Juniors and Blockchains

Trades in Whisky;

No one harps on about Bitcoin and gold more than yours truly. I have been hooked on gold since 1999, having attended a conference where I heard John Hathaway from Tocqueville Asset Management (now Sprott) speak on the subject.

Gold had been off the radar for 20 years, and he made compelling arguments about limited supply, the long-term demise of fiat money, and how gold would never again be this cheap. Gold surged in 1999, once the Bank of England had completed its well-publicised gold sales, before retesting its low in 2001. The price was $255, and today, it is more than ten times higher.

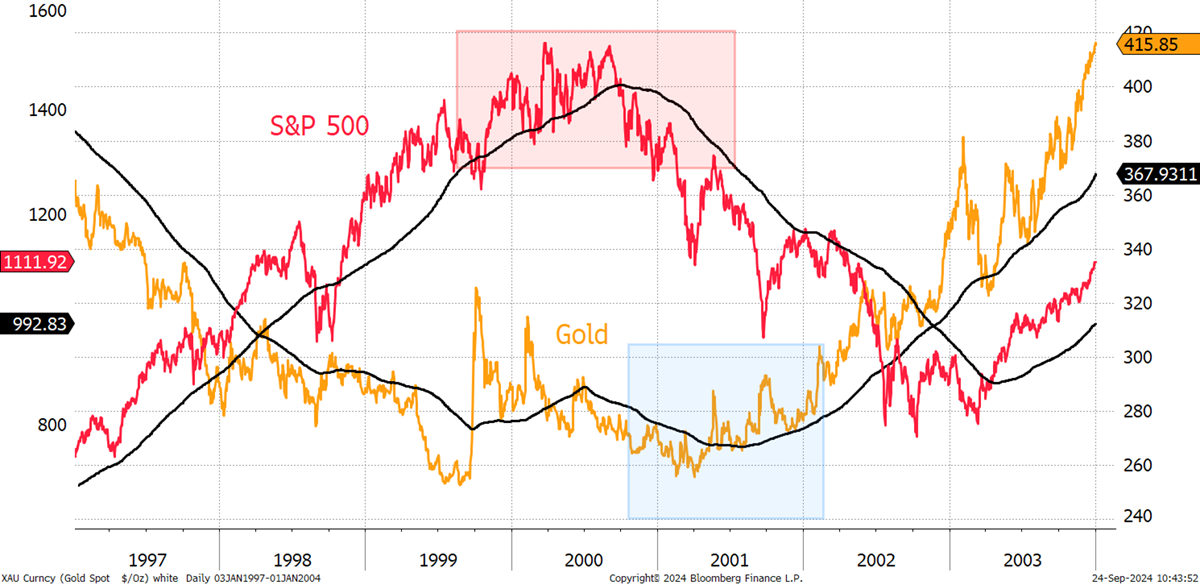

Gold and Stocks 1997 to 2003

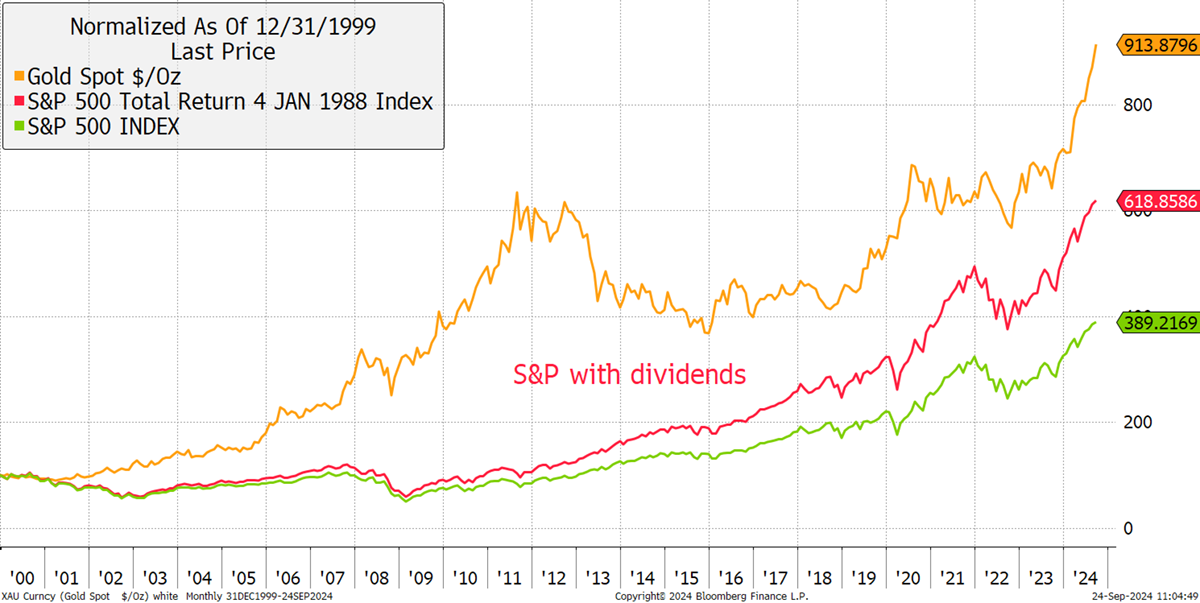

I had just completed my course with the Society of Technical Analysts and was therefore brushed up on moving averages. I witnessed the S&P 500 turn down while gold turned up. At the time, the idea of an equity bear market was absurd, and as for gold, a bull market was just plain ridiculous. Many of the senior staff were in their 50s and 60s and had lived through a gold bubble in the late 1970s and the 20-year bear market that followed. They couldn’t take it seriously, making young fans like me look somewhat crackpot. As I love to point out, here we are 24 years later, and gold is still ahead of the S&P 500, even after including dividends.

Gold and Stocks in the 21st century

Following the all-time high in March, gold does look a little overbought, but no more so than the S&P 500. The portfolios own gold, silver and gold stocks, and I am keen to increase that exposure.

The Whisky Portfolio also notionally holds some Bitcoin, which some describe as digital gold. I say notionally because it is hard to hold Bitcoin in the UK as it is persona non grata. This is despite the fact that there are no restrictions in most advanced countries. Over here, Bitcoin ETFs and financial products remain banned, yet Bitcoin-related equities are not.

My journey with Bitcoin began in 2012 when a friend, a hippy economist, introduced me to this idea of electronic money. Like most people on the first take, I was sceptical and ignored it until 2013, when the penny finally dropped. The blockchain meant that you couldn’t “cut and paste” digital money. I dug inside, saw the growth in network activity around the world, and have been a long-term bull ever since.

