An Inside Look at Meme Coins

Disclaimer: Your capital is at risk. This is not investment advice.

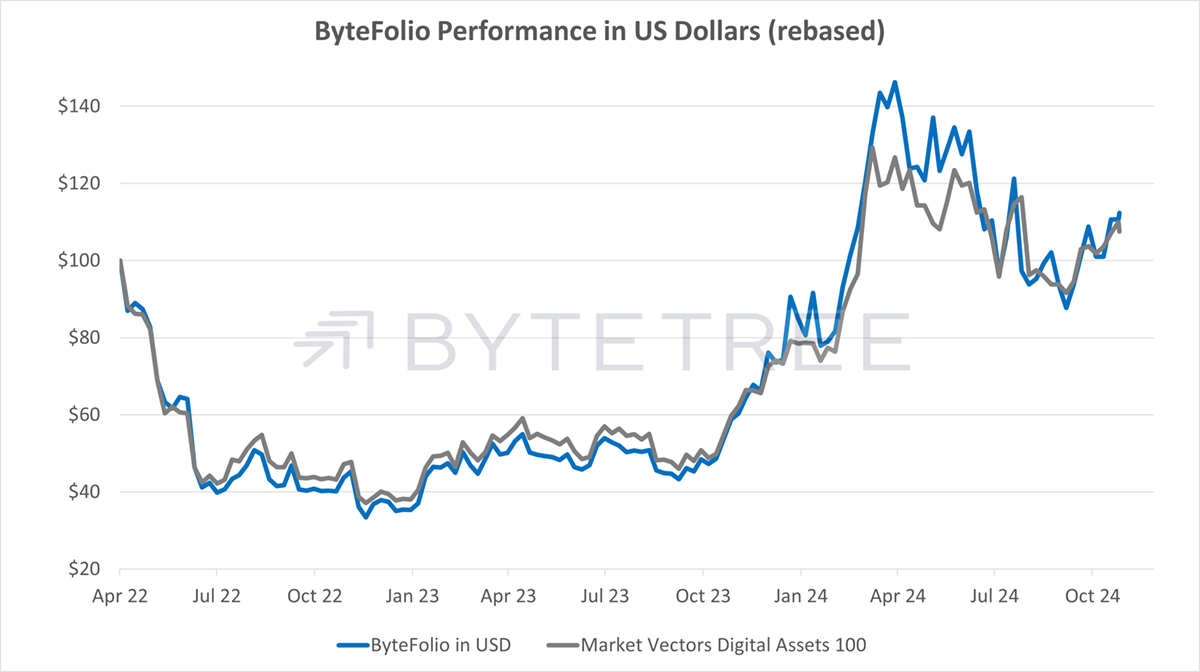

ByteFolio 131;

Meme coins, love them or hate them, have sky-rocketed in popularity within the crypto industry since Dogecoin (DOGE) was launched. A report by CoinGecko highlighted that meme coins were by far the most popular crypto narrative in Q1 2024, recording an average return of 1312.6% across the top tokens. That’s not an isolated statistic either, as they were often one of the few types of crypto tokens that achieved decent gains over the last crypto winter.

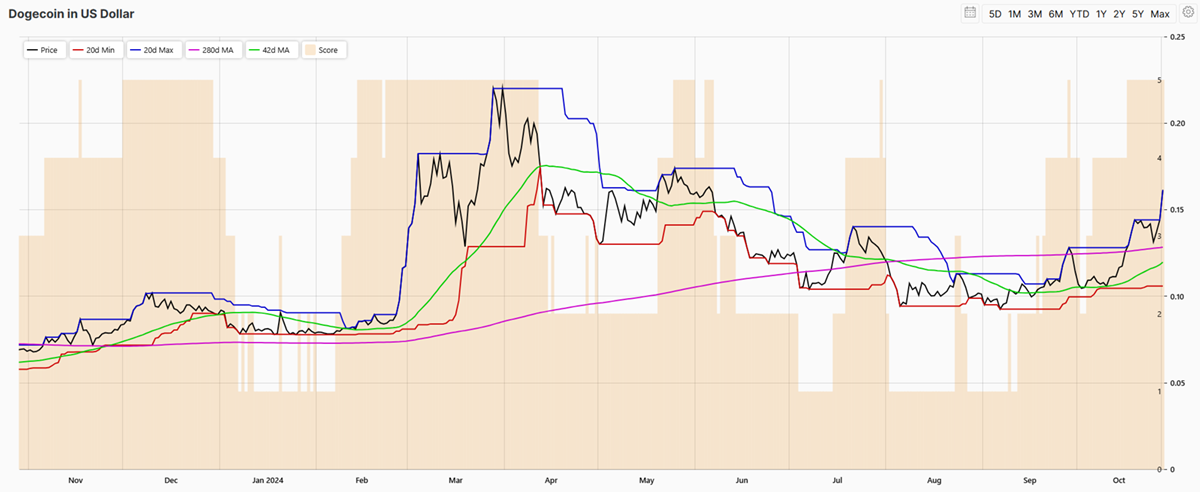

DOGE in USD

But it’s not just the meme coins that have benefited from the hype; the big protocols that they were launched on have benefitted too, Solana (SOL) in particular. The launch of Pump.fun, a meme coin launchpad built on Solana, in January 2024 achieved $100 million in revenue in a record-breaking 217 days, making it the fastest-growing protocol by revenue growth in the industry. While the revenue growth has been highly volatile, Pump.fun even surpassed Ethereum’s (ETH) daily revenue at one point.

But why? What is the appeal of meme coins that have taken the crypto industry by storm? To find out, I touched base with Liam Connor, who some of you might remember wrote our articles on the Cosmos (ATOM) ecosystem back in 2022.

Hi, good to catch up again. I still have investment positions in Cosmos. We’ve seen ~$300m USDC inflows into the ecosystem via Noble, and we’ve also seen a strong modular movement from teams such as Celestia, Dymension and Initia.

That said, I have chosen to commit my time and money elsewhere mainly because of the emergence of culture coins. Berachain, for example, is an EVM-equivalent Layer-1 chain, which has not even launched yet but has seen more social traction and engagement than many launched Layer-1 blockchains. The phenomena can be highlighted by the pre-launch Berachain NFT ecosystem. Bear NFTs, on both Ethereum and Arbitrum, are some of the most liquid and highly-traded collections in the market today.

To put it into perspective, here is a list of Berachain pre-chain NFT collections and their respective floor prices, many of which will migrate to Berachain mainnet after the launch

Why are these collections doing so well? Because it’s a network effect of people coming in and having fun. That culture is then transferred memetically from one person to another, and the network grows.

With this in mind, I think crypto communities that are different from the typical tech-centric communities will grow. Given how demanding this space can be, many people stick around where they are having fun or enjoying themselves - even as investors. It is much easier to devote time to the space if you are enjoying the time you spend here.

This is the phenomenon happening in memecoin communities like the ones we see on Solana, and also on chains like Berachain.

I think a part of it is that people in the space see many, to quote, “VC chains” launching with low circulating supplies and high FDVs (fully diluted valuations), which also sometimes bring very little innovation to the space.

Many see these chains as value extractive from the community whilst enriching what the community perceives as a sort of ‘Cabal’ - An insider group close to the money printer. When token unlocks come along, “insiders” dump, and the community is left with the bag. Then, the insider leaves and moves on to the next investment; rinse and repeat.

This perception has also manifested in proof of stake economies, whereby validators are selling staking rewards, generating revenue, paying for overheads, and making a profit with whatever is left. Conversely, regular community members, like retail investors, are hoping for an increase in price, all the while validators are directly causing selling pressure for the tokens.

This perceived lack of innovation from new and existing chains, as well as a perception that Cabals, VCs and insiders are extractive to the communities of so-called low float high FDV chains, has led to users seeking other places for fair token launches, opportunities to make it big, and fun communities to engage with.

Enter memecoins. These communities are fun; they post memes and engage with people. Also, many of these tokens are perceived to have a much better distribution of their token supply, a fairer launch, less supply controlled by fewer wallets and no unlocks that dilute investor holdings. Also, there is no expectation of delivered value, no promises of future products or changing the world, and this is powerful in allowing individuals who join meme communities to project their own perception of what the token represents. In doing so, they decide the value of the token for themselves without a limiting point of reference, such as the project's revenue flows, earnings or adoption of its product.

I think Murad from X.com captures it well here when talking about his three biggest memecoin picks. Also, Murad, in another tweet, shared a list of the top 20 tokens by YTD performance, the majority of which were memecoins.

Everything that happens today will impact the space in some way tomorrow, but it’s difficult to say how that impact will manifest over time.

There is clear harm to thousands of token launches, many of which are rugs, scams or fail, and many may be discouraged in the face of a big loss. However, it is also projected that the global online gambling market will reach $153.57 billion by 2030, with Crypto gambling one of the key drivers of that growth. Talk about product market fit. New token launches, like on Pump.fun, offer a way for individuals to gamble on newly launched cryptocurrencies.

As I alluded to, Pump.fun, which enables anyone to permissionlessly speculate on new coins, has a good product-market fit and contributes to the role that crypto and blockchain play in driving the adoption of global online gambling.

As for the perception of the crypto space as a result of this, in the long run, I don’t necessarily believe individuals will conflate speculation on new coins, online gambling and Pump.fun launches. With the tech-driven, business-focused, or ‘real world asset’ blockchain tokens that emerge in what would be completely contrasting sectors to Pump.fun tokens were it not for the blockchain technology that connects them all.

Also, people have short attention spans and lack the knowledge to meaningfully associate or conflate the activities that occur on Pump.fun today versus what it will look like five years from now. If that future economy instead looks similar to now, i.e. the market continues to grow with Pump.fun launches and memecoins as the main driver, it suggests a good product market fit for Pump.fun coins and memecoins.

The involvement of high-profile celebrities, Key Opinion Leaders (KOLs), and similar, such as Elon Musk, can benefit memecoins and propel them into popular culture. However, it could be argued that the reliance on individual KOLs can also have a negative effect. It can result in a sort of centralising reliance on that individual’s words, actions and ideas.

This argument has been made many times for cult community coins such as Cardano (ADA), Ethereum (ETH), and Polkadot (DOT). Here, Charles Hoskinson, Vitalik Buterin and Gavin Wood are seen as critical figures in the long-term success of their projects, contributing significantly to the cult-like community that supports it. Should those same people leave the project, or start talking negatively about its future, then what would happen to the token price? What would happen to the development of those networks?

Two factors I think are important when it comes to growing a token community are price performance and memetics.

Good price performance is ‘number-go-up technology’, and effective memetics is what builds a good community and consistently generates attention. This has been what memecoin communities have successfully been able to do, where many tokens and chains have not. Through this attention, they are able to propagate culture across the internet, build cult-like communities and produce number-go-up technology for their holders.

Memetics and attention are really the key features here, as this is what onboards people and capital and what generates the number-go-up technology. Memetics is a theory of the evolution of culture based on Darwinian principles, with the meme as the unit of culture. These units of culture have tangible value, converted into financial value and economic energy through memecoins.

This memetic value can even be seen in blue-chip tech coins, such as Chainlink (LINK) back in 2019-21. Don’t believe me? Study the Link Marines. Their memes, and the token price. Then, with this context, study the LINK token performance in the same period.

So… Community enrichment and attention retention, in the form of memetics and strong culture, drive the number-go-up technology.

Let me answer by saying that I believe memecoins generally attract individuals with a higher risk appetite. To be in the crypto space, individuals must be willing to take additional risk compared to your typical 9-5 worker who invests in a pension fund.

That said, most crypto investors are further along the risk curve. However, you could argue that memecoins are even further along the risk curve than investments in cryptocurrencies like BTC and ETH. Despite that, I believe memecoin communities are fairly diverse, particularly those that are successful.

The most successful memecoins generally build quite a diverse and well-functioning community of both left and right-curve community members along an IQ bell curve. The right-curvers are the main contributors, despite making up 5% or less of the community. The majority (left and mid-curvers) then contribute a sort of collective intelligence, adding ideas, concepts and so on, making up the final 5% or so of community contributions to form a complete, collective collaboration across the whole community

A great publication to read that dives into this phenomenon comes from one of the biggest contributors to Berachains social success: The Honey Jar. The article titled ‘Berachain, Cults and the Dawn of The Honey Jar’ dives into most of what we have discussed in this QA around memecoins, cult communities and so on, from the perspective of building the Berachain community. Absolutely recommend a read.

Effectively, successful memecoin communities are, in fact, diverse and receive contributions in many different forms from different community members, with a small minority delivering the majority of contributions and the majority making up the rest.

When you go back fundamentally to what blockchain and crypto are, as well as what types of tokens and blockchains have PMF, I think of money (and maybe finance or on-chain gambling).

Looking specifically at money, we know this has PMF. The fact that Bitcoin has a market cap of $1.3 trillion as a money-centric app chain shows the value in fixed, scarce supply on a decentralised, permissionless network, allowing peer-to-peer exchange of value.

When we look at memecoins, we can see that these are microcosms of what Bitcoin has achieved. They are networks of people that choose to hold and trade specific money created on a specific blockchain, and should enough people subscribe to the value of that money, the network effect will grow.

I don’t know whether memecoins will drive the next altcoin season, or even if the next altcoin season will look anything like those previous. However, I do think that if memecoins can capture the imagination and attention of the masses, they will drive considerable adoption.

The struggle crypto has today is finding PMF by breaking into the mainstream. Many enjoy entertainment, fun, memes and play. Few spend their day talking seriously about financial sovereignty and why privacy and freedom matter online; that's for us internet nerds to discuss. What they want is something that demands their attention and, in exchange, gives them some context to the meaning in their life, entertains them, and allows them to connect with people. If memecoins can achieve that more effectively than ‘low-float coin A’, or ‘modular chain b’ etc, then they will be serious and formidable drivers of adoption in this space.

Thank you! Whilst I won't leave you with my personal links, I thoroughly recommend taking some time to research the Berachain community to really understand the influence of memetics, culture and attention in early network success and potentially as a long-term value driver. A good place to start is articles written by The Honey Jar. Happy researching, and thanks for reading.