Lost Decades

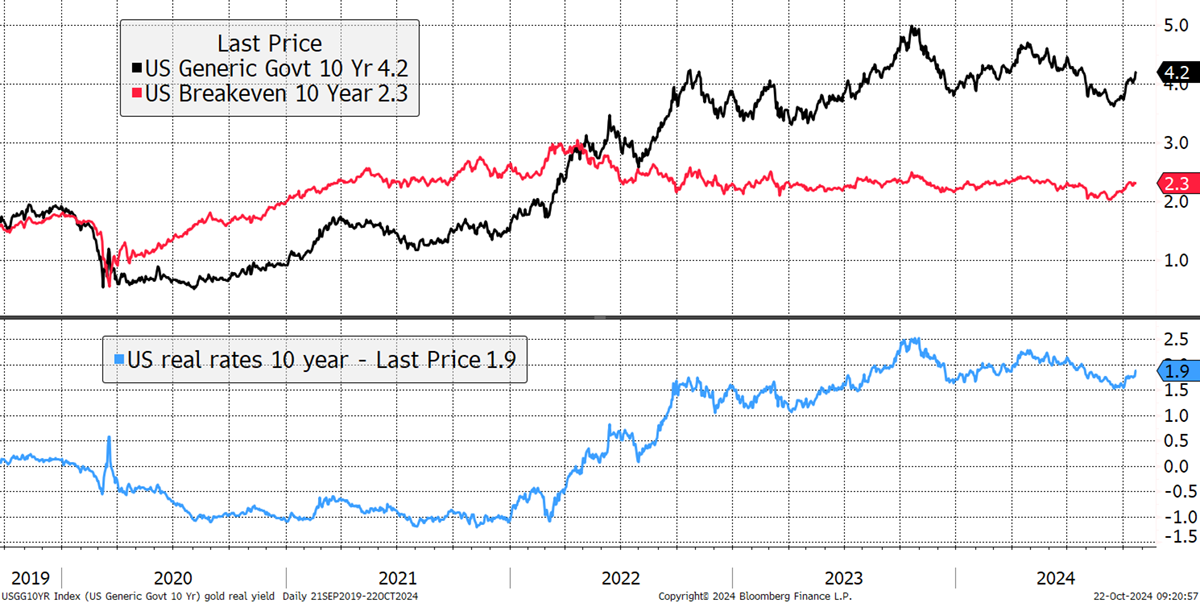

With inflation, taxes, strikes, political discontent, and gold soaring, it feels like the 1970s, except no one is wearing flares. I mention it because the 10-year bond yield is rising again, which means the price of bonds is falling in what could turn out to be the sixth downturn for the bond market since 2020. Long-term inflation expectations (red) are also rising, meaning the real yield (blue) is rising as well.

Bond Yields Rising Again

A rising real yield isn’t normally positive for gold, but this time, it has been. I would urge you to read yesterday’s Atlas Pulse for an update on gold’s historic breakout last week. In short, I remain bullish on gold and silver, which have recently boosted the portfolios.

Money Week Summit

On Friday, 8th November, I will be speaking in a panel on gold at the Money Week Wealth Summit with Adrian Ash from Bullion Vault and Dominic Frisby, the comic legend and gold bug.

Money Week has very kindly provided us with a code for 20% off on tickets! To buy a discounted ticket, please click the button below and add code BYTETREE20 at the checkout.

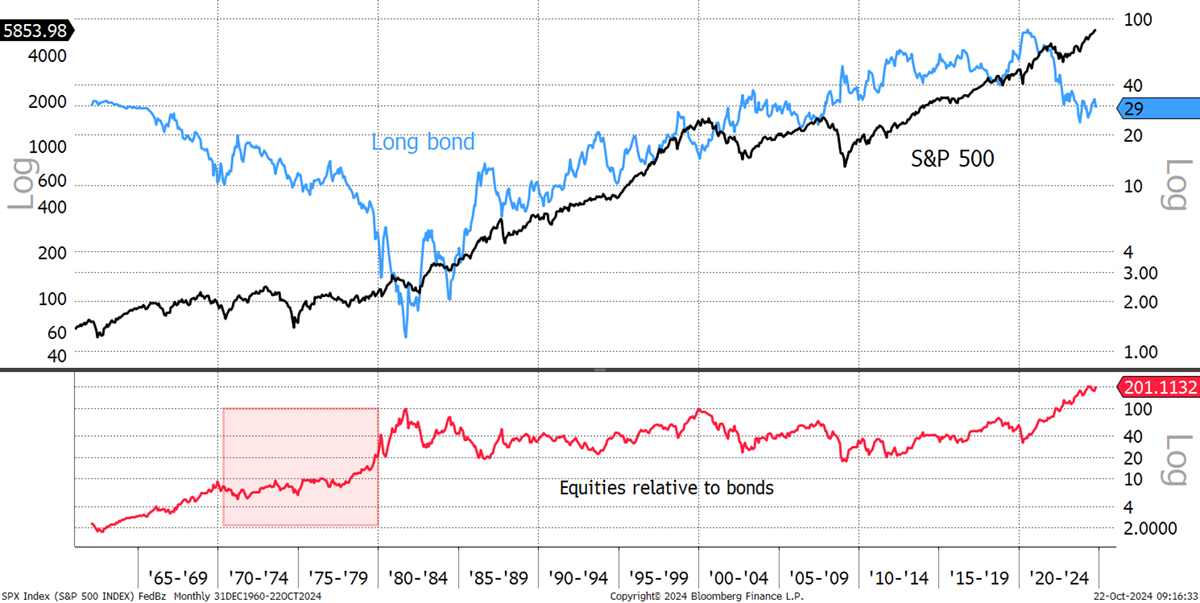

I mention the 1970s because, during that period, gold surged while bond yields rose, and therefore bond prices collapsed. I show this old favourite with a log scale, which emphasises the price moves in the early days.

Equities versus Bonds

Some believe one of the reasons equities are doing well is that bonds are doing poorly. Investors have avoided the bond market and bought equities with their capital instead. To some degree, that must be true because it takes money to move markets, or at least the anticipation of money coming.

What’s fascinating about the rise in rates in the 1960s and 1970s is that my hypothetical long-bond shown above fell by 96%. There was no issuance of 30-year bonds back then because the market wouldn’t buy them as inflation was too high, so I have synthesised one instead. To be clear, it doesn’t show the total return but the price. The bond coupons would have been in the teens and improved the situation greatly, but bonds still made returns below the level of inflation, as shown. Prices collapsed, and yields were never quite high enough to square the circle.

