Could Uptober Be Upended?

Disclaimer: Your capital is at risk. This is not investment advice.

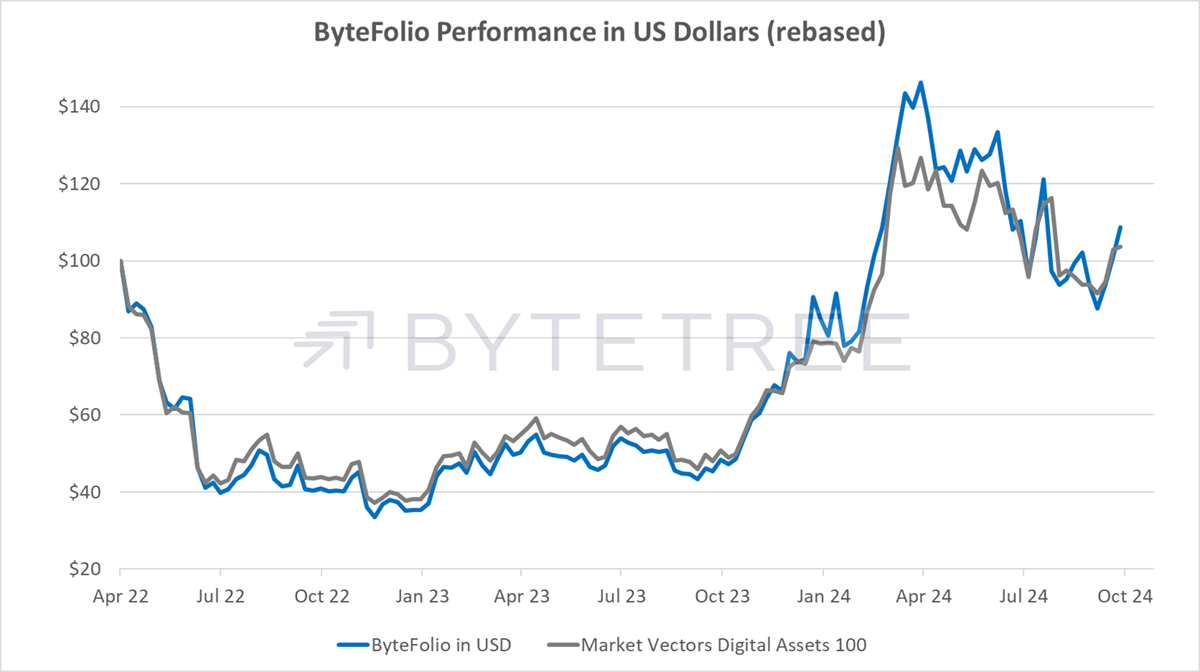

ByteFolio Issue 127;

During this morning’s analyst call, Uptober came up. Given how the Uptober thesis had become so widespread, I asked for views on how likely an autumn Bitcoin rally was this year. The contrarian will always be cautious of an idea that has become too popular because popularity means the money is already invested ahead of the event. How can the price rally if everyone’s in?

Although a split room, with Seran, an Uptober believer and Ali, a sceptic, I too was a believer. 2024 has been a halving year, and while the majority seem to expect a post-halving surge, what we have actually seen is a pre-halving surge followed by a six-month consolidation before the breakout comes.

Bitcoin Behaviour Around Halvings

It makes sense because although the rate of new Bitcoin supply growth halves on halving day, it takes a little while for the market to settle down; history suggests six months. In 2016 and 2020, halving led to a 6-month wait before the break, which suggests that is how long it took the market to tighten after a period of pre-halving excesses. There’s a repeatable pattern that makes October in halving years even more likely than any non-halving October.

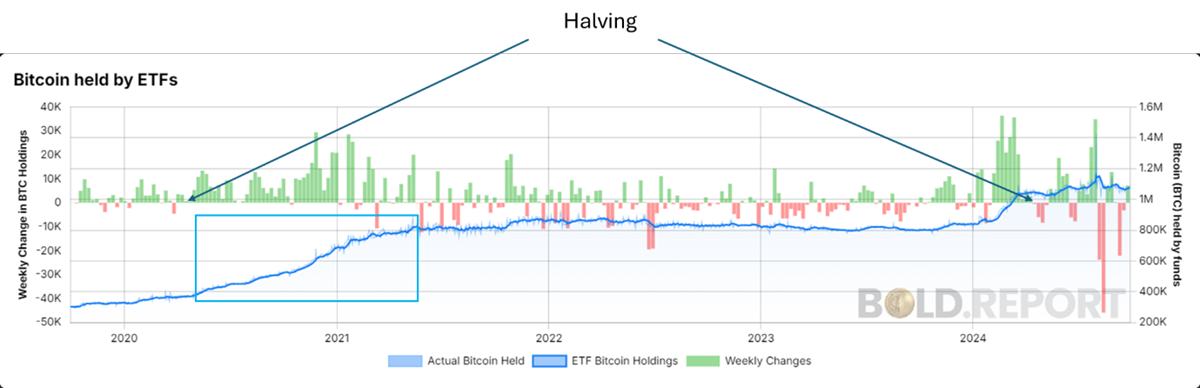

Add the simple idea that if the flows scale up, a breakout is inevitable. In 2020, the market scooped up 500k BTC. These days, that would cost $30 billion, so it is unlikely. However, steady inflows alone would be enough to see the price make a new all-time high. They are happening.

Bitcoin ETF Holdings