Bitcoin and Gold Are Best in Class

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

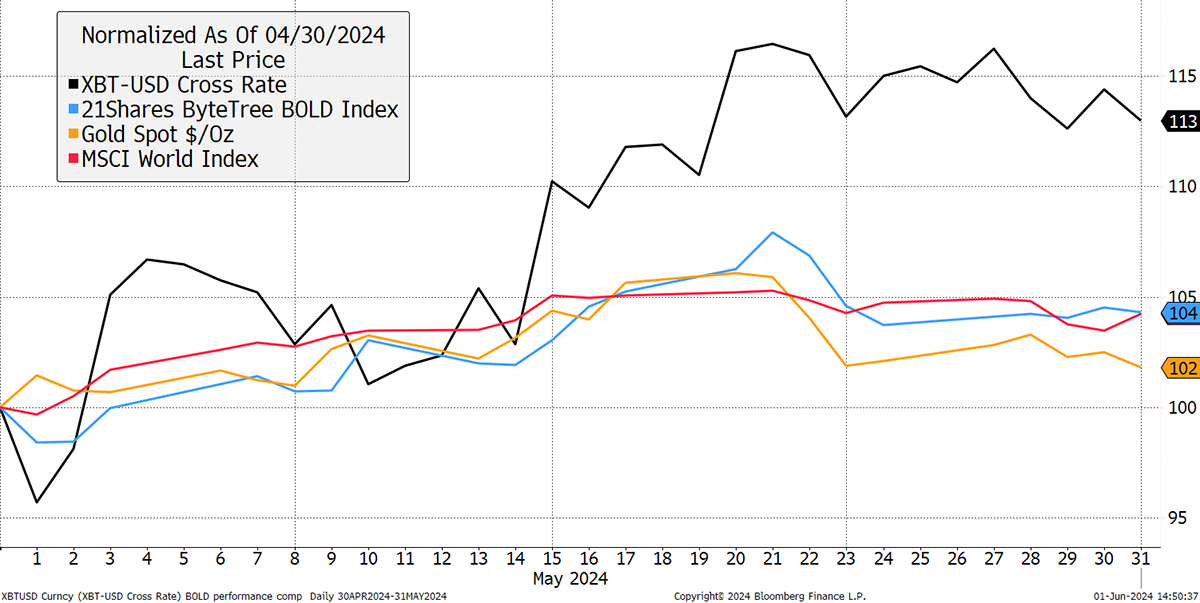

In May, BOLD rose by 4.3%, Bitcoin rose by 13%, and Gold rose by 1.8%, while equities rose by 4.3% in USD terms. Last month, the target weights were 24.8% for Bitcoin and 75.2% for Gold. Price changes over the month led to the last day’s weights at 26.6% and 73.4%. This means the latest rebalancing at the end of May has seen 2.3% added to Gold, and correspondingly reduced from Bitcoin, to meet the new target weights.

Bitcoin, Gold, BOLD, Equities – May 2024

With Bitcoin beating Gold in May, the price of a Bitcoin is once again close to 30 ounces of Gold. If it manages to pass 35 ounces, a new burst of growth is likely.

Bitcoin Priced in Gold

We don’t know if or when that happens, but the BOLD index benefits heavily during the rangebound periods, where the excess return is generated over and above the return from the assets themselves.

That is because if you accumulate the weaker asset each month, at the expense of the stronger, the process continually adds value as their prices cross over. If Bitcoin and gold stayed within the 15-to-35-ounce range for years, BOLD would materially beat a Bitcoin and Gold mix that had not been rebalanced while maintaining less risk. The process of monthly rebalancing is no more complicated than buying low and selling high.