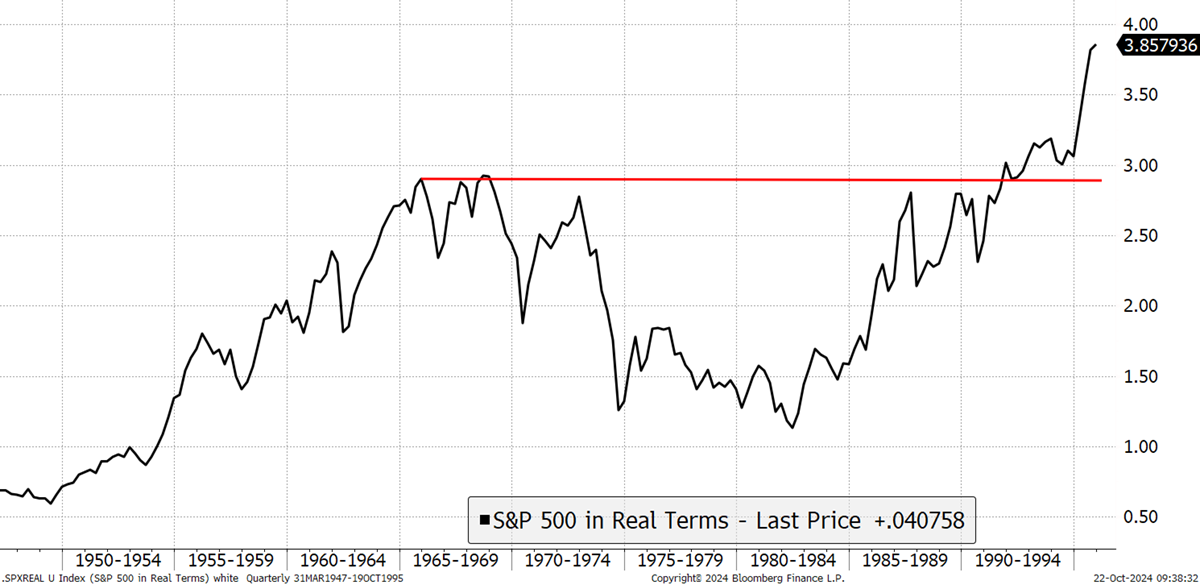

In real terms, bonds truly slumped, and while equities were better, they were still very weak. The S&P 500 fell 61% in real terms (capital only) between 1965 and 1982 (in the UK, it was worse) and didn’t make a new high until 1991. That is what we mean by the phrase “a lost decade”, recently cited by Goldman Sachs’s strategist, David Kostin, when discussing today’s market.

Real Price of Equities

Kostin’s reasons are ones I have mentioned before, such as sentiment, whereby the crowd is overly bullish on equities, the economy, concentration, i.e. too few stocks dominate the market, and last but not least, valuation. They are not original, nor have they been right so far, but now that we have Goldman Sachs saying it, it is getting harder to ignore.

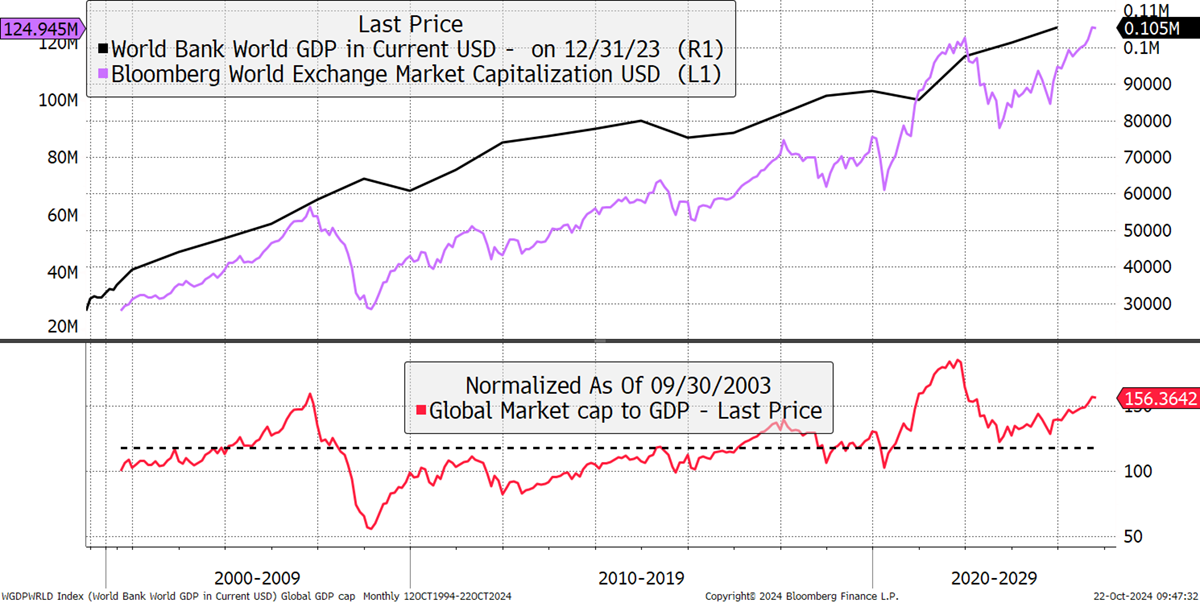

Using global market cap to GDP, markets are showing a premium again. While anything can happen on a one-year view, Kostin reminds us that over a decade, high prices are unlikely to lead to a good outcome. That’s not because they are necessarily bad; more so because investors have already had their outsized returns and will have to wait for a long time before they can have them again.

World Market Cap to GDP

You know something is up when gold is swimming against the tide. It’s not down to ebullient institutional or retail investors; it is the central banks. What do they know that we don’t? If Kostin is right, the index funds will struggle, and holding alternative investments such as gold is essential during these times. I am also a big believer in diversified family offices, which manage money on an ultra-long-term basis. When their shares are offered cheaply, it’s time to buy. I will provide an update on the Rothschild Investment Trust (RCP).

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd