Reserve Protocol: Fighting Inflation with Stablecoins

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: RSR;

Reserve Protocol is a fully decentralised platform for creating stable cryptocurrencies. It allows users to mint tokens, backed by a basket of assets, such as yield-bearing derivatives and tokenised assets, in a fully permissionless manner. This Token Takeaway will delve into the intricacies of Reserve Protocol, explore the broader stablecoin market and analyse the value proposition of its native token, RSR.

Overview

Originally launched on Ethereum in 2019 by Nevin Freeman and Matt Elder, Reserve Protocol aims to facilitate the creation of a global currency that is stable in the present and inflation-resistant in the long run. Today, it also allows users to create these stable cryptocurrencies on Ethereum layer-2s such as Base and Arbitrum.

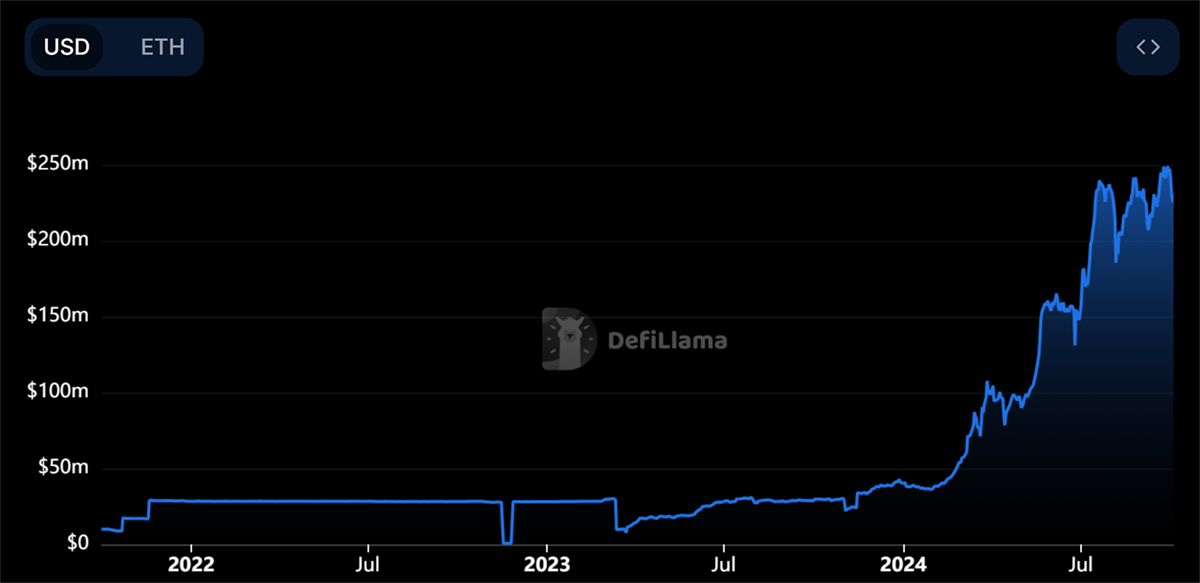

Reserve Protocol TVL

As illustrated above, the TVL on Reserve grew from $40.3m to $225m from January to October 2024. This remarkable 460% growth has also coincided with increased interest in tokenising real-world assets (RWAs) in the industry. Coupled with the high interest and involvement of TradFi behemoths like BlackRock and Franklin Templeton, the RWA Tokenisation sector has proliferated over the past year.

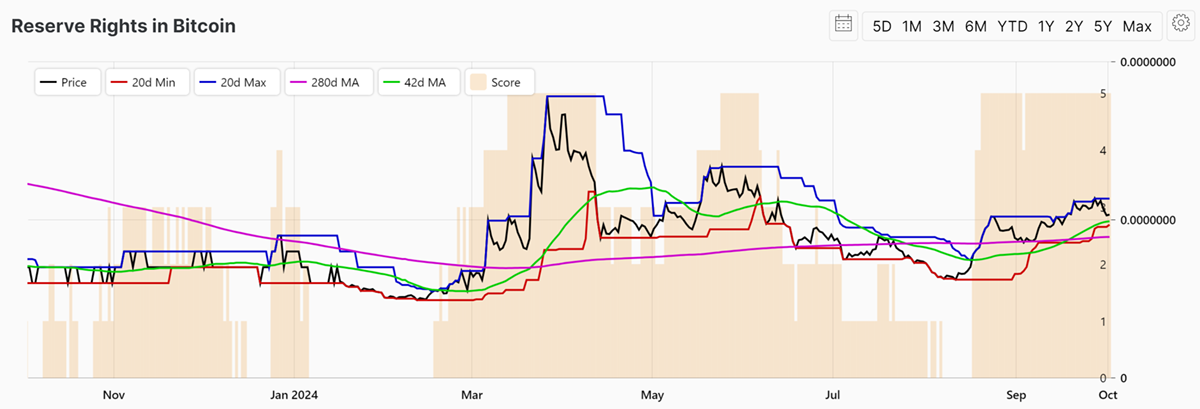

RSR, the native token of Reserve Protocol, has shown outperformance vs Bitcoin since January of this year, and it is currently holding a bullish 5-star ByteTrend score against BTC.

RSR in BTC

Reserve Protocol’s mission of creating a stable, inflation-resistant global reserve currency backed by a diversified basket of tokenised assets is closer to becoming a reality than ever before. However, despite having 12 cryptocurrencies, such as ETH+, USD3 and eUSD, on its platform, none can fully achieve this vision yet. There is still a long journey ahead, but it seems to be progressing in the right direction.

According to CryptoRank, Reserve Protocol raised around $10m in total over multiple funding rounds. The project is backed by some prominent personalities, such as OpenAI’s Sam Altman and former CEO of PayPal, Peter Thiel. It has also received backing from Coinbase Venters, Arrington XRP Capital and Shima Capital.

What’s the Purpose of Reserve Protocol?

For hundreds of years, we’ve seen the rise and fall of numerous global reserve currencies. Time has proven that no matter how strong a government-issued, centralised currency is, it will inevitably face demise or, at least, significantly lose its purchasing power. Today, the US dollar (USD) is the global reserve currency.

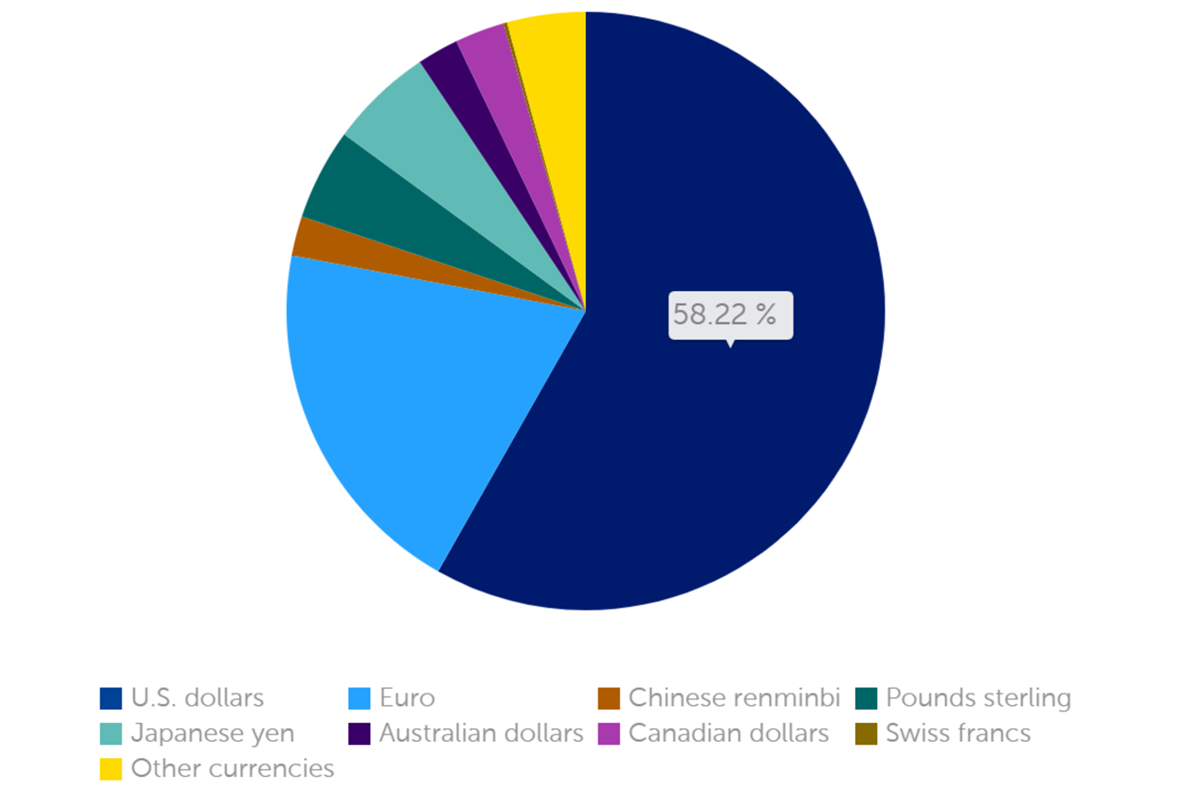

Global Foreign Reserves by Currency

According to the International Monetary Fund (IMF), over 58% of the global foreign reserves are in USD, followed by the Euro at 19.7%. The US dollar is by far the largest and most accepted worldwide and has the lowest exchange risk. However, several geo-political and economic factors, such as de-dollarisation, enormous US national debt, and high inflation, suggest that USD’s role in the global financial system will not be indefinite.

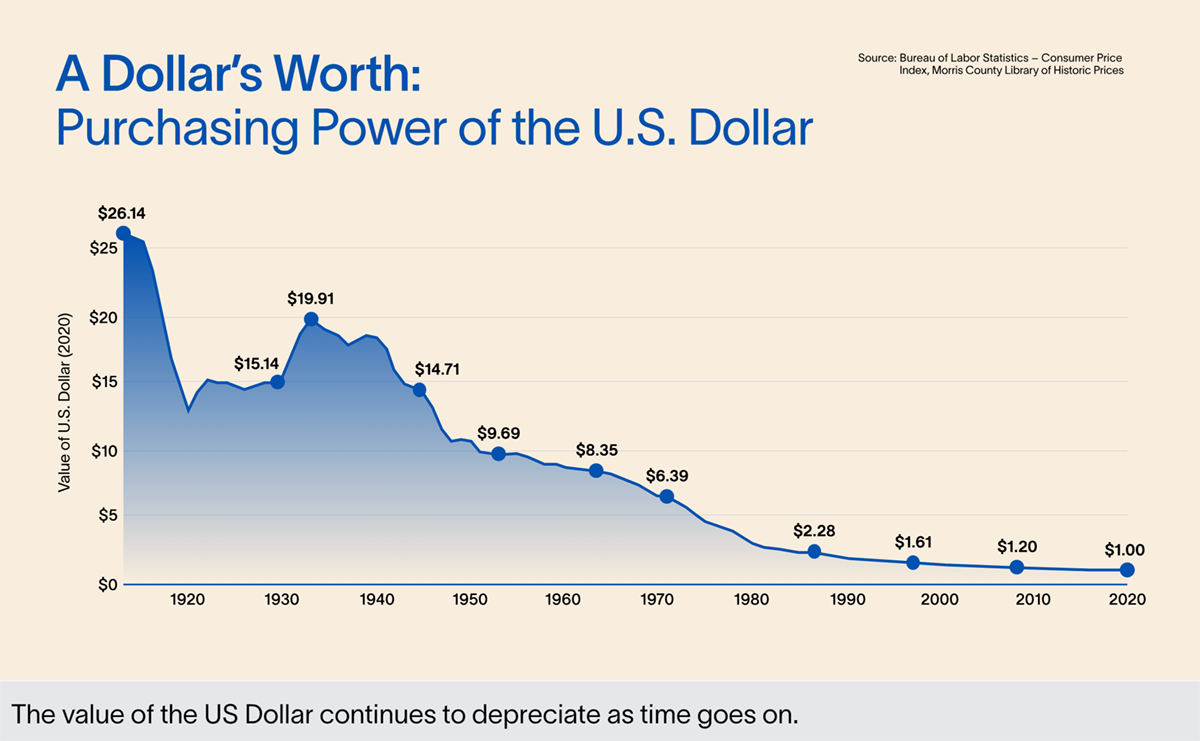

USD Purchasing Power Since 1910

As illustrated above, the purchasing power of $1 has declined significantly over time, losing 96.17% of its value in a little over a century. Major events since the start of this century, such as the dot-com bubble, the 2008 financial crisis, and the 2020 pandemic, have had a major impact on the value of the USD. Following in history’s footsteps, USD will continue to decline as time goes on, and so will your savings.

Imagine having a stable currency that isn’t issued or controlled by any government, is completely borderless, backed by real-world assets and, most importantly, will be as valuable in a hundred years as it is today. In Reserve’s own words:

“What if you could earn some money today and set it aside for your grandchildren, and when they spend it 100 years from now, they got to buy something just as valuable as what you could have bought right now?”

It aims to do it by facilitating the creation of Reserve Tokens (RToken).