Should we think of it as digital gold or digital cash? Probably the former because transactions aren’t cheap (around $6 for Bitcoin), but there are systems that can interact with the blockchain and transact for near zero. There are other applications, such as smart contracts, which, for example, could represent the ownership of gold or anything else you choose. But above all, the authorities have never much liked the idea of money and assets outside of the system, and so they made life difficult by telling banks to block related transactions. What did the crypto industry do? It invented the $160 billion stablecoin sector, which is thriving. Moreover, governments want to launch their own versions known as central bank digital currencies (CBDCs). This would put a pound onto the blockchain.

Don’t we already have digital cash?

No, we don’t; we have apps that are linked to bank deposits. The app may be recent, but the bank is the same, and banks can fail. A CBDC is linked to the central bank and is, therefore, the electronic version of a banknote. In theory, this technology could mean the banks are no longer required, but in practice, they will continue but will likely face change. They will likely have less freedom, power, and privilege in the financial system. This is a topic for another time, perhaps, but the bottom line is that Bitcoin, stablecoins, CBDCs, crypto, and the like are real. It is a shame that the UK, which should be a natural leader in this space, has been held back by policy choices driven by fear.

Bitcoin and gold are related in the sense that they both have limited supply and are widely held around the world as neutral assets that sit outside of government control. But they differ in that one is a precious element, and the other is a vibrant technology. As a result, they are both inflation-sensitive and benefit from a weak dollar. Yet, gold performs best when real interest rates are falling, and Bitcoin performs best when the economy is vibrant. That is why I believe they are such a natural fit.

I rarely write about Bitcoin in The Multi-Asset Investor, and less about gold than I would because there are free dedicated monthly publications on ByteTree. I write monthly about gold in Atlas Pulse and Bitcoin in ATOMIC (next issue this week). Please use those links if you need to brush up on this topic before we carry on. I believe this is a compelling time to add to both Bitcoin and gold.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd