Looking at the same chart over 34 years, we remind ourselves how similar the US and UK debt markets are. The biggest difference in recent years was before the pandemic when the USA hiked rates aggressively while the UK didn’t follow suit. In 2007, the UK had higher rates, resulting in two dollars to the pound and a New York shopping boom by Brits. Before that was in the early 1990s when we had sky-high rates to quash an inflation surge around the time we left the ERM. But since 2000, the relationship has been steady.

UK Versus US Bond Yields – Since 1990

If this stable relationship were to unsteady, then we’d know we have a problem. I believe that for as long as debt keeps on increasing faster than the economy can grow, a problem will one day be inevitable. But we don’t know how much is too much, nor when this will happen.

The Fed is expected to cut rates on Thursday by 0.25%, and the UK is expected to do the same. That should ease borrowing costs in both countries with the hope that inflation doesn’t reassert itself. But if it does, that will prove to be a menace for further cuts and keep borrowing costs high.

I don’t have much to say on the US election, but hopefully, there will be a clear winner announced soon.

Money Week Summit

This Friday, 8th November, I will be speaking in a panel on gold at the Money Week Wealth Summit with Adrian Ash from Bullion Vault and Dominic Frisby, the comic legend and gold bug.

Last chance to get tickets and Money Week has very kindly provided us with a 20% off code! To buy a discounted ticket, please click the button below and add code BYTETREE20 at the checkout.

Buffett’s company, Berkshire Hathaway (BRK), has amassed a cash position of $360 billion following the sales of Apple (AAPL), Bank of America (BAC), and others. Yet he also bought a large position in DR Horton (DHI), a US house builder, which is a bet on the economy. I believe he has sold AAPL because this is his chance to exit at a high price, and he sold BAC because it’s not the bank it once was, and he deems it dead money. Some say he’s banking profits before higher taxes come in.

He’s not buying his own shares because he thinks they are too high, so he sits in short-dated treasuries, waiting for the big opportunity. Maybe he’ll buy the UK and make it the 51st state? Not such a bad idea.

Moving away from global events, I have another stock that I have been watching for some time. It’s a high-growth financial technology (fintech) company, which will make a good fit.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd