No Time to Be a Doubter

Disclaimer: Your capital is at risk. This is not investment advice.

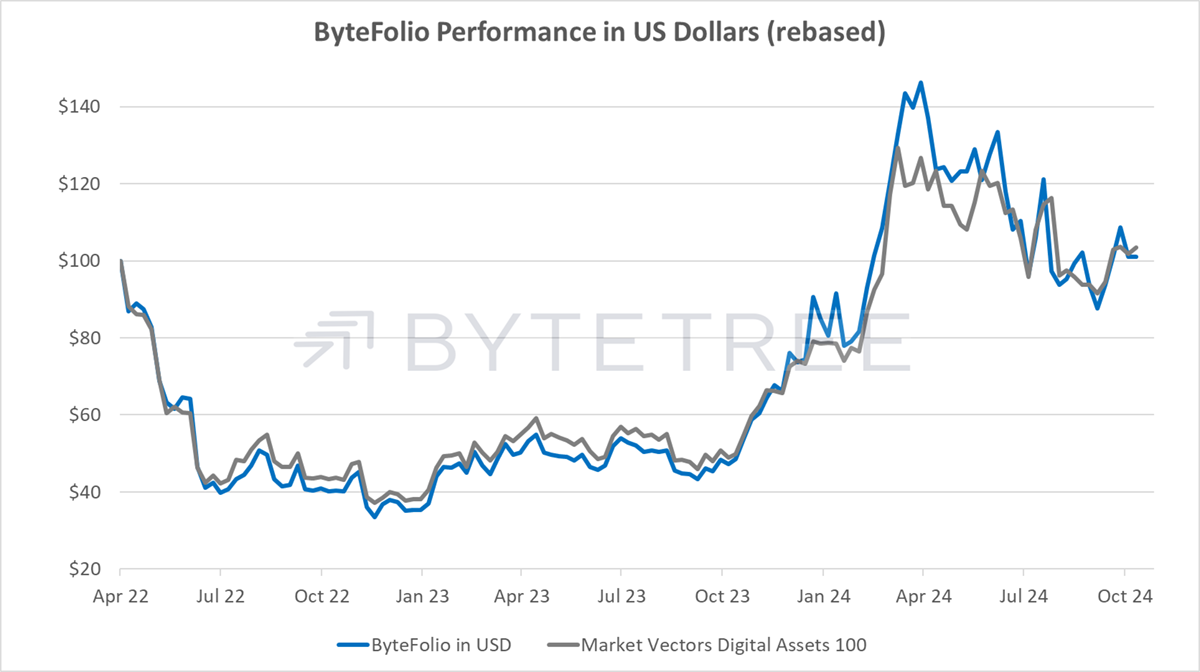

ByteFolio Issue 129;

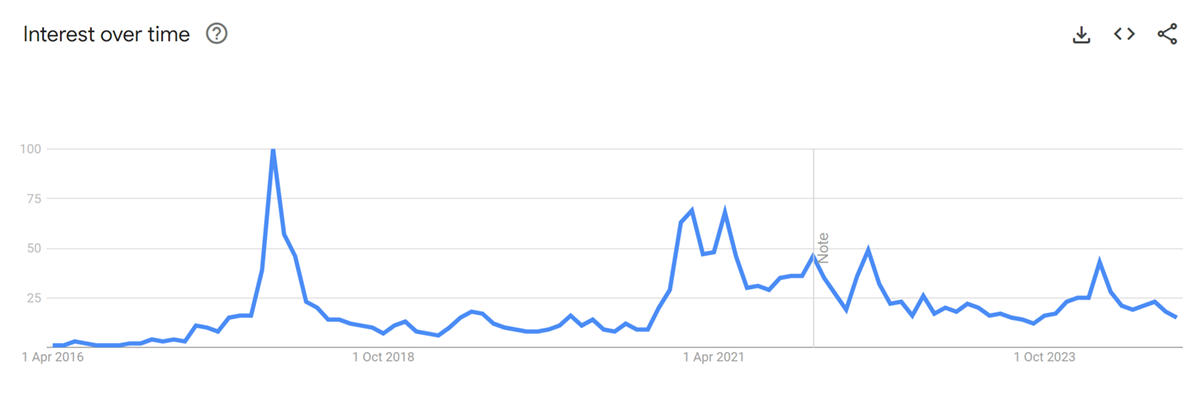

One of Bitcoin’s great rational bulls, Fred Krueger, aka @dotkrueger on X.com, posted a chart showing the current lack of interest in Bitcoin. It turns out to be 16% of the level seen in late 2017 (marked at 100). The last cycle of 2021 was 69, and the pre-halving ETF hype was a mere 43. I had assumed that the Bitcoin sentiment was better than that, but apparently not.

Bitcoin Interest Wanes

I suppose altcoins vs Bitcoin is another way to measure sentiment.

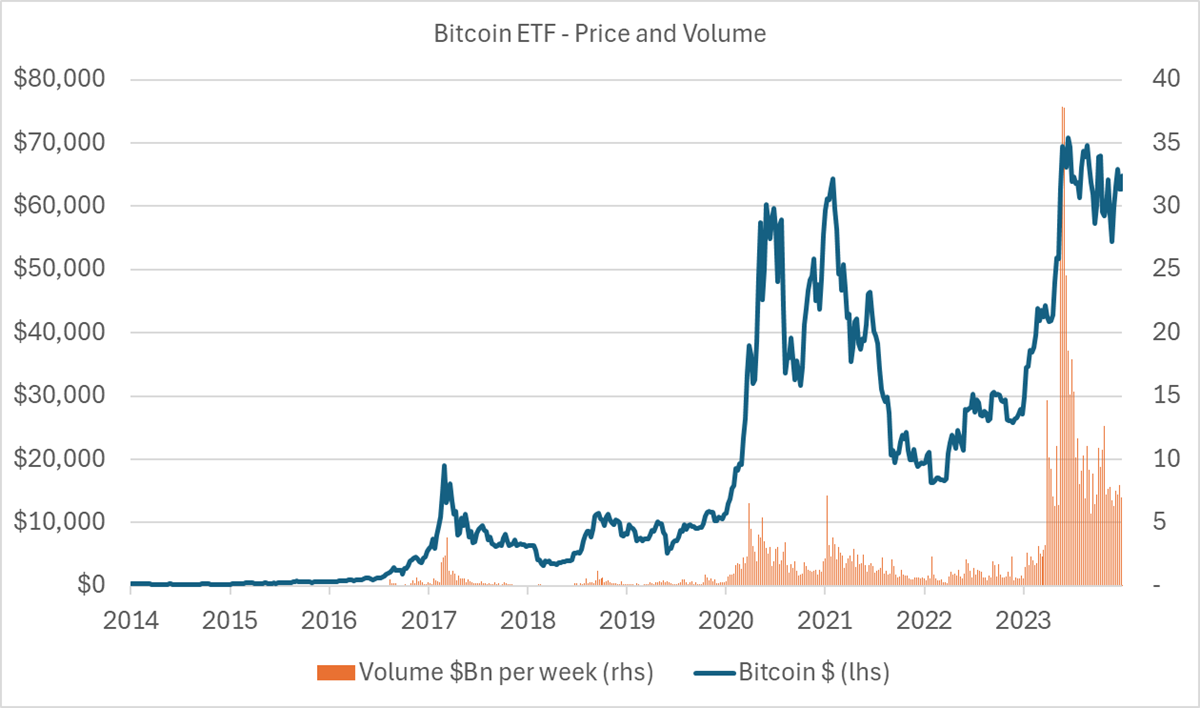

Poor sentiment can be a great thing because that is where the strongest rallies come from. While today, Google Trends is only seeing 16% of what it saw in 2017, the trading volume of the ETFs would challenge that. I show the top ten Bitcoin ETFs since 2014 and their weekly trading volume in USD. Volume has certainly settled back from the USA ETF launch era earlier this year but at a higher level than seen in 2017 and 2021.

Top 10 Bitcoin ETFs' Weekly Trading Volume and the Bitcoin Price

That might not have moved the hearts and minds of retail investors, but it confirms that Bitcoin is a much more serious and liquid asset than it is often assumed to be. $7 billion is now a poor week for Bitcoin, and I am only talking about a few ETFs. Naturally, the exchanges would be much higher than that.

The flows are positive and explain much of the strength or weakness in the Bitcoin price in recent years. This is not the time to be a doubter.

Bitcoin Flows

When there are few bulls, it is a good time to be one, and this week, we are adding a new project to the portfolio.