What Is Pendle Finance? Introducing Yield Tokenization

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: PENDLE;

Pendle Finance is a unique dApp that stands out in the DeFi space with its innovative yield tokenization mechanism. This platform not only facilitates the trading of various DeFi yields but also allows users to earn fixed yields and liquidity provision. In this Token Takeaway, we will explore the intricacies of Pendle Finance and analyse the value propositions of its native token, PENDLE.

Overview

Originally branded as Benchmark, Pendle Finance was introduced in November 2020 by TN Lee, a former Head of Business Development at Kyber. According to TN Lee, the motivation behind launching Pendle Finance was to create a protocol that allows users to lock in DeFi yield and offer certainty in the highly volatile DeFi yield market. Pendle Finance went live on Ethereum in June 2021, seven months after its introduction.

From its humble beginnings, Pendle Finance has rapidly evolved into a DeFi powerhouse. With an initial backing of just $3.7m from a private token sale led by Mechanism Capital in April 2021, the platform has now processed over $18.5bn in trading volume and boasts an impressive $6.1bn in TVL, a clear testament to the platform's popularity. The potential for further growth is strong as Pendle Finance is now supported on Ethereum, Arbitrum, Optimism, and BNB Chain.

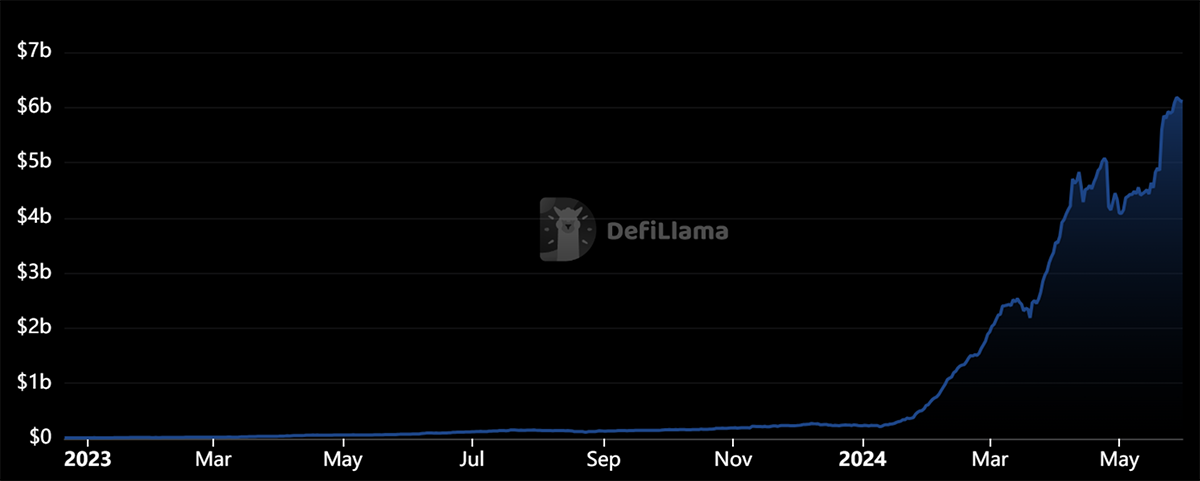

TVL on Pendle Finance

As depicted in the chart above, Pendle Finance has witnessed substantial TVL growth since 2024, skyrocketing by 2600% since January. This surge was largely driven by the tokenization trend in the industry, which gained momentum with the entry of TradFi giants like BlackRock and Franklin Templeton and DeFi Real World Asset (RWA) platforms like Ondo Finance. While Pendle Finance is not directly associated with these platforms, it employs the same fundamental mechanism for asset tokenization. However, unlike Ondo Finance, which tokenizes RWA such as bonds, Pendle Finance specializes in tokenizing DeFi yield.

What Makes Pendle Finance Unique?

To understand the value proposition of Pendle Finance, we need to understand the problems it aims to address. Let me ask you: what do you think the Ethereum staking yield is going to be two years from now? Honestly, there is no way you can answer this question accurately. This yield fluctuates a lot. Similar to how token prices pump during the bull markets and dump during crypto winters, the staking yield follows suit. In addition, several other internal factors could affect the yield, such as activity on the platform and the number of tokens staked.

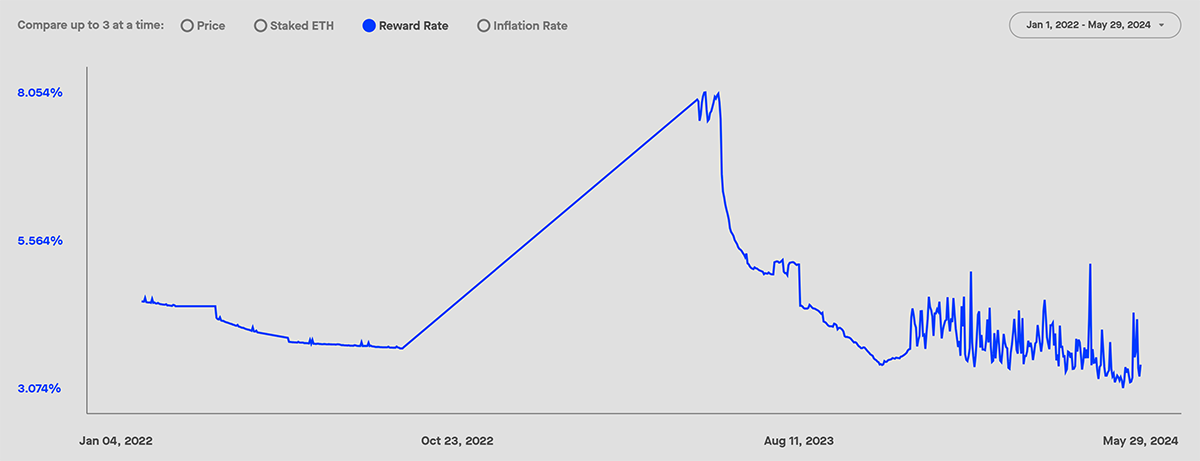

ETH Staking Yield

The above chart shows that the highest ETH staking yield was over 8%. You may have staked at that time because you assumed you would earn 8% every year. Instead, you would now be earning the current yield of 3.6%. If I were you, I would be mildly frustrated.

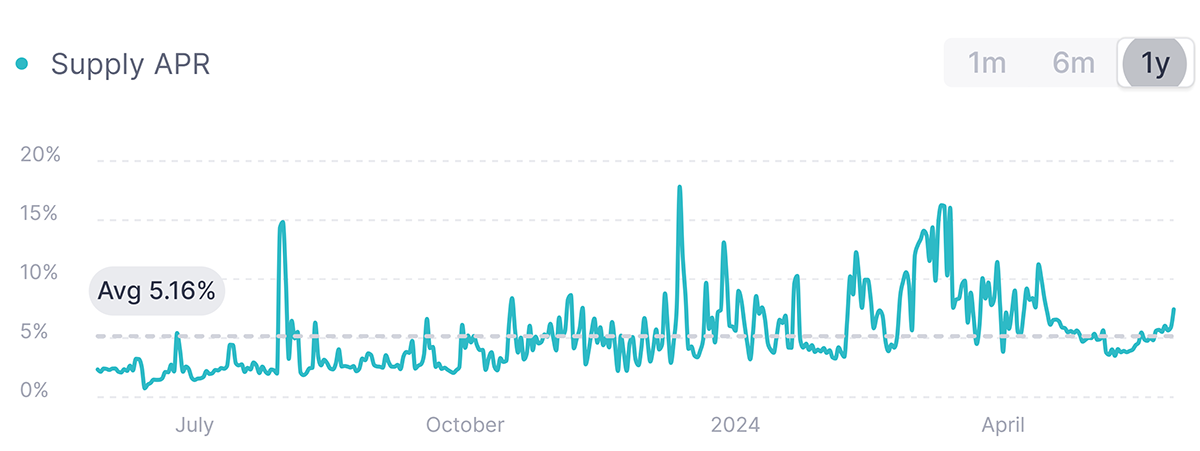

Unfortunately, volatility affects more than just staking yields. The volatility is even worse if you look at the supply APR for USDT on Aave, the largest DeFi lending platform.

USDT Supply APR on Aave

The supply APR for USDT was as low as 0.75% on 14 June 2023 and peaked at 17.8% on 13 December 2023. Notably, these fluctuations occurred within 6 months, highlighting the extent of variability. The future range of APR remains highly uncertain, making it next to impossible to accurately predict what the next year or two may hold.

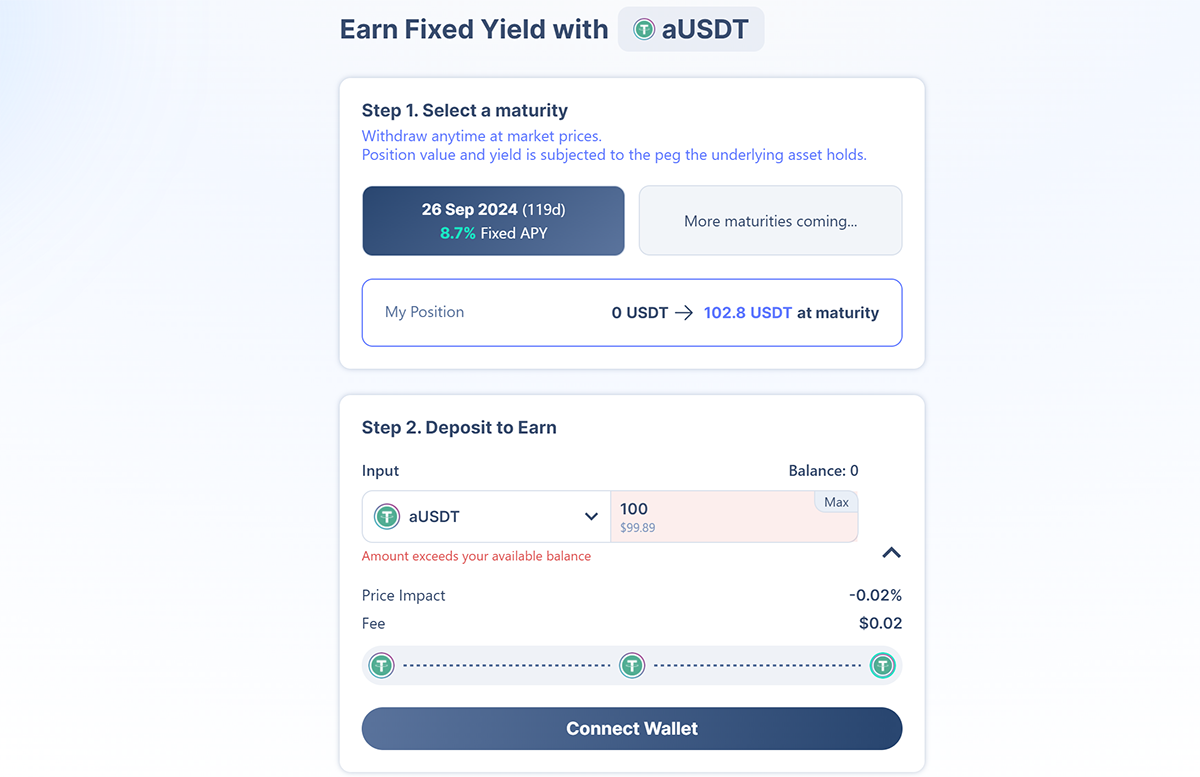

However, what if there is a platform that guarantees an annualised yield of 8.7% for locking aUSDT (Aave’s yield-bearing token that is 1:1 redeemable with USDT) in a smart contract maturing in 119 days?

aUSDT-Fixed Yield Smart Contract on Pendle Finance

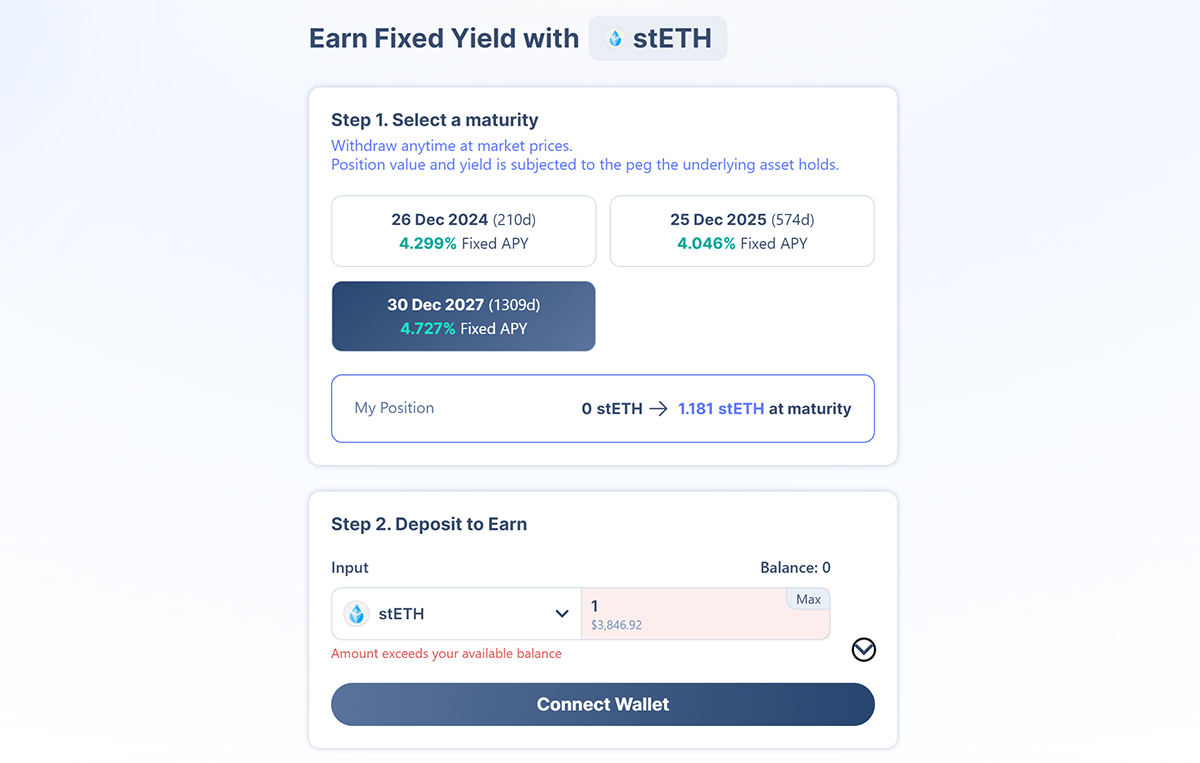

At the same time, what if the platform also offers an annualised fixed yield of 4% for locking stETH in a smart contract maturing in 1.5 years or 4.7% for a smart contract maturing in 3.5 years?

stETH-Fixed Yield Smart Contract on Pendle Finance

All this, and a lot more, is possible on Pendle Finance. It is revolutionising DeFi yield farming one token at a time. Unsurprisingly, this is no easy feat. Under the hood, Pendle employs complicated cryptography, math formulas for token valuations, and numerous other mechanisms to achieve this. Here’s my attempt to explain it in simple terms.