Bitcoin Finds a Home in the USA

Disclaimer: Your capital is at risk. This is not investment advice.

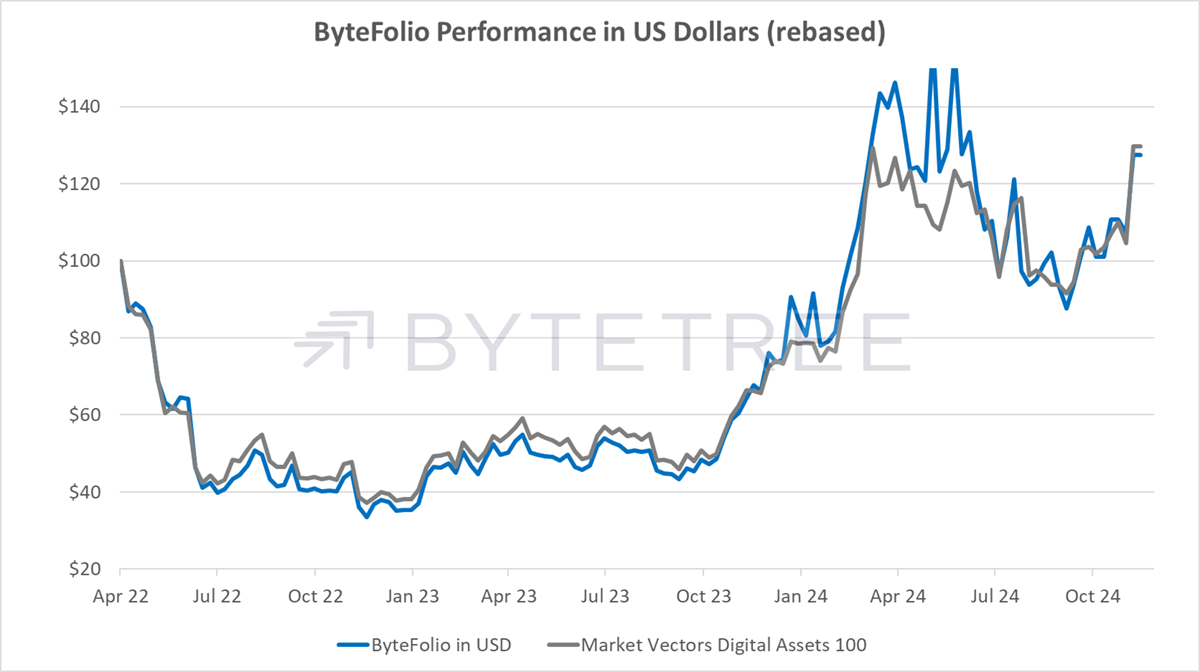

ByteFolio Issue 133;

Last week, a friend reminded me that one of Bitcoin’s problems is that it started from the ground level and rose up. Had it been launched by the establishment, it wouldn’t have caused so much controversy. It is 15 years old and has remained homeless. With the Trump/JD/Musk/Tech Bro administration, it has found a home in the USA.

Obviously, Bitcoin remains decentralised and digital, with no sense of geography, but it now has a place where it is welcome, and that is the USA. The world’s largest economy, with vast sums of capital and coding talent, is where crypto will thrive from here. That home could have been in London, but the opportunity was missed. Over here, our government seems to be terrified of the 21st century and would prefer we return to the stone age, a time when energy consumption was close to zero.

