Rich Gold and Cheap Oil Will Drive the Gold Miners

Disclaimer: Your capital is at risk. This is not investment advice.

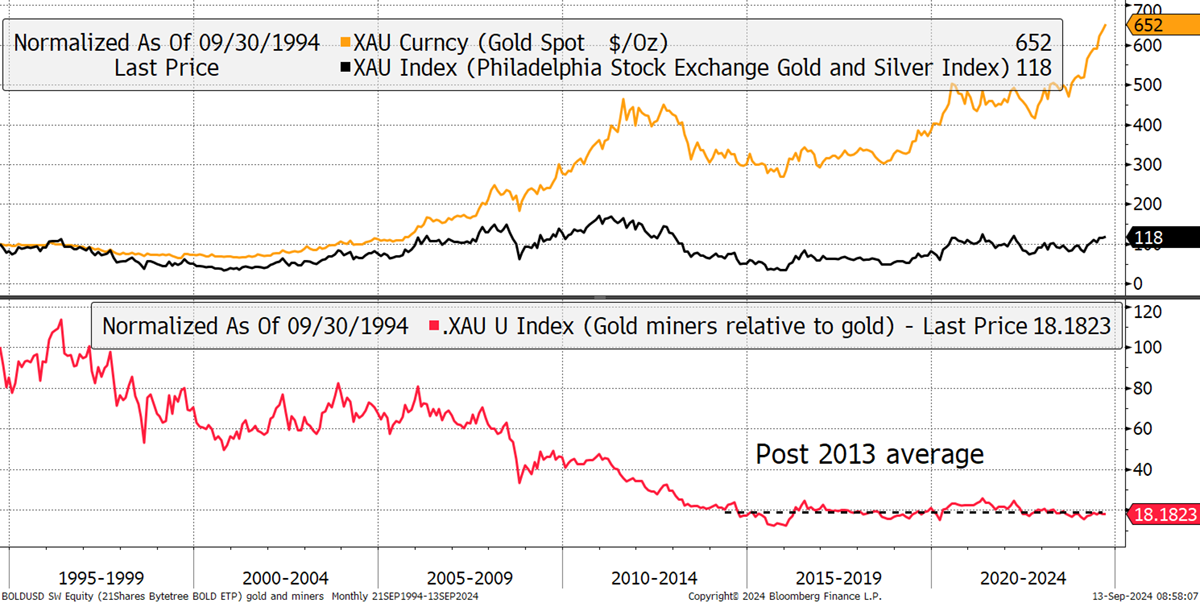

$100 invested in gold in 1994 is today worth $652, a $552 profit. Yet that same $100 invested into the gold miners is worth a mere $118. Many have pondered over this disappointing situation, wondering what the mining industry has been doing during this great bull market in gold.

Gold and the Gold Miners – Past 30 Years

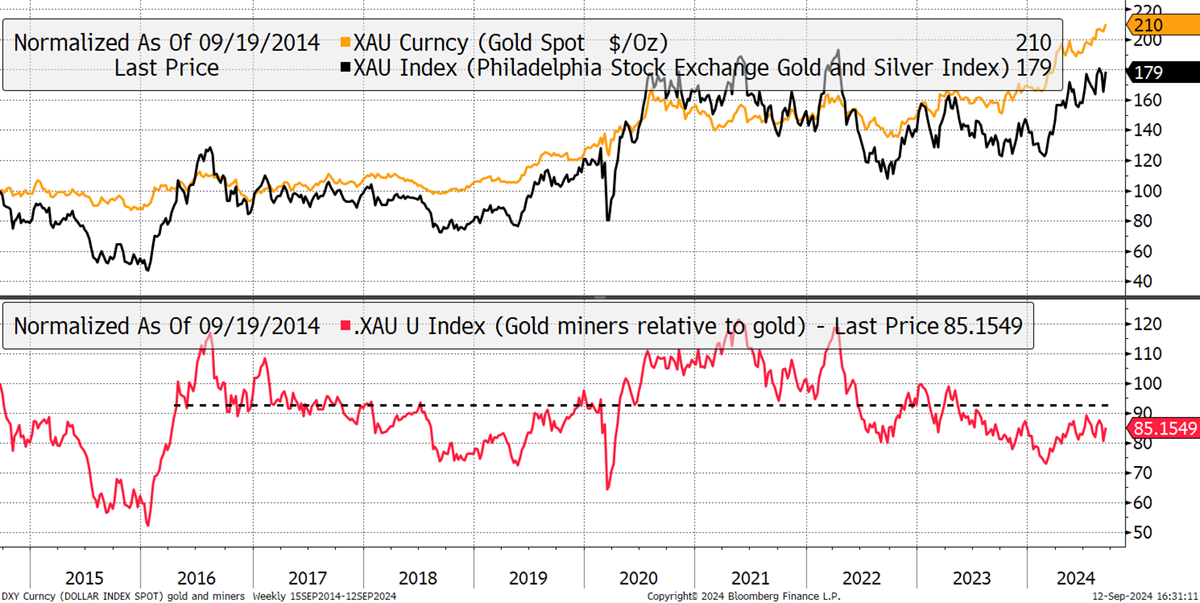

The miners have lagged gold since 1996, but since the major low point in 2015, they have been stable. I can demonstrate that by zooming in below. Unsurprisingly, the miners run harder on the gold rallies and vice versa on the falls. But despite the gold price at all-time highs ($2,550), the miners are still trading cheaply on this basis when you might reasonably expect them to have got in front of the gold price, as they did in 2016 ($1,247 av.), 2020 ($1,773 av.), and 2022 ($1,804 av.).

Gold and the Gold Miners – Past 10 Years

I have little doubt they will get ahead of the gold price, but stockmarkets don’t always do what you expect. The case for the gold miners to surge is strong, but gold is an ultra-high-quality asset. It is timeless, globally recognised, pristine collateral, and provides stability during uncertain times. Gold stocks, on the other hand, are businesses that are much less liquid, and far from being pristine collateral. They are generally considered to be risky. As the economy flirts with recession, it is of little surprise that the market backs gold, rewarding the miners only slightly.

The miners are supposed to beat gold during bull markets because they have operational leverage. That means if mining $100 of gold costs $50, when the gold price doubles, their profits treble from $50 to $150. That’s the theory, but in recent years, the miners’ costs have risen alongside the gold price, preventing margins from rising.

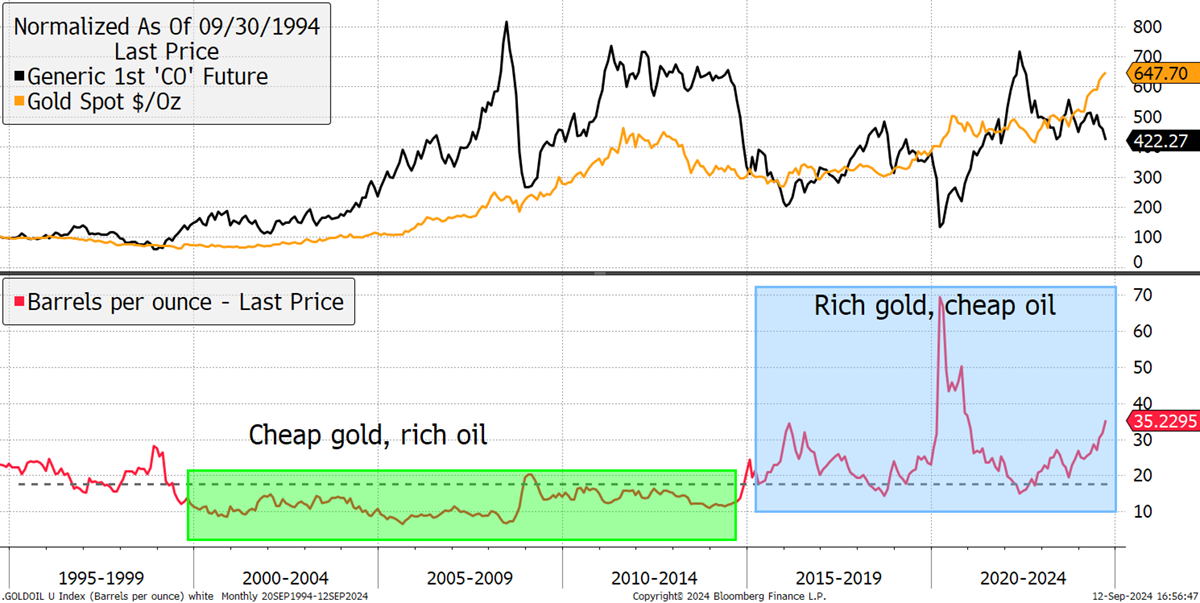

The miners’ largest cost, generally estimated to be around a third, is energy. Gold mines are energy-intensive and often far away from the grid, meaning they consume large quantities of diesel. If the price of gold is low and the oil price is high, that is bad news for the miners, as was the case between 2000 and 2015 when the gold miners were derated. But, since the oil break in 2014, courtesy of the US shale production, gold mining has become a more profitable activity.

Gold and Oil

Until a few months ago, gold and oil had the same 30-year return. Recently, gold has made an all-time high above $2,500, while oil has broken back below $80. While our oil stocks are now on the back foot, the gold stocks are in a prime position to perform. This situation of rich gold combined with cheap oil means the gold miners’ profitability will thrive. Better yet, this is happening while the miners remain cheap versus gold, making them even more attractive.

The gold miners are in the best position they have been for years. After a prolonged slump, their balance sheets have been cleaned up, and the profits are rolling in, all while investors have barely noticed. The simplest thing to do is to buy the Gold Miners Index ETF (the most popular one is GDX, with listings in many countries), which I suspect will do very well over the coming years. It is dominated by the titans such as Newmont (NEM), Agnico Eagle (AEM), Barrick (ABX), Wheaton (WPM), and Franco Nevada (FNV) that collectively make up half the index, which is comprised of 54 companies.

Beyond GDX, the gold mining industry has over 1,000 listed miners around the world, of which around 83 are valued above $1 billion and 202 above $100 million. In aggregate, the miners are worth $578 billion, which compares to $16.5 trillion of the world’s total supply of gold bullion. With a 30:1 ratio of gold to miners by value, it’s little wonder that gold is so much more liquid and less volatile.

Yet, in that pack of gold stocks, there are rich pickings. Last October, I recommended Centamin Plc (CEY London), a mid-tier gold producer, which was bid for by AngloGold Ashanti (ANG South Africa) on Tuesday at a 36.7% premium to the prevailing price. CEY was one of the five gold miners recommended in ByteTree Venture and returned 83.8% before it was sold this week. The deal cements ANG as the world’s fourth largest producer, and the appeal of CEY was a low valuation that will see it add to its production.

Since the pandemic, CEY has slumped to a hefty discount, and that caught my attention. The company was suffering from real-world issues during the lockdown, but the market was unforgiving. The shares were undervalued, and provided the gold price rose, or at least remained stable, CEY shares would rise. Since the time of purchase, the miners (red) rose in response to the higher gold price, but CEY (blue) did much better as it rose by 85% while the miners rose by 25%; a very satisfactory result for Venture.

Centamin Versus Gold Miners

As I wrote recently, the opportunity isn’t in the most profitable large-cap gold miners but the more junior companies, especially those involved in exploration.

The remaining four gold stocks in Venture are all mid-caps and a combination of exploration as well as undervalued production. These catch-up trades can be extremely profitable, and you’ll see more of these great opportunities over the coming weeks and months in ByteTree Venture.

A Week at ByteTree

The Venture sell note for Centamin is here, and since the trade is complete, the buy note can be seen here.

But it hasn’t all been plain sailing, as the Whisky Portfolio in The Multi-Asset Investor has been coming under pressure since the highs in April. Exposure to gold miners, silver, the Yen, and various quality growth stocks has worked well. But exposure to cyclicals, and especially oil, has been devastating. It seems the cold winds from China are weighing on an already slowing economy. But don’t bet against commodities, as the ByteTrend charts will confirm. Copper, silver, platinum, palladium, tin, and, of course, gold are all bullish 5-star trends today.

Follow ByteTrend on X.com for Daily Alerts

Another problem facing the economy is excessive regulation around net zero, which has ground the automotive industry to a halt. I covered this in The Multi-Asset Investor as we sold Stellantis, a former portfolio star that slumped over the summer. It’s not the company that has done wrong so much as the regulation, which is making it impossible to do business. Auto stocks are tumbling.

In my opinion, over-regulation is not just, but Mario Draghi, the former head of the European Central Bank and Italian prime minister, does not share my views. He is the man who’ll do “whatever it takes” to fix the European economy. He has written a report on how to boost European competitiveness.

Obviously, there were many sensible suggestions such as less regulation and (Thatcher-style) supply-side reforms. But all of that’s too difficult in a comfortable bureaucracy, so the focus flipped to the other suggestion, which was €800 billion of annual investment fuelled by joint public debt. Now, that is more like the Draghi we have come to know and love. That won’t just boost gold (and Bitcoin) but maybe even oil and commodities too.

In crypto, times have been tough, but we may have seen the worst as breadth improves.

Have a great weekend,

Charlie Morris

Founder, ByteTree