Wall Street Buys Gold (and the Saudis)

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 97;

Not only are the central banks still active, but Wall Street has finally noticed what’s going on. I say Wall Street because most of the action has indeed happened on Wall Street through ETP (ETF) buying, wherever the orders originated from around the world. Since May, the gold flows have turned the corner and started accumulating.

Highlights

| Technicals | New Highs Even in the World’s Strongest Currency |

| Positioning | Wall Street Buys Gold (and the Saudis) |

| Macro | Rate Cuts and Money Printing |

| Miners | Go Junior |

| BOLD | 21Shares Slash Fees |

Technicals: New Highs Even in the World’s Strongest Currency

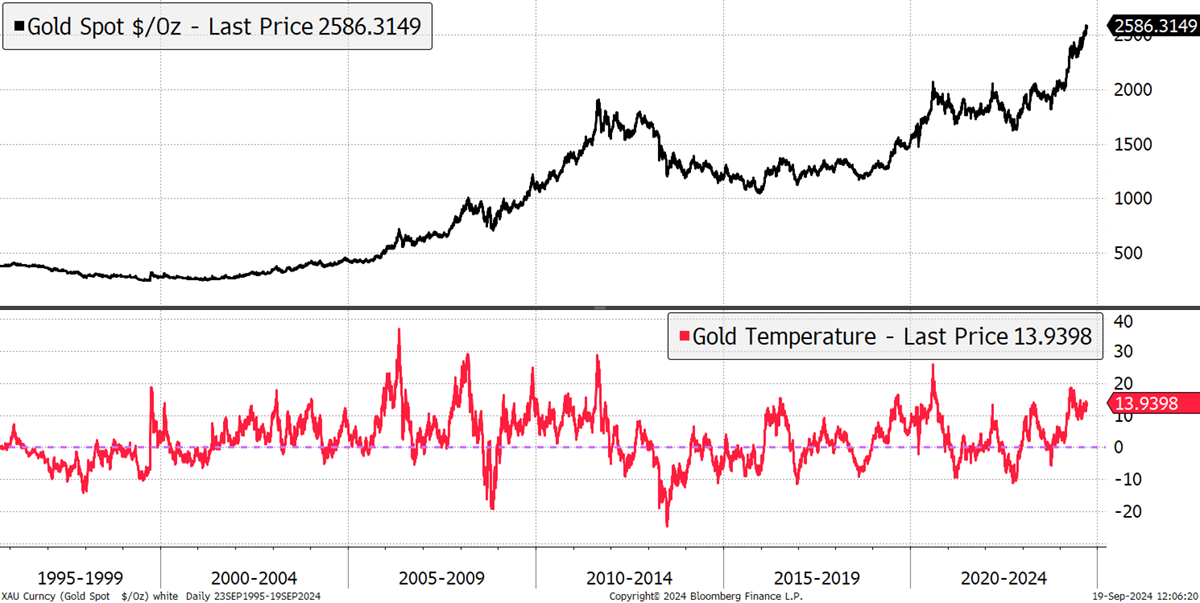

Charts can sometimes be a thing of beauty, especially when it’s gold. Do you remember us talking about the cup (2015) with a handle (2022) pattern developing two years ago? Well, it worked out spectacularly. How high could it go? I am still on record for $7,000 by 2030, but I very much doubt we will go straight there without a few corrections to flush out the doubters.

Gold All-time High

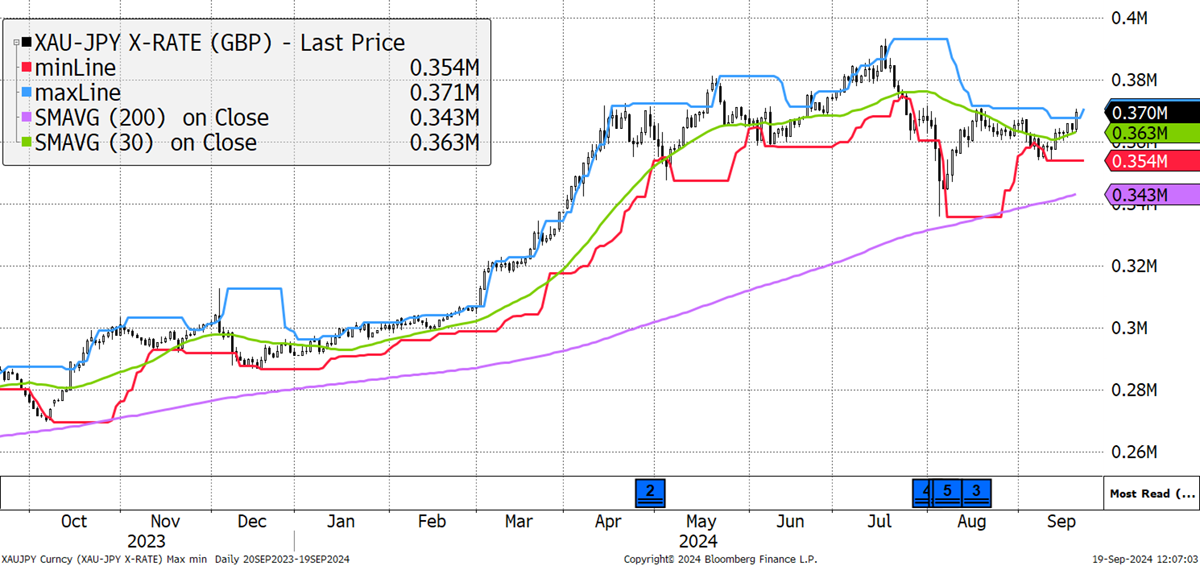

To those who say it’s just the dollar, gold is doing well in all currencies, even in the yen, which is on its way to becoming the world’s strongest currency. It’s interesting to see how gold in yen has maintained a range in recent months.

Gold in Yen Breakout

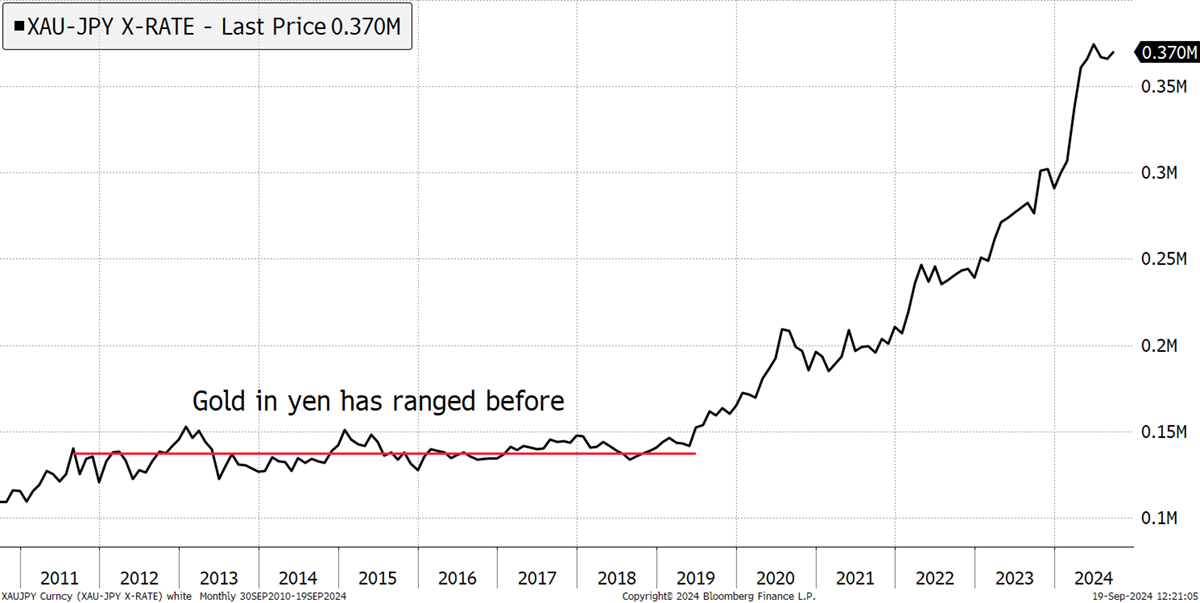

It wouldn’t be the first time. When gold was dying during the 2011 to 2015 gold bear market, the yen was too. That meant gold in yen held the same price for eight years. Now the yen is surging, gold is too.

Gold in Yen Flat 2011 to 2019

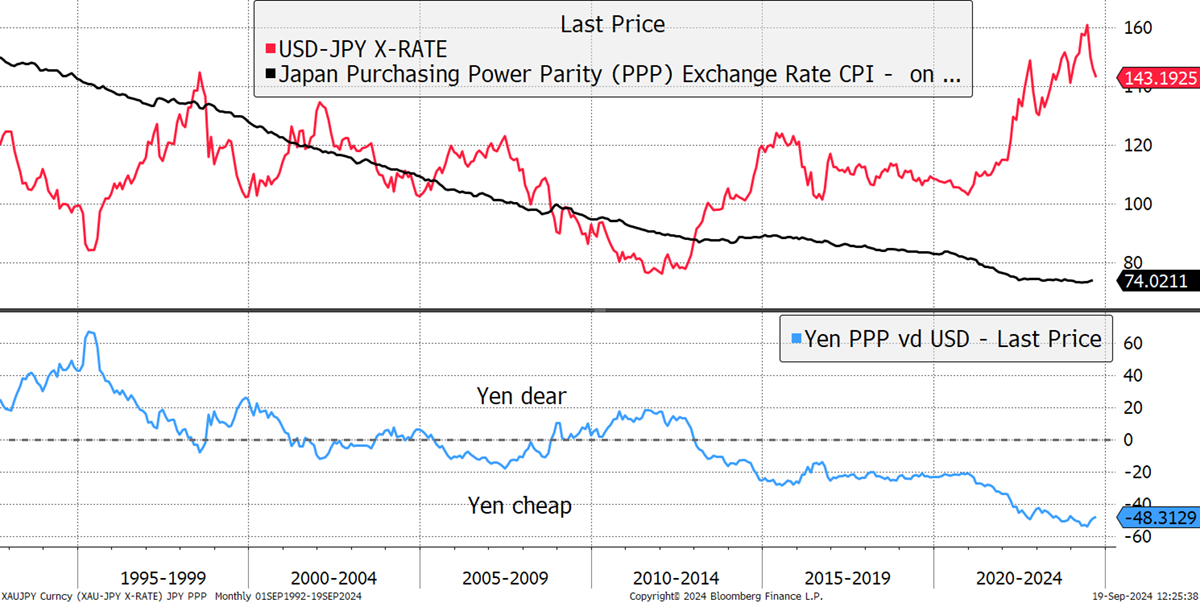

How high is gold going to go? Maybe we should ask how high the yen is going to go. The yen trades 48% below purchasing power, which suggests it may double. On that basis, gold is going to double as well – at least!

Yen Purchasing Power Is Twice the Current Level

To double, we need buyers, and fortunately, they are starting to join the queue.