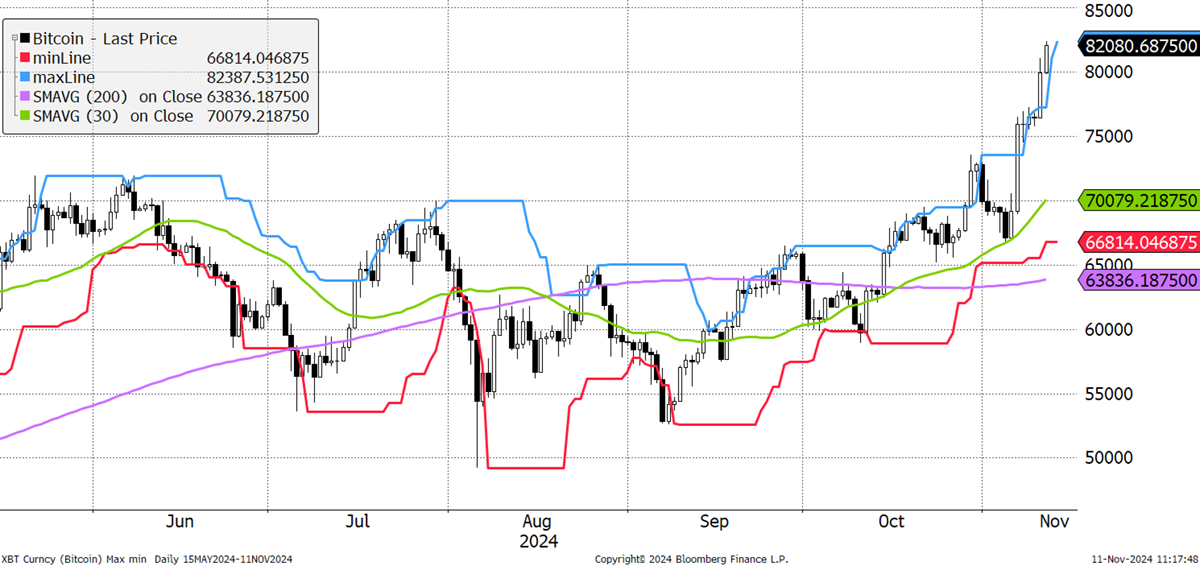

Bitcoin Breakout

The US election was well received by crypto and has brought forward the bullish case. Had Harris won, I believe Bitcoin would still have broken out, but it may have taken longer. The pattern is on track, and a new all-time high has been seen, which tends to follow around six months after halvings.

New Highs Follow Halvings

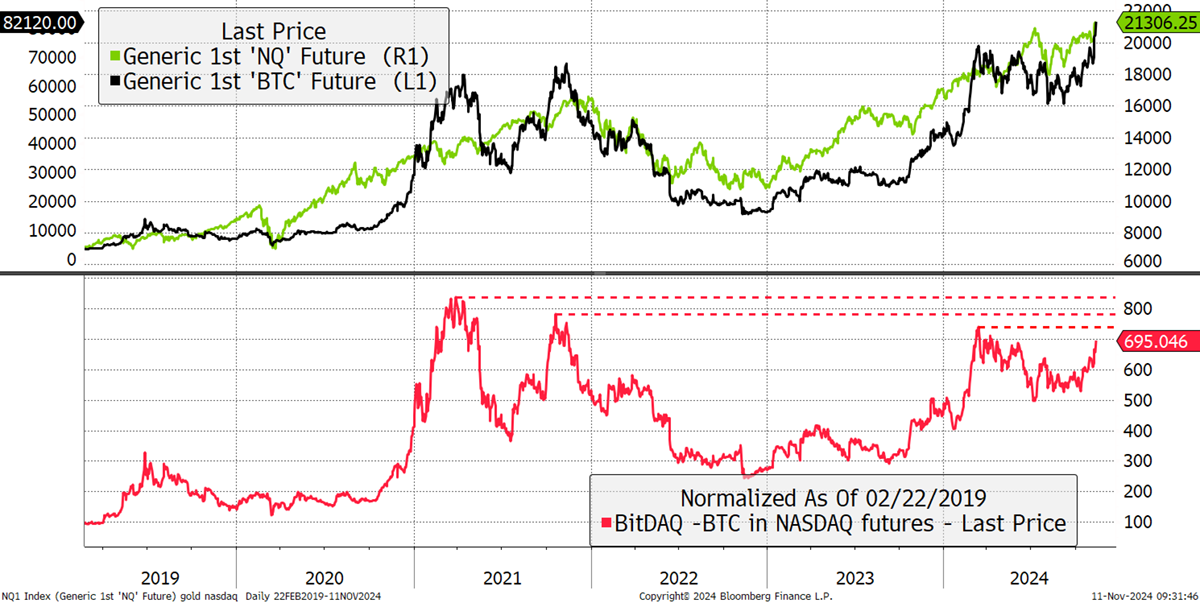

The reason this time is so much bigger is that Bitcoin and crypto have been legitimised by the new administration. As I remind our clients, the global wealth management industry controls $128 trillion, and their exposure to Bitcoin is approximately zero. This will change, especially when Bitcoin asserts itself as the new tech trade. It wouldn’t take much from here for Bitcoin to march ahead of the Nasdaq, the leading index for the past decade.

Bitcoin and Nasdaq

If Bitcoin is now officially deemed to be a legitimate asset class and is beating the Nasdaq, asset allocators will come in their droves. Bitcoin’s shadow ban, by which I mean the resistance to allocate by institutional investors, will be challenged, first in America and, eventually, in the rest of the world. A tidal wave is coming, and there’s no stopping it.

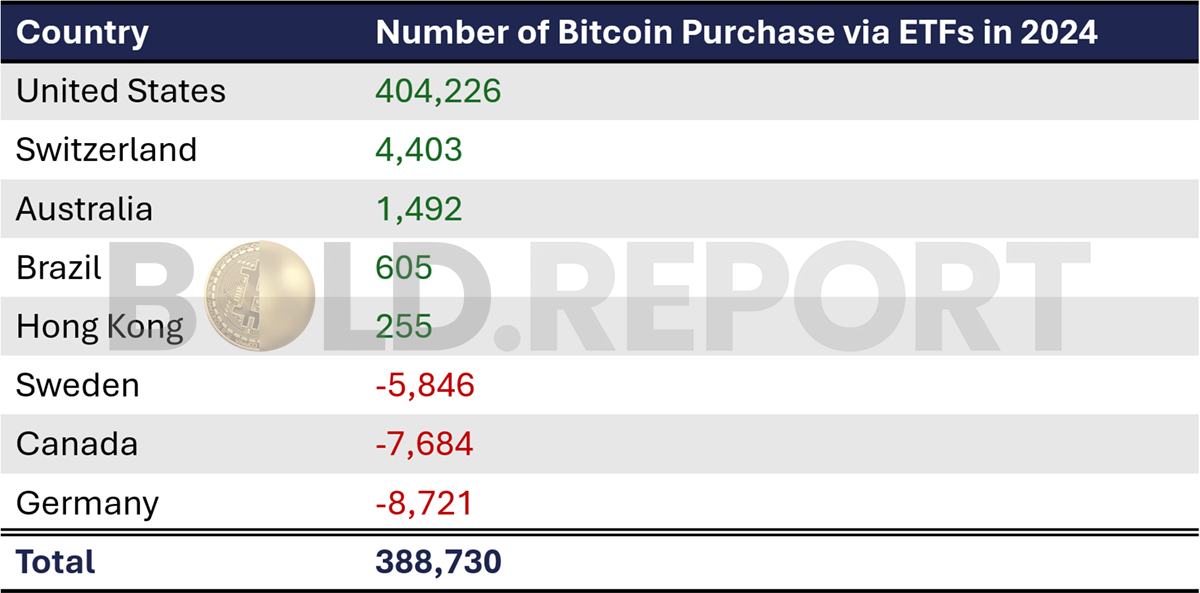

Look no further than ByteTree’s Bitcoin ETF data, which covers 46 funds in 8 issuing countries. The USA has added a net 404k BTC this year. Switzerland comes second with 4,403 BTC. Canada has likely seen outflows to the cheaper US ETFs, while Sweden and Germany have seen outflows.

There are notable major financial centres missing from the list, such as London, Tokyo, and Singapore, not to mention many European capitals. The US can drive Bitcoin higher alone, but the rest of the world will miss out on this asset class, which has finally entered the mainstream. Capital flows are the primary price driver, and in this uncertain, low-growth world, there is no shortage of capital looking for a new home.

The sooner the naysayers reevaluate their position, the better.