Meet the Resistance

Disclaimer: Your capital is at risk. This is not investment advice.

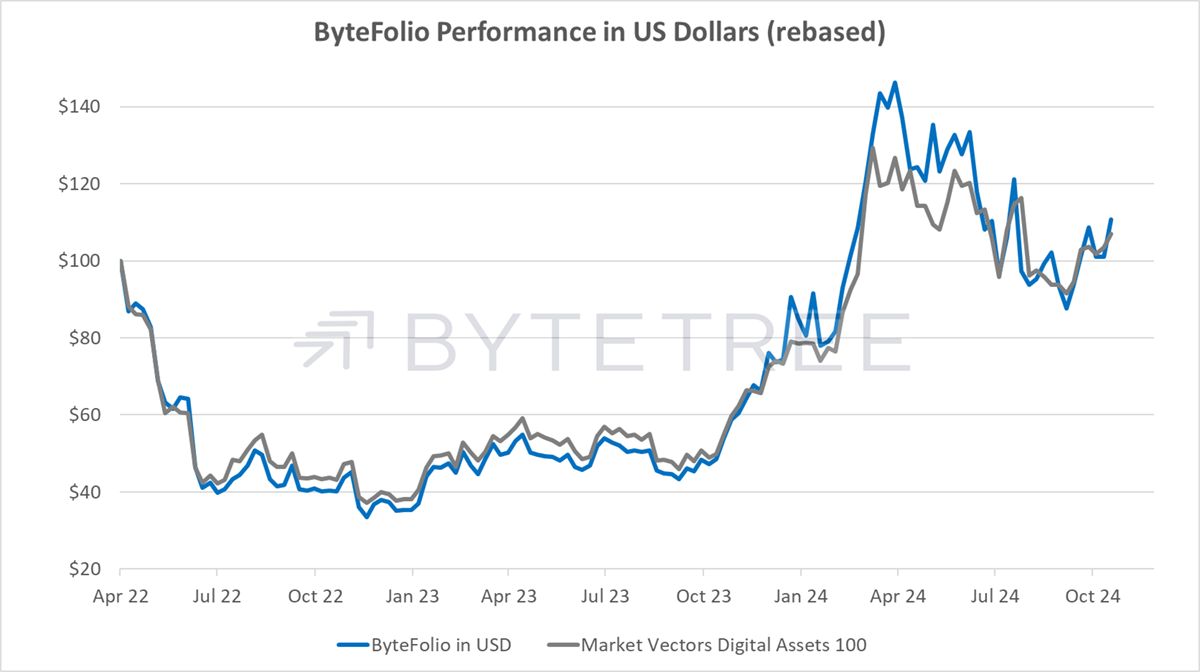

ByteFolio Issue 130;

One last hurdle until the price of Bitcoin meets fresh air, and that’s the resistance associated with trading zone above $55,000. It is strange to see the bars that remind us of how Bitcoin hasn’t actually spent much time up here since 2021. It has spent the most time in the $15k to $30k zone, followed by the $35k to $50k zone. This may seem disappointing, but Bitcoin has broken records over the past six months just by staying in the zone. Both visits in 2021 were short-lived.

Bitcoin Resistance Zone

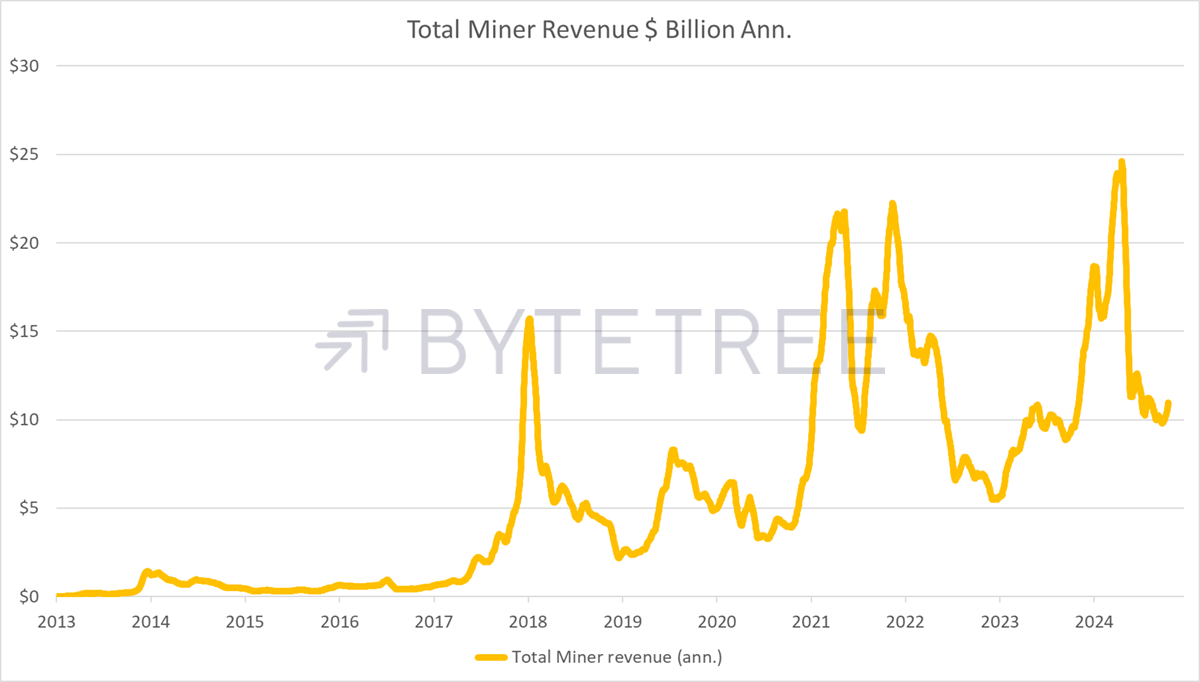

Many Bitcoiners pay too little attention to the cost of mining and its impact on price. The chart below shows the implied annualised cost of mining Bitcoin at past levels. Notice how the big spikes have never lasted for long because the network couldn’t manage it. In late 2017, holding the $20k level would have cost the network $16 billion p.a. It simply wasn’t ready for that at the time. The price can spike, but it can’t hold for long.

The Cost of Managing the Bitcoin Network

Two halvings later, the cost of maintaining $20k has fallen by 75%, making it much easier today. In 2021, attempts to break $70k were stalled because the network couldn’t afford to pay the miners circa $22 billion p.a. Now we’ve had another halving, which means that holding the price at similar levels in the resistance zone costs a mere $12 billion p.a.

How high can Bitcoin go? The answer is: how much can we pay the miners? It’s more these days, and when the vast global wealth management industry finally shows up, it will be much more.