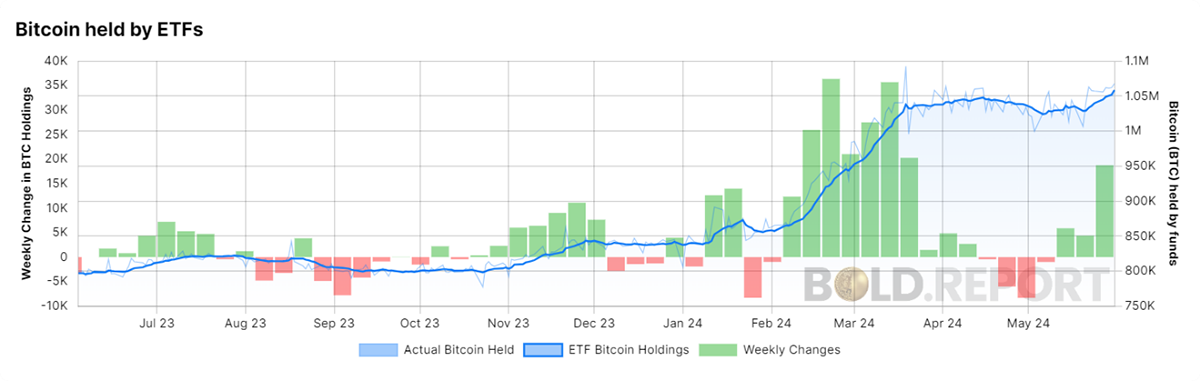

Bitcoin and Gold Flows

The new Bitcoin ETFs in London have made little difference to the overall Bitcoin holdings, but it is early days. May saw a turnaround in flows as 23,302 BTC were added to the Bitcoin ETFs. With around 13,930 BTC mined (450 per day) in May, that is a demand surplus, which has historically been bullish. However, anyone holding Bitcoin can sell, not just the miners, and so there must be some selling pressure in the system, which is unsurprising in a strong year. That said, the trend is strong, and the Bitcoin price weakness seen in April has been reversed.

Bitcoin Held by ETFs

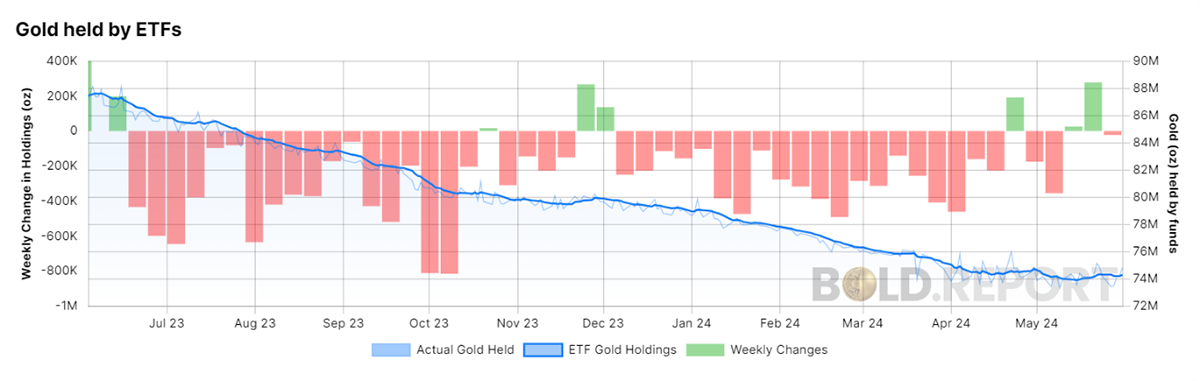

The Gold ETF flows have improved as well. After a prolonged patch of selling pressure, May was stable, with a week of strong inflows. At the very least the outflows have stabilized. The important point is how the Gold price has been so resilient in the face of such strong selling pressure. When outflows turn back to inflows, the upward pressure on the gold price will be unopposed.

Gold Held by ETFs

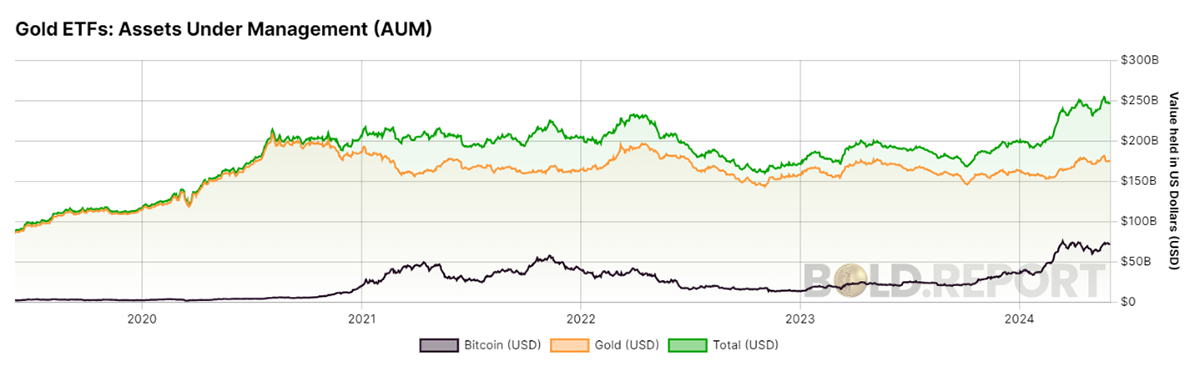

Putting the Bitcoin and Gold ETF assets together, the total comes to $250 billion, a number that seems to keep growing.

Gold ETFs Assets Under Management

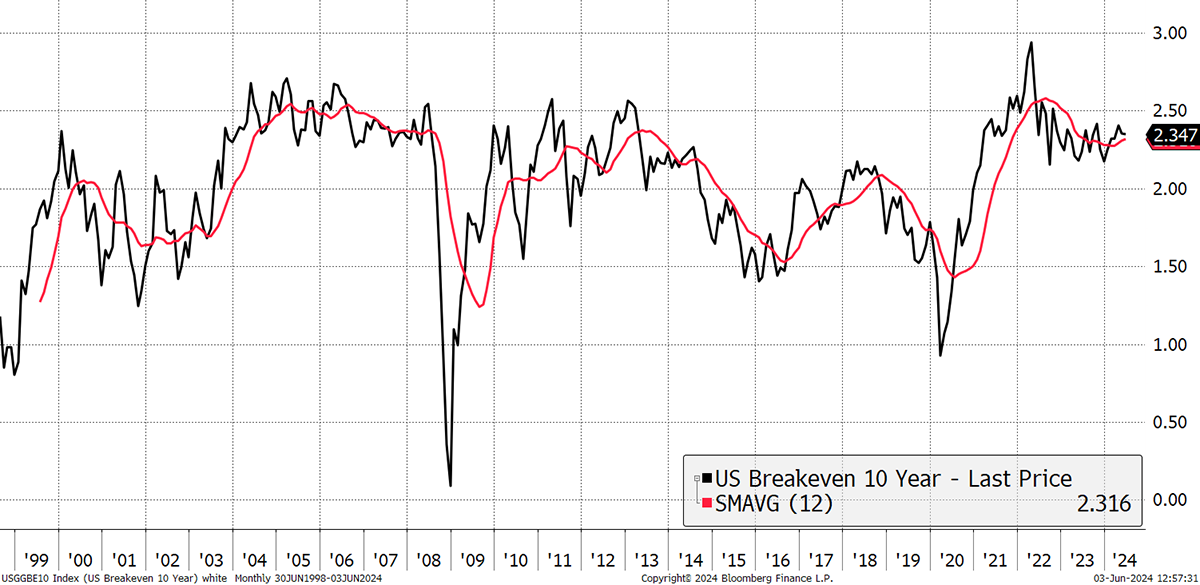

Demand for alternative assets increases during times of high inflation. We had the surge during the pandemic, which peaked shortly after the war in Ukraine. That period of cooling is behind us as shown by the US 10-year inflation expectations. They are now sitting above a rising 12-month moving average (red), which suggests the trend is once again rising.

US Inflation Expectations Are Rising

BOLD is an effective inflation hedge.

BOLD Performance

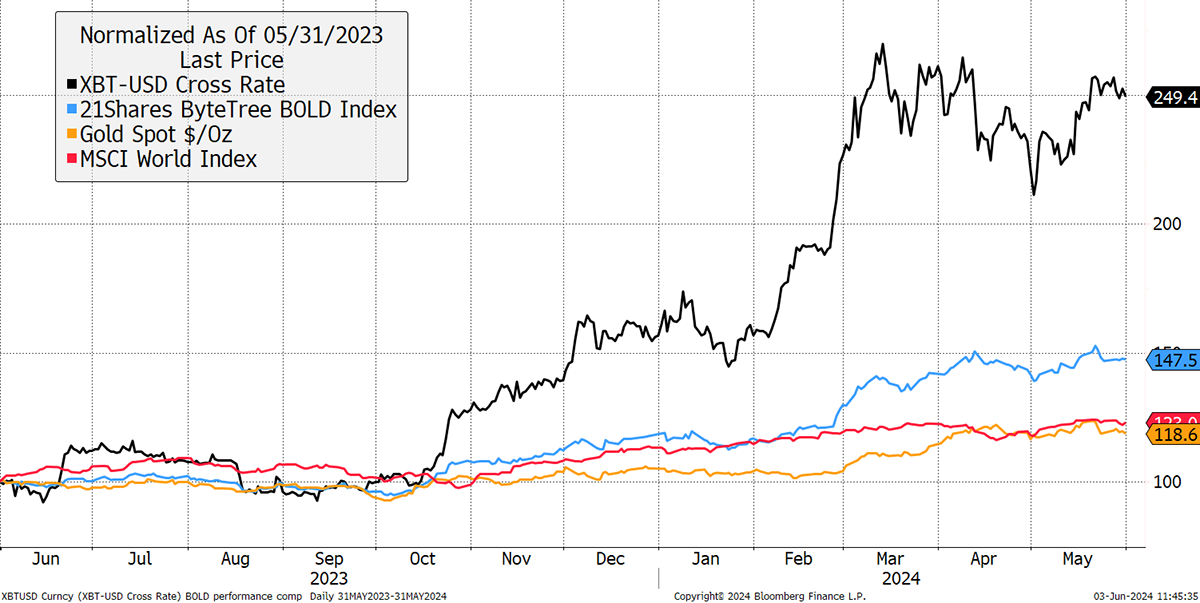

Over the past year, Bitcoin’s performance has returned 149%, compared to Gold's 19%. BOLD managed a respectable 47% return.

Bitcoin, Gold, BOLD, Equities - Past Year

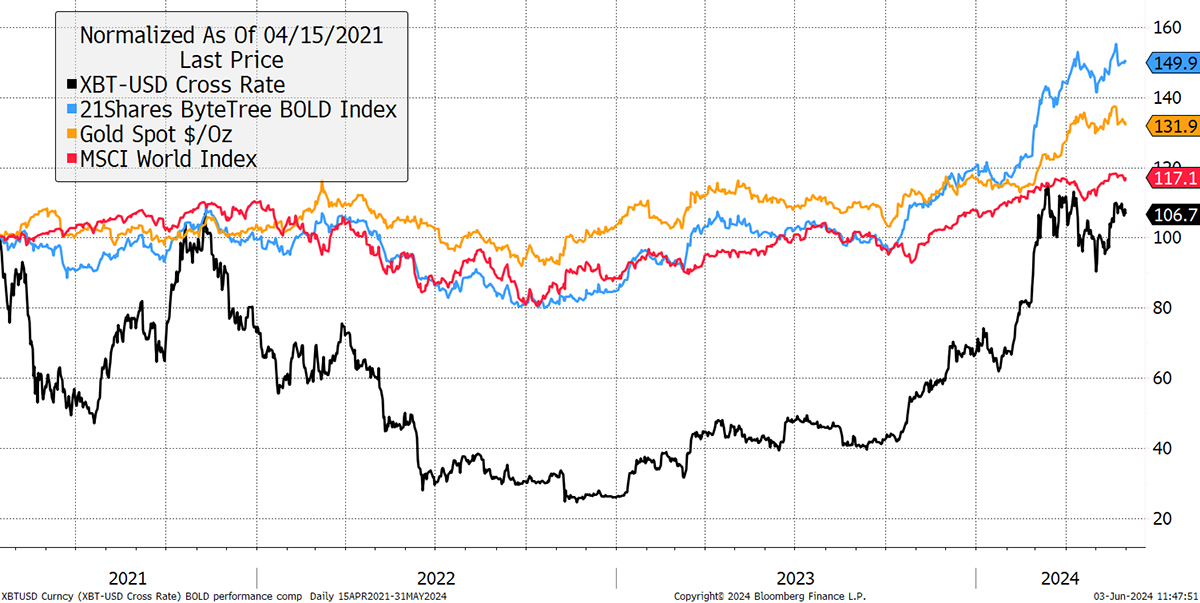

However, BOLD performs best, at least in relative terms, when Bitcoin is under pressure. Since the notable high in April 2021, ahead of the Chinese mining ban, BOLD has demonstrated the vitality of regular rebalancing. I remind people that BOLD was never designed to beat Bitcoin, but to enhance Gold.

Bitcoin, Gold and BOLD Since the April 2021 Bitcoin High

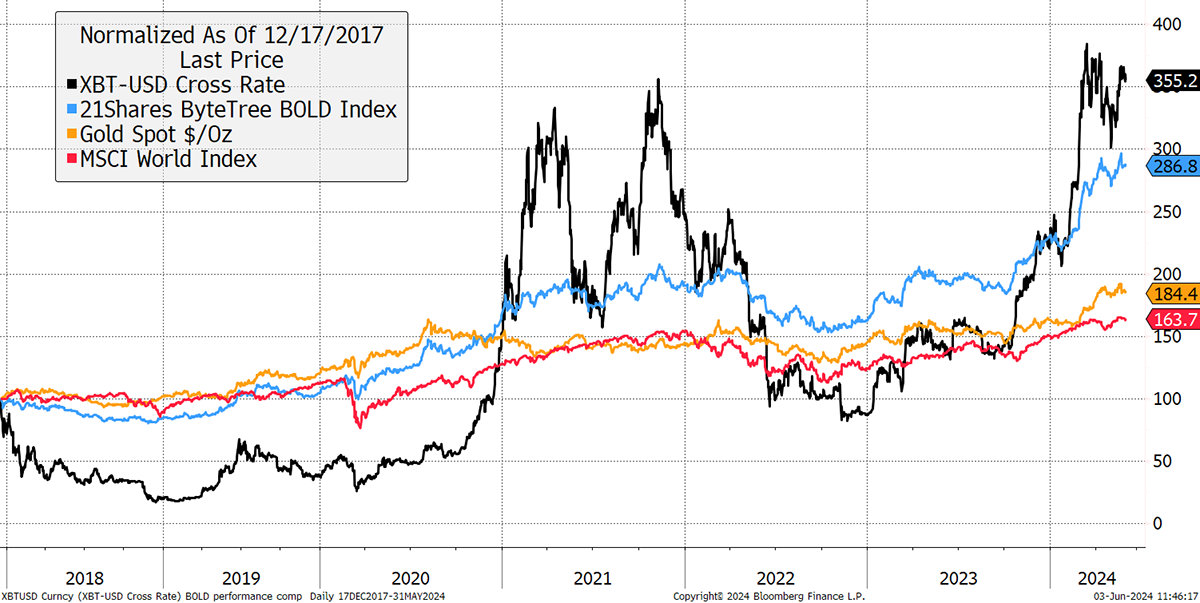

Staying on the theme of notable Bitcoin highs, BOLD has nearly kept up with Bitcoin since the 2017 high, with much lower risk and volatility. Since then, Bitcoin is +255%, while gold is +84% and BOLD +186%.

Bitcoin, Gold and BOLD Since the December 2017 Bitcoin High

The May 2024 Rebalancing of the BOLD Index

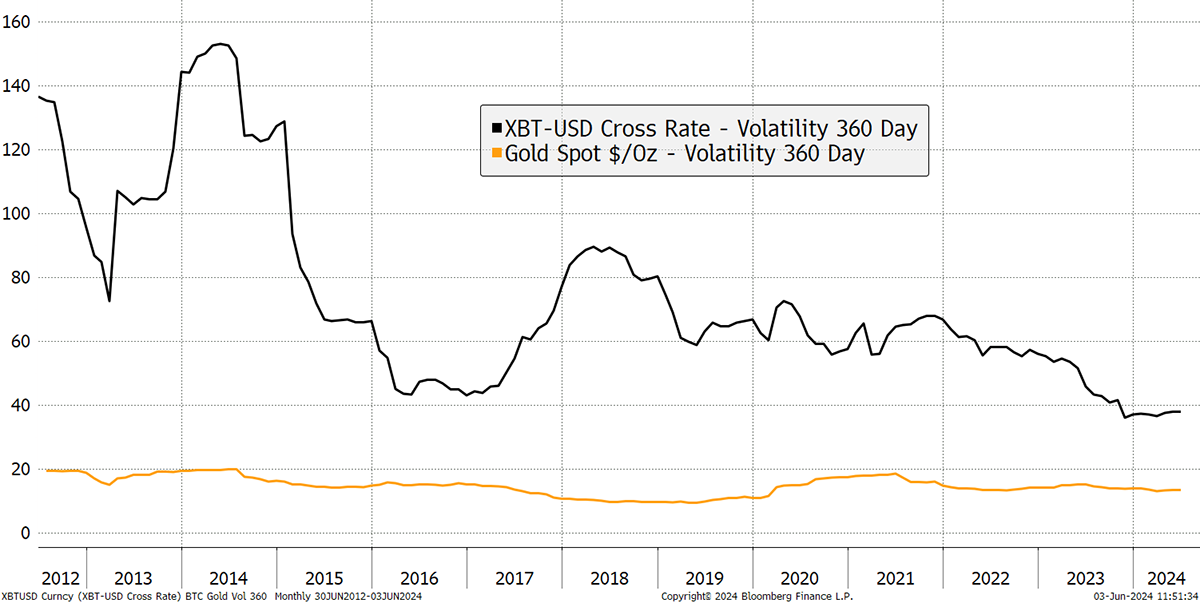

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing. Bitcoin’s volatility, measured over a year, has fallen significantly since the early days and is now no more volatile than a typical blue-chip stock.

Bitcoin and Gold - Past 360-day Volatility

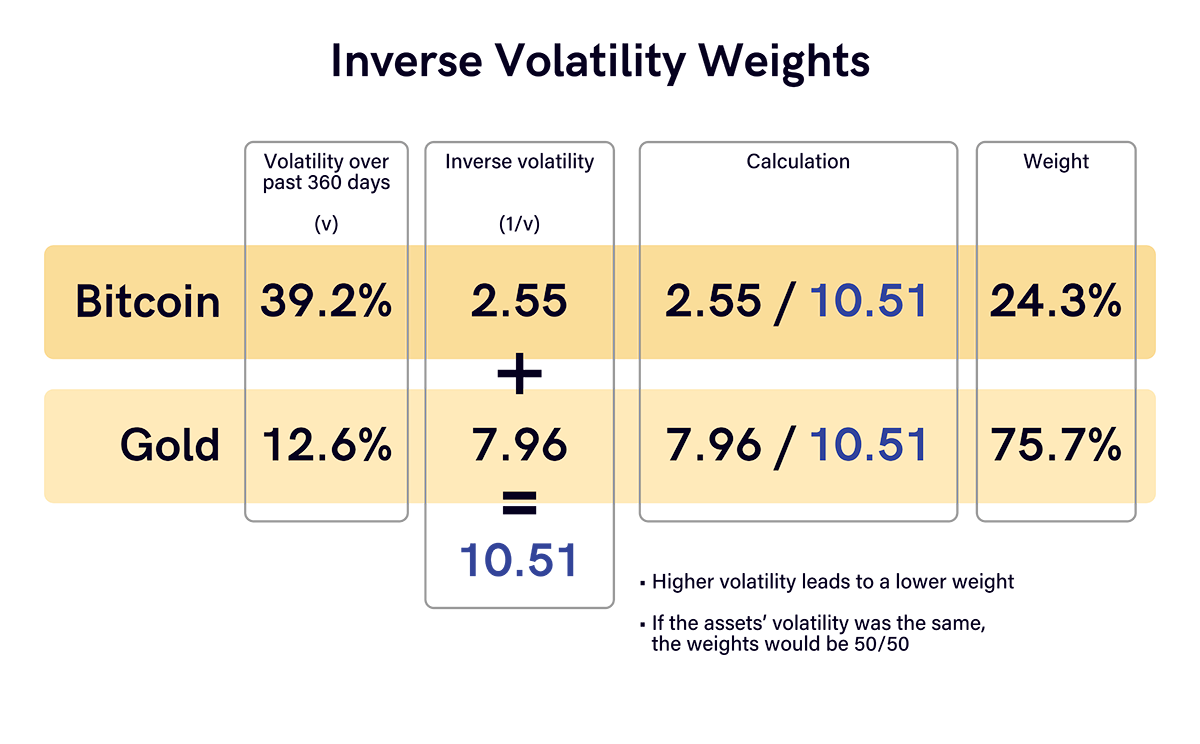

The volatility for Bitcoin and Gold over the past 360 days was observed to be 39.2% for Bitcoin and 12.6% for Gold. That means Gold’s volatility is slightly higher than last month, while Bitcoin is unchanged. This has resulted in new target weights of 24.3% Bitcoin and 75.7% Gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. It is hence “risk-weighted”.

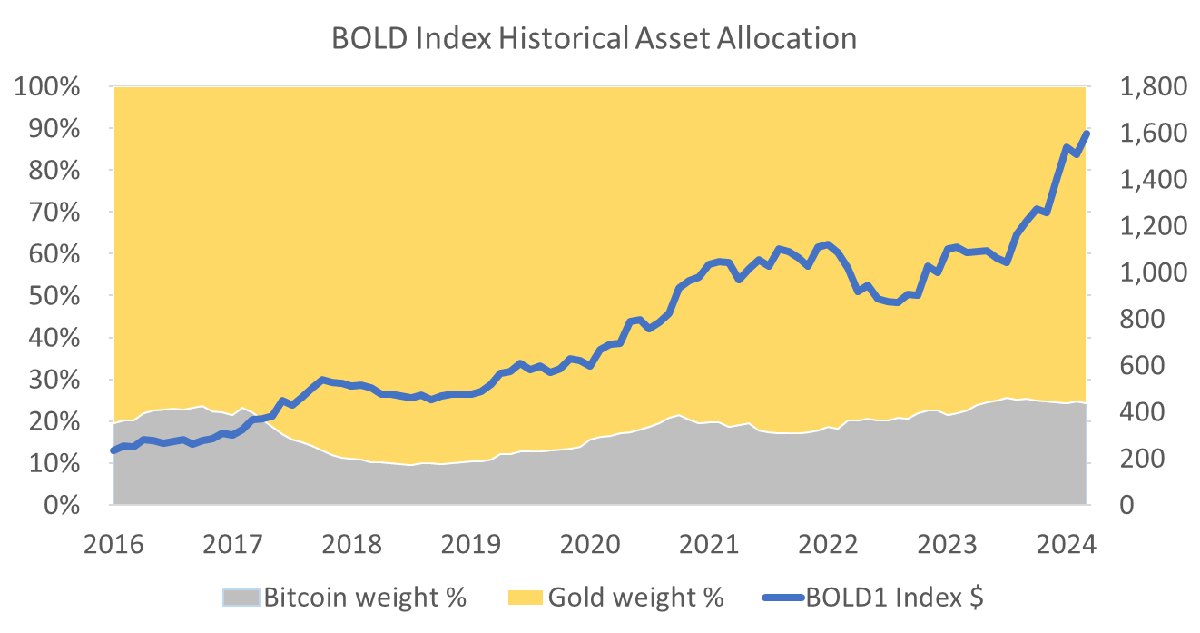

The BOLD allocation to Bitcoin was low in late 2017 and 2018 when Bitcoin’s volatility was high compared to Gold’s. Bitcoin exposure peaked at 25.5% in October but has been declining since the volatility spread has widened again. This is a key part of BOLD’s risk management.

Rebalancing transactions occur at the end of each month, which accumulates the weaker asset at the expense of the stronger asset. In a Bitcoin bull market, that’s Gold, and in a Bitcoin bear market, that’s Bitcoin. Since the end of 2022, BOLD has been reducing Bitcoin and increasing Gold.

Example

Consider a theoretical million-dollar investment into BOLD in January 2018. The BOLD weights were 13% Bitcoin and 87% Gold at the time. Our investor bought 9.27 BTC at $14,043 each for $130,000, and 668 ounces of Gold at $1,303 each for $870,000. At the end of May, a Bitcoin was worth $67,742 and an ounce of gold $2,327. The combined holdings are now worth $2,181,893, a gain of 118%. Yet the process of rebalancing has added value such that BOLD has risen by 197%, which is 79% more.

This simple and repeatable investment process accumulates the lower-performing asset over time. As Bitcoin matures and its performance converges with Gold, the result should see BOLD continue to offer enhanced returns with persistent lower volatility.

BOLD and the Magnificent Seven

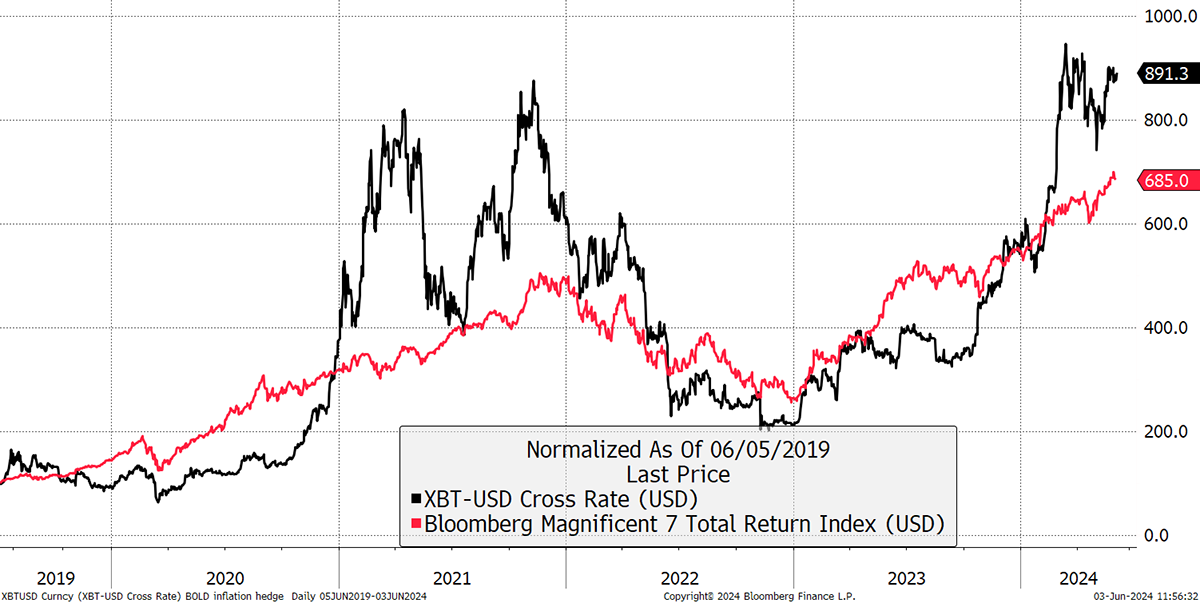

The Mag 7 stocks, which include Apple and Nvidia, have continued to do well, but it is remarkable that the very best internet stocks simply mimic Bitcoin.

BOLD and the Magnificent Seven – Five Years

That is unsurprising because Bitcoin is native to the internet, and as the web grows, so does Bitcoin. Large technology companies need to innovate and spend money to stay ahead. For Bitcoin, it simply needs to remain relevant. Given that the entire world’s wealth management industry has yet to allocate capital to Bitcoin, it strikes me that the risk lies with the Mag 7, where they have already parked trillions of dollars, much more than it does with Bitcoin.

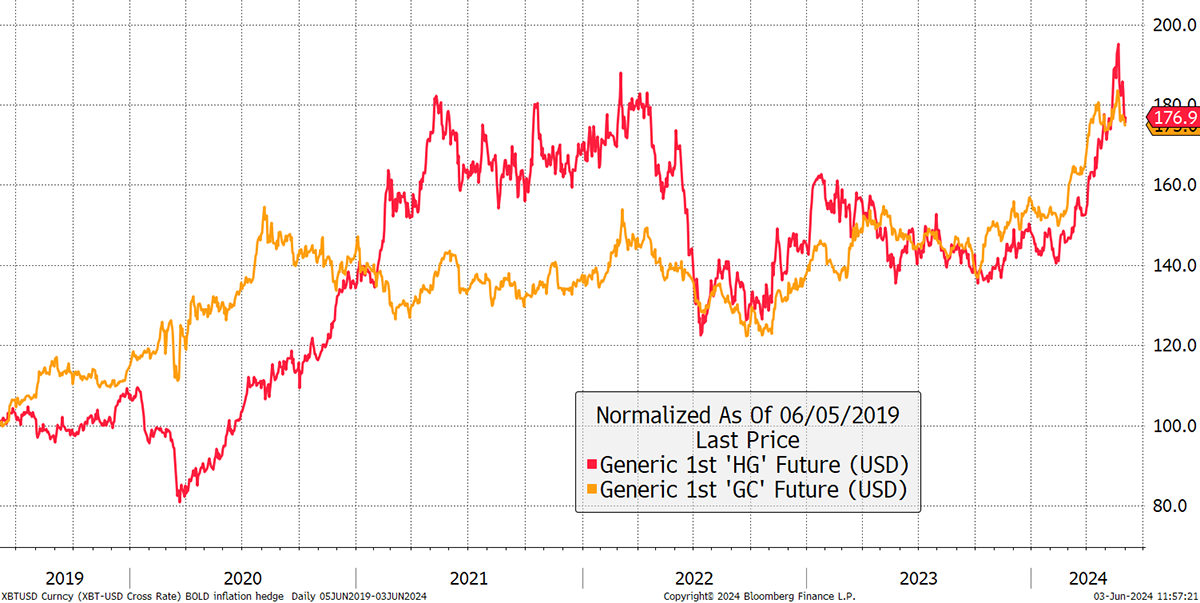

It is a similar story for Gold and commodities. We have seen strength in metals and food prices, yet we have also seen strength in Gold, which remains highly liquid and resilient at times of crisis such as in the early stages of the pandemic. I demonstrate that against copper, which has been highlighted as a potential performer as electrification drops into a higher gear. The correlation has risen, but it is a reminder that Gold not only keeps up with commodities over time but leads.

Gold and Copper

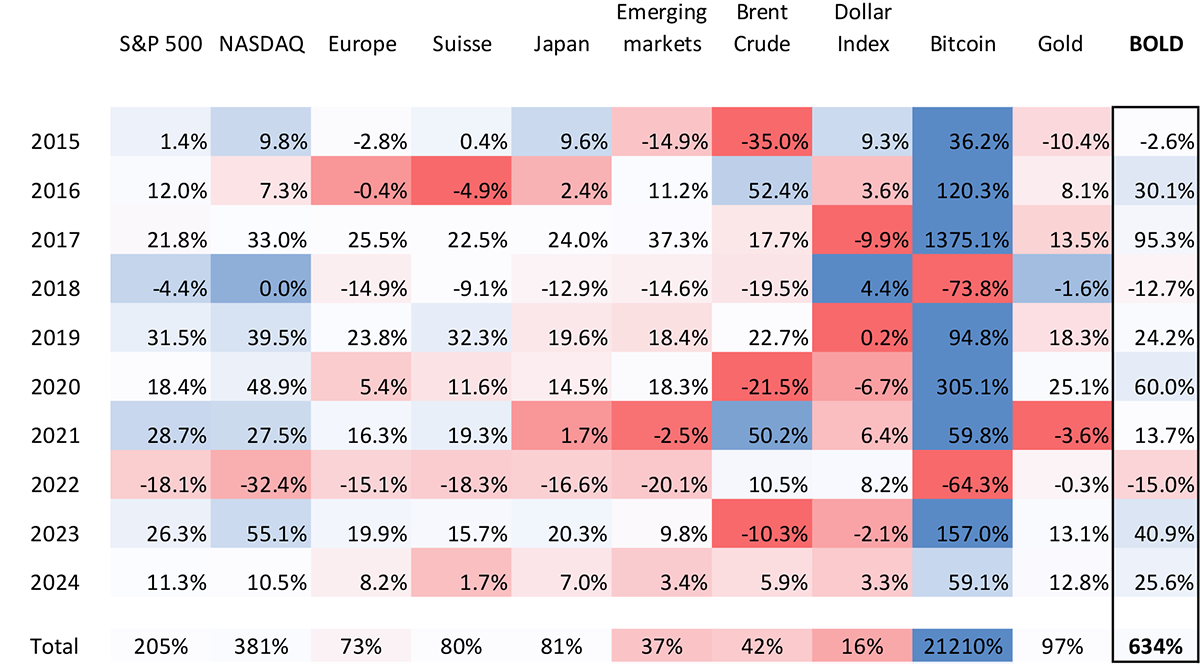

It could be said that Bitcoin is the leading technology asset, while Gold is the leading commodity. The BOLD Index brings them together and adds value through improved risk-management and monthly rebalancing transactions. BOLD has seen higher returns, with lower volatility than the NASDAQ.

Asset Class Returns Since 2015

Summary

There is a webinar with Alex Pollak from 21Shares where we will discuss the recent rebalancing and the longer-term drivers of BOLD. Please join us at 4 PM (UK Time) on Wednesday, 5th June, and we will be delighted to answer your questions.

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

BOLD.report

Research

ByteTree provides more in-depth research on Bitcoin and Gold for free on our website.

Comments ()